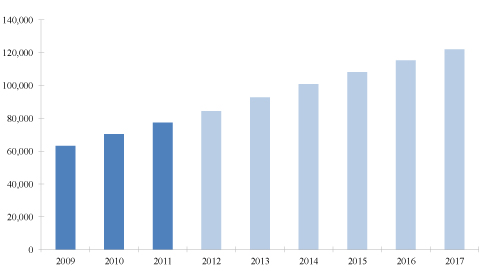

Growth in ATM Withdrawal Volumes Suggests Bright Future for Cash Growth in Cash Withdrawals to Outstrip Growth in Installations The global ATM market is set to continue to grow, largely as a result of huge projected growth in demand for cash withdrawal services in the coming years, particularly from emerging markets, according to "Global ATM Market and Forecasts to 2017", a study from London-based strategic research and consulting firm, RBR. The report predicts that some emerging markets will explode in the next few years, with the number of ATM cash withdrawals projected to rise by around 90% in the Asia Pacific and Middle East and Africa regions between 2011 and 2017. In Asia Pacific, the Middle East and Africa and central and eastern Europe, growth in ATM usage is expected to outpace the increase in ATM installations. Globally, the total number of cash withdrawals is forecast to rise at a rate of 8% per year, in comparison with growth in the number of installations of 7% per year. Despite speculation about the emergence of cashless societies, it seems that worldwide the demand for ATMs and cash withdrawals will remain high. Volume of Cash Withdrawals (millions), 2009-2017

Emerging Markets will Drive Growth Vast numbers of people in emerging markets in Asia Pacific and Middle East and Africa still have no access to ATMs or other banking services, which means that the potential for new ATMs and ATM usage in these regions remains immense. In Asia Pacific, the annual volume of cash withdrawals is forecast to outpace growth in installations in China, Pakistan and Taiwan, whilst in the Middle East and Africa the same is predicted to be true for Egypt, Iran and Nigeria. Cash has been the primary means of payment for many in these regions until now. This, along with high numbers of new customers entering banking systems and government programmes to encourage usage of cards to access bank accounts, will bring about such an increase in ATM withdrawal volumes in many of these markets that deployers will be forced to ramp up their deployment of ATMs. Demand for ATM services in Iran means that it is forecast to be the strongest growing market in Middle East and Africa, its installed base expected to almost double between 2011 and 2017 to 50,000 ATMs, while the annual volume of withdrawals in the market is predicted to grow by 122% over the same period. Most of the growth in the Asia Pacific region will come from China and India. The Chinese installed base of ATMs expanded by almost 60,000 machines in 2011, while Indian deployers added nearly 20,000 new ATMs during the year. Along with other fast growing markets such as Russia, these markets are expected to push the total global installed base of ATMs to 3.5 million by 2017. Preliminary data from these markets confirm that growth continued to be very positive - the Chinese installed base of ATMs reached around 377,000 terminals in the second quarter of 2012 (up from 339,000 at end-2011), with growth in the second half of the year thought to be even stronger. Meanwhile, the total number of ATMs in Russia grew by 6% in the first half of 2012 to reach 119,000 ATMs, and the Indian market grew by 13% to 101,000 machines. Notes to Editors The information in this article draws on RBR's new study "Global ATM Market and Forecasts to 2017". Since its first appearance in 1998, RBR's annual survey has been used for strategic planning across the industry. RBR is a strategic research and consulting firm with three decades of experience in retail banking, banking automation and payment systems. It assists its clients by providing independent advice and intelligence through published reports, consulting, newsletters and events. RBR is recognised as the leading provider of premium research reports on ATMs and payment cards. For more information, please visit www.rbrlondon.com or contact Andrei Charniauski on +44 (20) 8831 7300 or [email protected]. The information and data within this press release are the copyright of RBR, and may only be quoted with appropriate attribution to RBR. The information is provided free of charge and may not be resold. RBR

|