ATMIA Sponsors Spotlight ATMIA is proud to have industry leaders as regional and global sponsors. Hear from some of our sponsors and the work they are doing for the ATM Industry. Click on the logo to read the company's article or simply scroll down.

As we move into the new year, what trends should banks be aware of for 2018? As we reach the end of 2017, we're examining some of the most important trends that are set to shape the banking industry in 2018 and how banks can start preparing now. Branch networks are shrinking, but branches are getting smarter Here at Auriga, we predict that the role of the bank branch in customer engagement is going to become much clearer. Although the rate of closures may accelerate, leading to branch networks becoming smaller, there is going to be significant investment into making sure that the remaining branches are equipped with smarter technology to increase their appeal to customers. By investing into automation and customer experience, banks in 2018 are going to further drive the convergence that we are seeing between different banking channels, helping to create a seamless customer experience, from the branch, ATMs to mobile devices. White label financial hubs are on the horizon The trend for "white label hubs" is taking off in many European countries already. This term refers to a new branch format that is focused on a customer digital experience zone, designated for self-service devices, where clients can carry out a range of tasks autonomously via sophisticated ATM software, while also having the option of consulting with bank staff if needed. The key thing for banks here is to strike the right balance between digital and physical service, by embracing new technology, but not at the expense of the human touch and personalisation. In 2018, banks are going to be thinking think creatively about the space within their branches – we are already seeing everything from coffee shops to community meeting spaces for hire. Third-party ATM ownership and self-service offerings are expanding Banks are also set to consider different methods of sharing the branch infrastructure costs. As we move into 2018, we expect to see more and more banks choosing to co-locate within a white label financial services hub rather than the traditional approach of having their own branded branches. This is part of the wider trend that of the new platform model of the economy, which emphasises lower cost of ownership, as well as collaboration and a deeper focus on the customer experience. To prepare for this, banks need to invest in innovative software and self-service tech. This is essential if they are to improve and differentiate interactions with their customers, as branch location is no longer a deciding factor for customer loyalty. Additionally, banks are likely to share resources, pooling out-of-branch technology in order to free up capital to invest more heavily in branch ATMs. To prepare for this new, more flexible approach, banks should look to embrace cloud-based ATM and ASD (Assisted Self-Service Device) software. 2018: the time to get use of data right Organisations across all industries are preparing for GDPR, and with the deadline looming, banks know that 2018 is the crunch year to get their use of personal data right. As consumers are granted new-found power over how their data is used, there is a risk that they will challenge their banks on how their personal data is being used. The advent of the laws may come as a shock to banks, however well prepared they think they are. It is essential that their customer systems are fully integrated and capable of gathering and reporting on data use, to reassure their clients that they are taking care of their data. In this way, GDPR can actually be seen as an opportunity for banks to strengthen their relationships with their customers. Hype around challenger banks will keep going The hype around new players is set to continue into 2018, and while challenger banks are not sufficiently equipped to really pose a threat to traditional banks, now is the time for banks to consider how they want to deal with them. So, as our final trend, we expect to see co-creation emerge as the winning strategy. Tradition banks have a lot to gain from partnering with innovative challenger banks and fintechs, namely in terms of creativity and agility in responding to evolving customer needs. An overarching trend that links to all of the predictions outlined above is the growing need for customer experience to be placed at the very core of a bank's strategy. As bank branches continue to close and customer and bank reliance on technology increases, it is critical that banks create a deeply personalised customer journey that is seamless across all channels, including in-branch and via mobiles and apps. Vault Cash Rely on the leading provider of ATM vault cash, the people who manage over $1.6 billion annually and source cash in all 50 states and Puerto Rico. As a business of U.S. Bank, Elan can obtain cash directly from the Federal Reserve and eliminate many of the fees associated with alternative programs. We provide the experience, stability and scale as well as a wide range of vault cash provisioning and management services. Cash Flow

Thorough Support

Scalable Options

To learn more, call us at 800.343.7064 or visit www.elanfinancialservcies.com/atm-debit

The role of the ATM is undergoing a "face-lift". Modern ATMs now boast a wide range of capabilities and continued innovations in technology and offer diverse opportunities to engage customers. Fleet owners have opportunities to leverage ATM software like Euronet's ATM Channel Manager (ACM) to help expedite the introduction of new products, services and revenue streams. Many FIs are working to transition teller transactions to self-service channels as a means of controlling costs while meeting the expectations of today's always-on-the-go consumer. ATM and Mobile Banking are often the most utilized customer touch-points and in many cases, the ATM has become the "face" of the bank. As a primary point of contact, it's clear that the customer experience at the ATM is a key consideration for those looking to maintain competitiveness and customer satisfaction. Properly maximizing the full potential of the ATM increases the value of the self-service channel and positions ATMs as powerful brand ambassadors, fostering deeper and longer lasting connections with your customers. The Interactive Customer Experience In today's market, customers don't just want great design, they expect it. It becomes imperative that fleet owners showcase products and services in a consistent and easy to consume way. Software that is clunky, difficult to use and quite honestly not fit for the task, often create barriers when looking to optimize features across a multi-vendor ATM fleet. To ensure a great customer experience that strengthens the bond with customers, consider the following: DELIVER VALUE Choose a mix of features that provide personalization, value and convenience. With services like Cardless, Contactless, Bill Pay and Dynamic Currency Conversion there are opportunities to provide speed, accuracy and drive additional revenue. Because the customer is at the heart of every transaction, personalized greetings are a likely friend when exploring your customer acquisition and retention efforts as they allow you to target more effectively. MAKE IT OBVIOUS Customer maintained preferred transaction shortcuts are a great option to streamline transactions. Not only is it an opportunity to improve the user experience, it affords an opportunity to create customer profiles that can be leveraged to identify your high value customers. There is an art when it comes to the presentation and promotion of products and services at the ATM. Discoverability is essential, so it's important to be clear on what it is that you want the customer to do while at the ATM. Don't ever leave the customer confused. KEEP IT COHESIVE Keep the styling and navigation consistent and cohesive throughout the experience. Keeping functionality consistent and intuitive helps users easily master the experience. Unlocking Potential Traditionally, ATMs have been considered a "cost center" or for some FIs, "cost neutral". ATMs can support multiple use cases that increase operating income which shifts the ATM business model from cost to revenue generation, this is particularly attractive for assets that are already owned. In a rapidly changing industry, having access to software that supports several business model types is essential when growing and protecting lines of business. In fact, not having adequate access to the right software tools can impact your business in undesirable ways. It is for this reason that Euronet provides tools that can accommodate fleet owners who not only take a multi-vendor ATM approach but those who also embrace a hybrid business model. Euronet's ATM Channel Manager Helps Command the Fleet Ensuring maximum availability is the starting point for a positive customer experience. In the words of Peter Drucker, "You can't manage what you can't measure." Running today's ATM fleets at optimum levels demands one system that can measure, manage and drive the entire fleet - even multi-vendor fleets. Besides optimizing multi-vendor device management, the ACM solution allows FI's to streamline development and support operations by eliminating the need for vendor specific processes and staffing. Real-time device status and transaction data can be easily accessed and presented in a user-friendly format--everything from cash levels to electronic transaction journaling to printer status. Operational alerts are sent by email and /or SMS based on criteria defined by the FI. User roles and access controls ensure only authorized users have access, and only to data pertinent to their role. ATMs and data can be organized based on the institutions organizational framework and be extracted to perform analysis of usage and customer behaviors for ongoing improvements. Remote command capabilities--such as Remote Key Load and remote screen downloads, save time and money. Marketing campaigns can be pre-planned with a variety of options including screen flow positioning, time-of-day, day-of-week, single ATM or groups of ATMs, etc., videos, photos, graphics, labels, text, fonts and colors can be updated easily. Screen design and maintenance of the "look and feel" of your ATM screens can be configured by marketing associates without aide from IT staff. Planned changes can be previewed and validated on the desktop prior to deployment. When looking to create amazing customer experiences take full advantage of your ATM fleet with Euronet's ATM Channel Manager (ACM). In the industry, it's a game changer that allows you to maximize the potential of your fleet while effortlessly managing it. Open standards for the ATM. How bright is the future? The banking industry is changing. Branch automation, the internet of things and open banking APIs are just a few of the factors influencing this transformation. These changes are making it harder to differentiate and ensure a profitable business. How can ATM software keep up and support innovation? Today, most ATMs in a multi-vendor environment use a Windows operating system and a software stack built on the CEN/XFS standard. While CEN/XFS allowed ATM operators to easily deploy a single software solution across ATMs from different hardware vendors, the standard has become a limiting factor in our fast-changing environment. Recent developments expose these limitations. The ongoing drive towards branch automation has created increasingly sophisticated hardware and a correspondingly complex CEN/XFS standard. This is especially the case for deposit devices, due to the differing hardware capabilities and variations across ATM types and vendors. The increased focus on security and authentication presents additional challenges. For example, while ATM operators are increasingly deploying terminals with biometric verification devices - fingerprint/palm readers, voice recognition devices, facial recognition devices and iris scanners - these have yet to be adopted in the CEN/XFS standards. Another relative newcomer is the Near Field Communication (NFC) reader, used to drive ATM transactions with mobile devices and contactless payment cards. These readers became commonplace before the software standards were in place to support them, leaving ATM operators no choice but to deploy software using proprietary interfaces. The demand for non-Windows operating systems, cloud-based application software, and improved defence against security threats has led ATM operators and ATM hardware/software vendors to seek an overhaul of software standards. Whether a new software standard will be an evolution of CEN/XFS or a complete revolution remains unclear. However, there is a consensus that a new standard needs to address security concerns, and that it needs to be OS and technology-agnostic. It will need to provide support for cloud-based applications and be flexible in supporting new hardware in a timely manner. Regardless of the extent that standards evolve, change needs to be managed to minimise risk. Software and hardware vendors as well as ATM operators must have a rigorous testing strategy. The appropriate testing tools and processes are key for an efficient channel and a satisfying customer experience. In other areas of banking and payments software, formal certification processes are commonplace. Multi-vendor ATM software standards don't yet have these processes defined. Undoubtedly, a formal certification process would give users a certainty of compliance to a standard, and, in the case of an open ATM software standard, would provide guaranteed compatibility and interoperability between vendors. While this would undoubtedly be welcomed in the industry, there is the risk of additional "red-tape" having a negative impact, slowing time-to-market and making compliance too costly or complex for small organisations to continue to effectively compete with the big players. These ongoing changes put software, technology and standards at the heart of our sector. Testing and certification processes occupy that same central space, adding to the foundation that will define tomorrow's innovations. A well-designed and efficient testing and certification process could provide advantages in interoperability and ease of deployment in the long term that would outweigh the short-term investment. It is evident that the industry will need to decide how standards evolve and how compatibility can be assured. FIS™ is the world's largest global provider dedicated to financial technology solutions. Our test solutions and test services help ATM operators, ATM manufacturers, banks and processors confirm the quality of their ATM channel. Our solutions enable to save time, minimize downtime and support innovation. Contact: [email protected] and https://www.fisglobal.com/ GRGBanking, we move faster. GRGBanking is a leading provider of financial intelligent equipment and solutions, not only providing comprehensive product portfolio including Automatic Teller Machine (ATM), Video Teller Machine (VTM), Cash Sorting Machine, Automatic Fare Collection (AFC), but also focusing on ATM maintenance, cash managing service, CIT business as well as outsourced service. Established in 1999, GRGBanking has set up branch offices and subsidiaries in Germany, Turkey, Mexico, Russia, Singapore, Hongkong, Indonesia, Vietnam and Middle East. So far, there are more than 220,000 GRGBanking machines are providing reliable service in over 80 countries and regions. As the No.1 ATM supplier in China and top 4 in the world, GRGBanking has always been keeping up with the changing trend. Entering the digital era, E-commerce and mobile payment are becoming increasingly popular while ATM growth is remaining stagnant or even declining due to the new consumer behavior. However, we still believe that cash will still account for the majority of payment though more and more customers are using mobile and M-wallet to realize financial service. To satisfy new needs and life style of consumers, banks need to transform actively and GRGBanking has already provided various banking transformation solutions. We have launched the VTMs (Video Teller Machines) and STMs (Smart Teller Machines) to overcome the limitation of time and place and make branches more efficient and profitable. The combination of remote video assistance and in-person assistance allows the bank to migrate transactions from the traditional counter while also engaging with the customers who prefer a face-to-face interaction. VTMs incorporate the features of an ATM, bank branch and call center as well as mobile and a brick-and-mortar bank branch, the VTM carries much lower fixing and operational costs, enabling a financial institution to expand its reach at a significant saving. Real-time visual and biometric processes help deter illegal usage even in the case of a stolen ID, and the video record kept by the VTM serves as added security. Now, GRGBanking's VTM has been put into use to support branch transformation in a number of famous banks of both domestic and overseas markets, such as Standard Chartered Bank, HSBC, DBS, TPB, Wing Lung Bank, etc. It brings consumers better and intelligent experience, and efficiently lowers cost and increase the benefit through transforming branches for banks. In the future, the integration between banking and high-end technologies is irreversible. To create automated and digitalized branches to provide seamless customer experience, a comprehensive and collaborated Omni-channel solution is crucial. Aiming at making banking more convenient, GRGBanking will keep exploring and combining big data, AI, biometric solution and other new technologies to promote categorized banking. We have established the Fintech Research Center to embrace the digital transformation and break the barrier of channels to optimize the banking transformation in a digital and humanistic way. We believe that financial services will not be limited in the bank branch, Fintech and intelligent terminal equipment may be integrated into more application scenario such as coffee shops, hospitals, scenic spots even airports. As a world-leading intelligent financial solutions provider, GRGBanking will continually promote Omni-channel and Multi-channel financial services to satisfy different kind of consumer behavior. More solutions will be released to satisfy the requirement of ubiquitous application scenario, user-friendly interaction, accurate risk control, etc. GRGBanking, we move faster.

When banks are rolling out ATM solutions, it's vitally important they consider the needs of all their customers, especially those who may have accessibility issues such as visual impairments that may make it difficult to complete interactions in the same way as most people. That's why investing in tools that can meet these challenges is so important in order to ensure full financial inclusion, and it's an area NCR has always had a strong focus on, which is allowing banks around the world to offer a fuller range of accessibility services to their customers. Improving accessibility in the UAE One bank that has recently taken advantage of the accessibility solutions offered by NCR is UAE-based Abu Dhabi Islamic Bank (ADIB), which is set to upgrade its ATMs with NCR audio-guided technology. This allows visually impaired customers to plug in their headphones and hear audio guidance that enables them to securely navigate the devices without the need for additional assistance. As around 98 per cent of ADIB's cash transactions are conducted through the bank's ATM network, ensuring all customers are able to interact with the devices easily is essential. The bank's fleet also offers a range of other services, such as utility bill payments, money transfers and charitable giving, so accessibility offers much more than just easy access to cash. Head of retail banking at ADIB Philip King said: "In line with the Central Bank's commitment to the visually impaired, we are pleased to be partnering with NCR in our efforts to better meet the needs of visually impaired customers, and to empower them to take control of their transactions and have secure access to our ATM services." Meeting the needs of the visually impaired ADIB will therefore become the latest financial institution to benefit from NCR's unique software and hardware features. These include having on-screen messages and instructions read aloud to help provide complete orientation and make the transaction easier to navigate. Wael El Aawar, managing director for NCR in Saudi and Gulf, also noted that NCR ATMs are designed with Access for All standards in mind and offer a large number of design and functionality features to meet the needs of the visually impaired. "Accessible key pads, voice-guidance technology, Braille stickers and multi-lingual capability [allow] visually challenged customers to securely execute standard ATM transactions such as withdrawals, deposits and payments without any help," he said. Another key factor in NCR's ATM accessibility is the ability for the user to blank out the screen. This acts as a security mechanism that prevents any other bystander from accessing confidential customer data by 'shoulder surfing' during a transaction. This isn't the only security feature that could benefit the visually-impaired in the coming years. Contactless ATMs, for example, are likely to be a key factor in the fight against skimming in the coming year, by removing the need to physically enter a card into a machine. But the technology could also help visually impaired people by making it easier to authenticate themselves, while innovative applications such as mobile cash withdrawal or setting up presets on their smartphone can enable them to receive a tailored experience at the ATM. For more NCR authored blogs on this subject and much more, please visit https://www.ncr.com/blogs/ or banking.com Consumer Experience, Criminals and Running on Empty The ATM is a high-profile, customer-facing, self-service machine that consumers depend on to go about their daily lives. It's availability – or lack thereof – makes an impression on the user that impacts their view of the provider's brand. Those professionals responsible for ensuring that ATMs are available for use wherever and whenever the consumer wishes know that the increasing diversity of ATM types, functions and options for using them creates challenges. Availability, however, is just one measure the consumer applies when evaluating the services offered by a financial services provider. The user's experience in using a channel providing financial services, such as the ATM, – e.g., was it clear how to use the ATM, did it provide the features you wanted, did it have a touch screen and did it work, did it provide a receipt, etc. – is another way in which a provider's reputation can be enhanced or eroded.

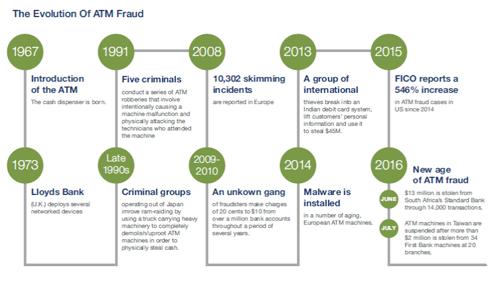

In this area, the bar is being raised as well. When Citibank unveiled the Bank of the Future in New York City in 2016 the ATM lobby was the centerpiece of the branch. There were interactive sales walls with touchscreen capabilities, 24/7 video chat stations, media display walls and even a free Wi-Fi lounge. When you checked in to the branch via Foursquare, an internal marketing screen showed who else was at the bank at the same time. In short, in the Citibank environment, the ATM became a shared multi-media experience1. Security is another important component in how consumers perceive their experience at the ATM. If the surroundings do not provide them with a feeling of safety, it won't matter how modern a user interface is because they may never stay around long enough to use it. Of course, the consumers are not the only ones concerned about security. Because ATMs contain a considerable amount of cash, allowing consumers to access their deposit accounts and offer more feature-rich service options, they have become a target of interest for criminals. These thieves can cost an ATM-network operator millions in direct and indirect costs while also greatly inconveniencing end users. All these factors – availability, user experience, and security – mean more updates to the hardware and software that is used to power the ATM and ATM network. EMV is just the most recent example of what ATM operators face in staying current with regulations, mandates and security requirements continually. As with many of the areas within financial services, the effort required to do all that is required often outstrips the resources available to get the work done. Meeting these day-to-day demands often becomes impossible when other large industry-wide initiatives must be addressed. For example, with the end-of-life for Windows 7 and Windows CE ATM network operators must undertake a massive upgrade project that most are not resourced to meet.

Most ATM testing tools do little to help address these challenges as they require manual, repetitive tasks that are time consuming. For the testing team supporting an ATM network, this results in lost efficiencies, low morale and growing overhead. As one industry insider put it, "You're so busy bailing the boat you never have time to fix the holes." With the stakes so high, environments so complex, and the use case scenarios nearly boundless the risk of not fixing those holes can result in a career-ending event. Many legacy testing processes remain centered on the desktop workstation, which results in many senior testers needing to spend more time running tests than designing them. (This drag on productivity is further exacerbated by the fact that this type of testing methodology requires access to a model of the ATM-type being tested, ultimately all tests must be run on a physical ATM. This limits an organization's ability to utilize offshore resources, limits collaboration is and requires a test pen full of each model of the ATMs an operator wishes to test. The variety of ATM functionality can further compromise efficiencies when using traditional desktop ATM testing tools. For some segments of society, the appetite for cash can be effectively served by the barebones "cash and dash" ATM models often found at convenience stores. On the other end of the spectrum are the customers accustom to the highly sophisticated, full-service machines (offering bill payment and other features). Breaking the 80/20 Rule These factors may be why ATM testing is a more specialized field than much of traditional IT testing, requiring knowledge of a wide array of touch points and inter-dependencies, both internal and external. This limits the number of resources available to help an organization protect its brand and reputation at the ATM. That is why many organizations with legacy test programs too often use the 80/20 rule. This approach, which is not limited to ATM testing, focuses on the 20 percent of use case scenarios most likely to expose 80 percent of the flaws.

And after all, it only takes one wayward scenario to cause a fault, which could cause a handful of transactions to be lost or create a network-wide outage. This means that just because a network has not been down for years that it won't be down tomorrow. Even if the person whose career rests on providing the appropriate level of testing considers this a good bet, successful gamblers always take steps to improve their odds. Thus, any organization can benefit from testing as many scenarios as possible, minimizing the window for unnoticed defects. Virtualization provides the opportunity to drive that number down much, much closer to zero than most organization realize is possible. A modern virtual testing solution provides a repository for test cases and related media that is accessible, as required, by the members of a testing organization. As the test cases within the repository grow over time, the more benefit it provides decreasing the need recreates tests scenarios and increasing the level of accuracy by allowing users to use previous tests to more accurately design new ones. In addition to these catalogued scenarios, leading virtual platforms store input from users across multiple installations providing an organization with the benefit of lessons learned. Conclusion For years, predictions have circulated touting the pending extinction of cash. In the US, Federal Reserve data shows that the number of ATM withdrawals has remained stable, while the average size of those withdrawals has increased. Viewed in combination with the growing use of cash back at the point of sale during debit card transactions, it would seem the appetite for cash remains strong. Approaches to development have evolved markedly over the past three decades but the testing strategy many organizations use to protect the networks and systems spend millions on has not. Production and development environments continue to grow more complex while user expectations increase along with the consequences an organization may face for any misstep. A shift in the regulatory pendulum will not lessen the need for testing – in fact, the potential for innovations leveraging infrastructure capabilities such as real-time or same-day payments, cardless cash, etc. may accelerate the need. Given the opportunity to reduce cost, improve quality, reduce risk and speed time to market, the business case for adopting next-gen virtualized payments testing is not something to be created in the future but rather now and as soon as possible. 1 Turning ATMs into Automated Thinking Machines by Dominic Basulto 2016 |

© 2017 ATM Industry Association. All Rights Reserved.

.png)

Also, consider innovations like "cardless cash" that are rapidly taking hold in the US. Given the introduction of Apple Pay and other mobile phone-based digital wallets, it logically follows that many consumers will expect the ability to similarly access cash using their phone as opposed to the traditional plastic card. This carries implications for both ATM software and hardware and extends to other logistical issues such as the ability of the consumer to unlock the unattended doors behind which many ATMs sit.

Also, consider innovations like "cardless cash" that are rapidly taking hold in the US. Given the introduction of Apple Pay and other mobile phone-based digital wallets, it logically follows that many consumers will expect the ability to similarly access cash using their phone as opposed to the traditional plastic card. This carries implications for both ATM software and hardware and extends to other logistical issues such as the ability of the consumer to unlock the unattended doors behind which many ATMs sit. Even if this "rule" is applied accurately, it leaves the organization counting on it with a significant level of exposure. In most cases, however, our experience suggests that ATM network operators along with other players in the financial services industry, generate far less use case coverage than they realize, often well below 20 percent. No one who is head of an ATM testing organization could sleep well know this.

Even if this "rule" is applied accurately, it leaves the organization counting on it with a significant level of exposure. In most cases, however, our experience suggests that ATM network operators along with other players in the financial services industry, generate far less use case coverage than they realize, often well below 20 percent. No one who is head of an ATM testing organization could sleep well know this.