News

Cash is safe and protects from identity theft

Wednesday, February 14, 2018

View Showroom

By Currency Research

In studies conducted by Central Banks around the world, the average wallet is reported to hold the equivalent of $50 USD to $100 USD at any one time. If a wallet is lost, the cash loss is limited to the finite amount of the missing cash. The long-term implications of identity loss are far greater.

As payment technology becomes more advanced, ways to circumvent protective technological barriers also become more advanced. Of course, the unfortunate byproduct of this is the extra costs incurred to financial institutions, retailers, and consumers. For example, Currency Research estimates that the implementation of chip-and-pin technology in the US will cost retailers over $1 billion – and chip-and-pin is far from leading-edge technology.

As discussed in the aforementioned Riksbank article, even in Sweden, a country apparently at the forefront of promoting a cashless society, the majority of consumers continue to acknowledge the safety and security of cash:

The Australian Institute of Criminology’s report on identity-related economic crime examines the innovative – and not so innovative – ways in which encrypted and biometrically protected data can be compromised:

The role of money in providing transaction privacy is examined in a working paper published by the Federal Reserve Bank of Atlanta, which demonstrates that the value of money can derive from the anonymity it confers on consumers:

The results of the Federal Reserve Bank of Boston’s 2009 Survey of Consumer Payment Choice (SCPC) are examined in a 2013 working paper by Charles M. Kahn and José Manuel Liñares-Zegarra, who find that identity the incidents increase cash usage:

Kahn and Liñares-Zegarra reported on these findings in the briefing prepared for a 2012 Royal Economic Society conference presentation:

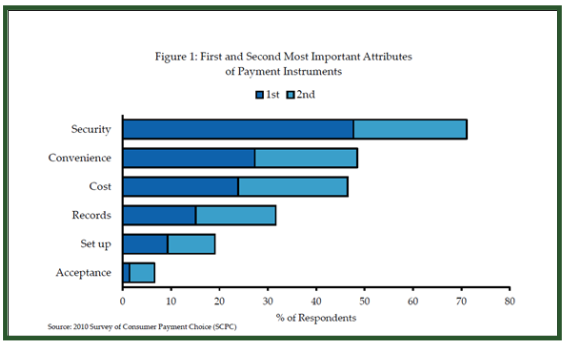

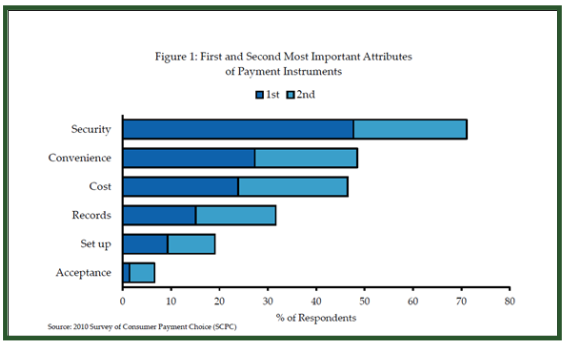

Indeed, in each annual SCPC survey, consumers consistently select security as the most important characteristic of payments, surpassing all other options such as cost, speed, and convenience. The results from the 2010 SCPC survey in the chart below are illustrative of this ongoing trend:60

In a public policy discussion paper for the Federal Reserve Bank of Boston, Joanna Stavins analyses the implications of the SCPC findings and concludes that citizens most concerned about the loss of personal information are most likely to adopt cash payments:

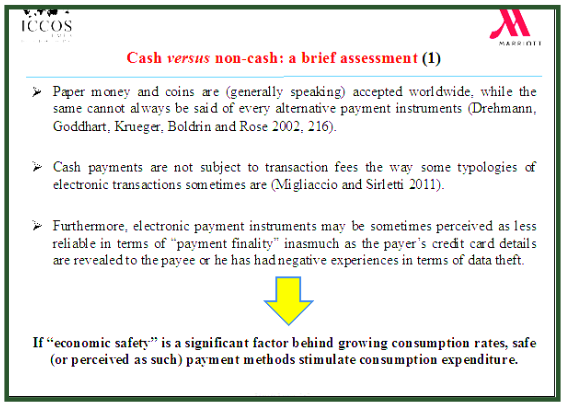

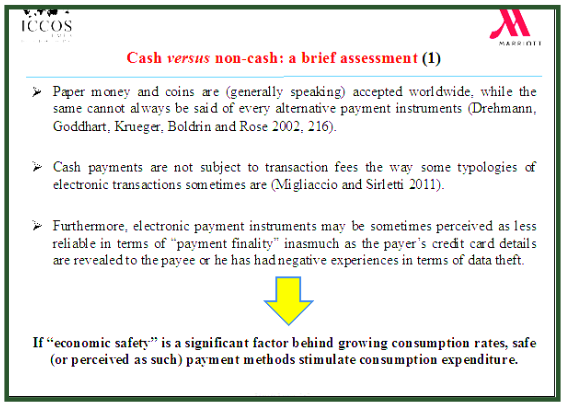

In a recent presentation at the 2015 Cash Cycle Seminar (ICCOS EMEA) in Milan, Dr. Edoardo Beretta of the Università della Svizzera italiana (USI) discussed the concept of “economic safety” and the relationship between the perceived safety of cash as a payment method to the stimulation of the economy through increased consumption:

Cash not only protects consumers from identity the and contributes to an overall sense of security, but also stimulates the economy through increased consumption.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

55 http://www.riksbank.se/Documents/Rapporter/Ekonomiska_kommentarer/2014/rap_ek_kom_nr09_141125_eng.pdf

56 http://aic.gov.au/documents/D/6/E/{D6E60060-303B-4C82-A6EF-88570F8B950F}ti129.pdf

57 Charles M. Kahn, James McAndrews & William Roberds, https://www.frbatlanta.org/research/publications/wp/2004/04_18.aspx

58 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2005694

59 http://www.res.org.uk/view/2012conf_briefing_7.html

60 http://www.bostonfed.org/economic/ppdp/2013/ppdp1309.pdf

61 http://www.bostonfed.org/economic/ppdp/2013/ppdp1309.pdf

In studies conducted by Central Banks around the world, the average wallet is reported to hold the equivalent of $50 USD to $100 USD at any one time. If a wallet is lost, the cash loss is limited to the finite amount of the missing cash. The long-term implications of identity loss are far greater.

As payment technology becomes more advanced, ways to circumvent protective technological barriers also become more advanced. Of course, the unfortunate byproduct of this is the extra costs incurred to financial institutions, retailers, and consumers. For example, Currency Research estimates that the implementation of chip-and-pin technology in the US will cost retailers over $1 billion – and chip-and-pin is far from leading-edge technology.

As discussed in the aforementioned Riksbank article, even in Sweden, a country apparently at the forefront of promoting a cashless society, the majority of consumers continue to acknowledge the safety and security of cash:

The Riksbank’s interview surveys show that households perceive both cash payments and electronic payments to be secure, with a small advantage for cash.55

The Australian Institute of Criminology’s report on identity-related economic crime examines the innovative – and not so innovative – ways in which encrypted and biometrically protected data can be compromised:

It has been found, however, that the encryption used on smartcards can be broken if certain types of errors can be created on the card, such as through the use of ionising or microwave radiation. For example, Bellcore, a United States computer and communications security company, and others have identified a number of design flaws in computer chip cards which may permit data to be leaked or information contained in the card to be tampered with.

A more simple problem with smartcards, of course, is that access to the card is usually only protected by a PIN.

Reliance on biometric systems does, however, raise a number of practical and ethical concerns. The costs, and volume of data that must be stored online to enable comparison for any potential user, may be prohibitive and there is always the possibility that computer security systems could be compromised by reproducing data streams.56

The role of money in providing transaction privacy is examined in a working paper published by the Federal Reserve Bank of Atlanta, which demonstrates that the value of money can derive from the anonymity it confers on consumers:

MONEY IS PRIVACY

In this article we investigate another use for money, the provision of privacy. That is, a money purchase does not identify the purchaser, whereas a credit purchase does. In a simple trading economy with moral hazard, we compare the efficiency of money and credit, and find that money may be useful even when information is free.57

The results of the Federal Reserve Bank of Boston’s 2009 Survey of Consumer Payment Choice (SCPC) are examined in a 2013 working paper by Charles M. Kahn and José Manuel Liñares-Zegarra, who find that identity the incidents increase cash usage:

IDENTITY THEFT AND CONSUMER PAYMENT CHOICE: DOES SECURITY REALLY MATTER? Security is a critical aspect of electronic payment systems. In recent years, the phenomenon of identity theft has gained widespread media coverage and has grown to be a major concern for payment providers and consumers alike. How identity theft has affected consumer’s payment choice is still an open research question. Using a newly available nationally representative survey from the U.S., we study the effect of identity theft incidents on adoption and usage patterns for nine different payment instruments. Our results suggest that specific identity theft incidents alter the probability of adopting cash, money orders, credit cards, stored value cards, bank account number payments and online banking bill payment, after controlling for socio-demographic and payment characteristics. As for payment usage, we observe a positive and statistically significant effect of certain types of identity theft incidents on cash, money orders and credit cards. However, we also find that specific identity theft incidents could decrease the usage of checks and online banking bill payment. These results are robust across different types of transaction after controlling for various socio-demographic characteristics and perceptions toward payment methods. 58

Kahn and Liñares-Zegarra reported on these findings in the briefing prepared for a 2012 Royal Economic Society conference presentation:

IDENTITY THEFT: THE IMPACT ON PEOPLE’S CHOICE OF PAYMENT METHOD

Incidents of identity theft are a critical factor in people’s decisions about what payment methods they use.

Identity theft is one of the fastest growing crimes in the US, and millions of people become victims each year. The consequences can be severe for both financial institutions and their customers.

The study analyses data from the 2009 Survey of Consumer Payment Choice in the US. The results show that a 12% increase in incidents of identity theft is likely to:

• Reduce the use of cheques in up to eight transactions per year per person. • Reduce the use of online banking bill payments by between 1.7 and 2.7 transactions. • Increase the use of credit cards for shopping, bill payments and online payments. • Increase the number of cash transactions by up to 17 transactions per year.

The authors comment:

Our findings may be useful in helping to understand determinants of payment behaviour (such as the recent drop in cheque use in the US), consumer attitudes toward financial products and the effectiveness of security and anti-fraud measures on payment’s usage and adoption.

Security issues have become a major concern for the public and for payment providers. The industry has already made considerable efforts to ensure security for payment transactions, considering their rapid growth during the last years. In this scenario, economists, regulators and the payment industry have been interested in understanding how security affects the adoption and usage decisions of consumers.

In general, there is not a strong agreement about whether security concerns really matter when consumers choose whether to adopt or to use a specific payment instrument. Whether consumer concerns about security translate into behaviour is still an open research question.

The recently launched 2009 Survey of Consumer Payment Choice offers a unique opportunity to test how identity theft incidents have affected adoption and usage patterns of nine payment instruments commonly used in US.

After running a set of simulations based on a 12% increase in identity theft incidents, the results show that identity theft victims could reduce the use of checks in 8.04 and 4.74 transactions per consumer per year for paying services and for other types of payments (in person), respectively.

Also, the use of online banking bill payment would decrease between 1.7 and 2.7 transactions per consumer per year. Interestingly, credit cards would be used more intensively for retail payments, bill payments and online payments, when specific identity theft incidents emerge.

In a similar way, it would be expected an increase in the number of cash transactions for paying bills and services (ranging between 7.98 and 16.86 additional transactions per consumer per year).

Summing up, the results show that identity theft incidents play a non-negligible role in the payment card market. Hence, the results leave room for additional policy discussions about the effectiveness of measures taken to control fraud that may arise in the payment system. 59

Indeed, in each annual SCPC survey, consumers consistently select security as the most important characteristic of payments, surpassing all other options such as cost, speed, and convenience. The results from the 2010 SCPC survey in the chart below are illustrative of this ongoing trend:60

In a public policy discussion paper for the Federal Reserve Bank of Boston, Joanna Stavins analyses the implications of the SCPC findings and concludes that citizens most concerned about the loss of personal information are most likely to adopt cash payments:

Note that the main security question asks respondents to “rate the security of each method against permanent financial loss or unwanted disclosure of personal information.” This broad concept includes loss of money as well as loss of privacy. While both could occur if – for example – one’s credit card or bank account was hacked, some payment instruments most susceptible to theft are also best at protecting one’s privacy (for example, cash). If cash is stolen, it is likely to lead to “permanent financial loss,” but extremely unlikely to lead to “unwanted disclosure of personal information.”

Security can be interpreted differently by different people. Respondents who are more concerned about their financial loss (those who view cash as risky)

are more likely to adopt bank account number payments, while those who are more concerned about loss of their personal information (those who view cash as secure) are less likely to adopt bank account number payments.61

In a recent presentation at the 2015 Cash Cycle Seminar (ICCOS EMEA) in Milan, Dr. Edoardo Beretta of the Università della Svizzera italiana (USI) discussed the concept of “economic safety” and the relationship between the perceived safety of cash as a payment method to the stimulation of the economy through increased consumption:

Cash not only protects consumers from identity the and contributes to an overall sense of security, but also stimulates the economy through increased consumption.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

55 http://www.riksbank.se/Documents/Rapporter/Ekonomiska_kommentarer/2014/rap_ek_kom_nr09_141125_eng.pdf

56 http://aic.gov.au/documents/D/6/E/{D6E60060-303B-4C82-A6EF-88570F8B950F}ti129.pdf

57 Charles M. Kahn, James McAndrews & William Roberds, https://www.frbatlanta.org/research/publications/wp/2004/04_18.aspx

58 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2005694

59 http://www.res.org.uk/view/2012conf_briefing_7.html

60 http://www.bostonfed.org/economic/ppdp/2013/ppdp1309.pdf

61 http://www.bostonfed.org/economic/ppdp/2013/ppdp1309.pdf

Additional Resources from ATM Industry Association

- 4/26/2024 - Time to Take Action! Support the Crime Bill - We Need You!

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- Show All ATM Industry Association Press Releases / Blog Posts