News

Myth: Bitcoin will replace cash

Friday, April 21, 2017

View Showroom

By Currency Research

Lately it seems like everyone, from technology futurists to bloggers and journalists, has been loudly predicting that Bitcoin, or some other “universally accepted and untraceable” digital currency, is poised to replace cash. Almost every other day, another article is published praising Bitcoin as the next great payment instrument set to overtake traditional currency as the preferred payment method of the masses. From the omnipresence of the media coverage, one would believe this takeover is imminent.

For example, in a recent article the technology futurist Daniel Burrus deems digital virtual currencies like Bitcoin “game changers” set to displace other methods of payment:

In a 2013 article, the Business Section of the Times of Malta asked:

Invented by a mysterious figure known as “Satoshi Nakamoto,” Bitcoin is a technological wonder, an intellectually stimulating idea, and, at least theoretically, an economical way to transact payments. Increasingly, retailers are accepting Bitcoin as payment; even ATMs are now dispensing Bitcoins.

So, is Bitcoin positioned to replace banknotes and coins?

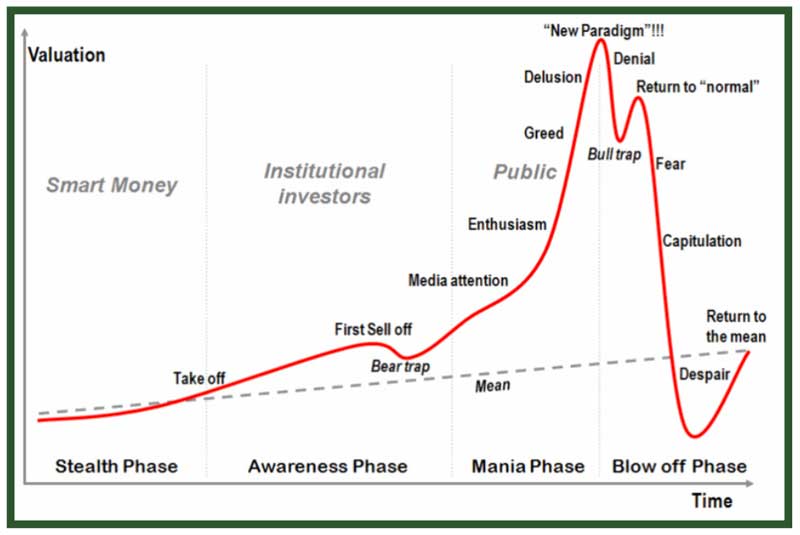

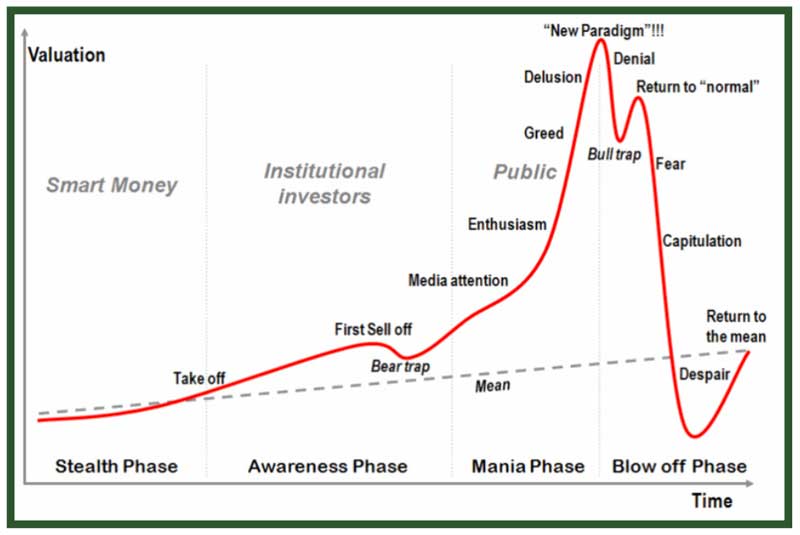

The value of Bitcoin fluctuates so regularly, and as shown in the chart below, so dramatically, that its risk factor is very high. In fact, as Bitcoin has been compared to a classic market bubble chart, 75 Currency Research would argue that it is not suitable as a stored value cash replacement, but perhaps should rather be approached as a casino-style “gamble.”

To illustrate, in a 2013 article, Forbes reported that Bitcoin appears to be tracing the stages of a classic bubble chart. For comparison, Forbes presents the Bitcoin price chart from October to December of 2013 alongside the archetypal bubble stages chart created by Dr. Jean-Paul Rodrigue:

Currency Research additionally looked into the claim that Bitcoin possesses certain attributes of cash that consumers desire, including security and anonymity. With the US federal government cracking down on Silk Road and many companies losing Bitcoins to hackers, popular claims that Bitcoin is unhackable and anonymous are now proving false.

The following headline calls into question the repeated claims of Bitcoin’s anonymity: 77

Of late, defenders have stepped up to explain why Bitcoin will not, and cannot, replace cash. A recent article in Capitalism Magazine breaks down the various reasons, explained from an economics standpoint, why Bitcoin cannot replace actual money:

Bitcoin is not:

Taken together, these factors indicate that Bitcoin is not well situated to replace cash as a payment method.

While there will be, and have been in the past, many alternatives to cash that have been innovative and “good for purpose” methods of payment to varying degrees, Currency Research believes that there has not yet been a viable alternative to replace cash as a payment method. In the eventuality of mass adoption of such an alternative, central banks risk losing control of their economies and their relevance if they promote and encourage alternate means of payment that do not have the speed, convenience, trust, universal acceptability, and even the relative anonymity of cash.

However, Currency Research does not believe that central banks should ignore the world of technological cryptocurrency payments. Any central bank or mint needs to fully understand all implications of any payment method and be able to regulate it for consumer protection. Should a future alternative emerge able to viably replace the many benefits and consumer confidence in physical cash, the central bank or mint needs to be adaptable. Currency Research has not yet witnessed such a technology.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

73 http://www.huffingtonpost.com/daniel-burrus/will-bitcoin-replace-cash_b_4816979.html

74 http://www.timesofmalta.com/articles/view/20130704/business-news/Will-Bitcoin-replace-cash-any-time-soon-.476563

75 http://www.forbes.com/sites/jessecolombo/2013/12/19/bitcoin-may-be-following-this-classic-bubble-stages-chart/

76 http://www.reuters.com/article/2014/03/21/us-bitcoin-mtgox-wallet-idUSBREA2K05N20140321

77 http://money.cnn.com/2014/01/27/technology/security/bitcoin-arrest/

78 http://capitalismmagazine.com/2014/01/bitcoin-replace-money/

Lately it seems like everyone, from technology futurists to bloggers and journalists, has been loudly predicting that Bitcoin, or some other “universally accepted and untraceable” digital currency, is poised to replace cash. Almost every other day, another article is published praising Bitcoin as the next great payment instrument set to overtake traditional currency as the preferred payment method of the masses. From the omnipresence of the media coverage, one would believe this takeover is imminent.

For example, in a recent article the technology futurist Daniel Burrus deems digital virtual currencies like Bitcoin “game changers” set to displace other methods of payment:

WILL BITCOIN REPLACE CASH?

Move over cash, credit, and debit cards ... there’s a new payment method available. It’s called Bitcoin--a virtual and digital version of cash that’s emerging as a global payment platform that can be used through smart phones, tablets, and other devices.

Recently, officials within the United States Treasury and Justice Departments have now recognized the virtual currency as legitimate and financially viable.

The value of a Bitcoin does fluctuate with the markets. But remember, all currencies fluctuate in value on a daily basis, so that’s not unique to Bitcoin.

Will Bitcoin be around for a long time? That’s hard to say because Bitcoin’s future represents a soft trend--it is not a sure thing. But the idea of a digital virtual currency that is the closest thing to cash becoming part of our everyday reality in the near future represents a Hard TrendTM--it will happen. 73

In a 2013 article, the Business Section of the Times of Malta asked:

WILL BITCOIN REPLACE CASH ANY TIME SOON?

You can have cash hidden under the mattress that gets burned in a fire. You can have gold jewellery which gets stolen. You could have a safety deposit box that your children do not know about. You could have money in a bank which goes bust. The risks associated with Bitcoins are on par with those associated with many other established currencies, and that, if anything, they offer advantages that other asset forms do not Really, when you think about it, where is the safest place to keep your wealth – and still have access to it?

Well, you could opt for Bitcoins, a virtual currency which has no ties to any monetary authority, no underlying commodity and no fixed exchange rate.

“Now, more and more people are accepting payment in Bitcoin. “Some industry observers are predicting that Bitcoin will replace cash within a few years...” 74

Invented by a mysterious figure known as “Satoshi Nakamoto,” Bitcoin is a technological wonder, an intellectually stimulating idea, and, at least theoretically, an economical way to transact payments. Increasingly, retailers are accepting Bitcoin as payment; even ATMs are now dispensing Bitcoins.

So, is Bitcoin positioned to replace banknotes and coins?

The value of Bitcoin fluctuates so regularly, and as shown in the chart below, so dramatically, that its risk factor is very high. In fact, as Bitcoin has been compared to a classic market bubble chart, 75 Currency Research would argue that it is not suitable as a stored value cash replacement, but perhaps should rather be approached as a casino-style “gamble.”

To illustrate, in a 2013 article, Forbes reported that Bitcoin appears to be tracing the stages of a classic bubble chart. For comparison, Forbes presents the Bitcoin price chart from October to December of 2013 alongside the archetypal bubble stages chart created by Dr. Jean-Paul Rodrigue:

Currency Research additionally looked into the claim that Bitcoin possesses certain attributes of cash that consumers desire, including security and anonymity. With the US federal government cracking down on Silk Road and many companies losing Bitcoins to hackers, popular claims that Bitcoin is unhackable and anonymous are now proving false.

Many of Mt Gox’s 127,000 creditors, who feared they had lost their investments when the exchange filed for bankruptcy, are sceptical about what the exchange has said happened to the bitcoins it had. In its bankruptcy filing, Mt Gox also said $28 million was “missing” from its Japanese bank accounts.

Mt Gox blamed the loss of 750,000 bitcoins belonging to its customers and 100,000 of its own on hackers. 76

The following headline calls into question the repeated claims of Bitcoin’s anonymity: 77

BITCOIN EXCHANGE CEO ARRESTED FOR MONEY LAUNDERING

Of late, defenders have stepped up to explain why Bitcoin will not, and cannot, replace cash. A recent article in Capitalism Magazine breaks down the various reasons, explained from an economics standpoint, why Bitcoin cannot replace actual money:

MORE ON BITCOIN: WHY IT CANNOT REPLACE MONEY

Bitcoin is not money in and of itself. The bitcoin price is essentially the price of transferring already existent fiat currency or, in another sense, it is simply a non-binding “claim” to standard money. Since the value of bitcoins are not in their usage as standard money but in their usage in transactions, bitcoins are only as good as the fiat currencies in which they can be sold.

Merchants or individuals who accept bitcoins in foreign countries are betting that they can either exchange the bitcoins for something or cash them in for a more stable currency in the future as opposed to accepting local currency. This is a rational bet if you live in a country with a tyrannical government and/or an unstable currency. 78

Bitcoin is not:

- easy (to understand, create, or to use);

- quick (a transaction takes between 10 minutes and 1 hour to complete);

- a unique cryptocurrency (Dogecoin, Feathercoin, Litecoin, Megacoin, and RonPaulCoin are a few competitors);

- secure (as pointed out above); or,

- convenient.

Taken together, these factors indicate that Bitcoin is not well situated to replace cash as a payment method.

While there will be, and have been in the past, many alternatives to cash that have been innovative and “good for purpose” methods of payment to varying degrees, Currency Research believes that there has not yet been a viable alternative to replace cash as a payment method. In the eventuality of mass adoption of such an alternative, central banks risk losing control of their economies and their relevance if they promote and encourage alternate means of payment that do not have the speed, convenience, trust, universal acceptability, and even the relative anonymity of cash.

However, Currency Research does not believe that central banks should ignore the world of technological cryptocurrency payments. Any central bank or mint needs to fully understand all implications of any payment method and be able to regulate it for consumer protection. Should a future alternative emerge able to viably replace the many benefits and consumer confidence in physical cash, the central bank or mint needs to be adaptable. Currency Research has not yet witnessed such a technology.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

73 http://www.huffingtonpost.com/daniel-burrus/will-bitcoin-replace-cash_b_4816979.html

74 http://www.timesofmalta.com/articles/view/20130704/business-news/Will-Bitcoin-replace-cash-any-time-soon-.476563

75 http://www.forbes.com/sites/jessecolombo/2013/12/19/bitcoin-may-be-following-this-classic-bubble-stages-chart/

76 http://www.reuters.com/article/2014/03/21/us-bitcoin-mtgox-wallet-idUSBREA2K05N20140321

77 http://money.cnn.com/2014/01/27/technology/security/bitcoin-arrest/

78 http://capitalismmagazine.com/2014/01/bitcoin-replace-money/

Additional Resources from ATM Industry Association

- 4/26/2024 - Time to Take Action! Support the Crime Bill - We Need You!

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- Show All ATM Industry Association Press Releases / Blog Posts