Mexico: Cash > Digital Payments

The author thanks Bernardo Bátiz-Lazo, Gustavo Del Ángel, and Guillaume Lepecq for references and feedback.

Since 2019, the government of President Andrés Manuel López Obrador has promoted the adoption of digital payments and a reduction in the use of cashMoney in physical form such as banknotes and coins. More to promote financial inclusion in Mexico. Mexican authorities define financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More as the “access and usage to formal and adequately regulated financial services that guarantee consumer protection rights and promote financial literacy” (INEGI 2022: 3).

The National Banking and Securities Commission (CNBV) and the National Institute of Statistics, Geography, and Computing (INEGI) have conducted national surveys since 2012 to measure financial inclusion in Mexico. The most recent survey took place between June and August 2021: it comprised 13,352 households, representing 90.33 million Mexican adults.

“Measuring financial inclusion across the population and [obtaining] information on the use of financial products by individuals is an indispensable exercise to identify levels of financial access, usage and inclusion, and financial habits; [to identify] inclusion gaps among different groups; [to map] mexisting barriers and their relation to relevant variables, such as individuals’ socio-demographic characteristics,” said Gustavo Del Ángel, professor of Economics at CIDE.

Financial Inclusion

According to the survey’s results and data (published last May), Mexico’s level of financial inclusion (measured by access to formal financial products) worsened slightly during the Covid-19 pandemic.

- An adult is “financially included” if the respondent reported having at least one financial product (a savings account or card, a credit or insurance product, or a retirement savings account). Although the number of financially-included adults increased between 2018 and 2021 (going from 54 million to 56.7 million), its relative share worsened. In 2018, financial inclusion reached 68.3% of adults; the ratio fell to 67.8% of Mexicans (56.7 million people) in 2021 (INEGI 2022: 7).

- Women experienced the most significant drop in financial inclusion, going from 65.2% in 2018 to 61.9% in 2021 (INEGI 2022: 7). The government’s 2019 decision to eliminate the Prospera welfare program explains a large part of this drop, as many women received cash transfers through debit cards.

- Adults in urban and rural areas experienced a decline in financial inclusion. Financially-included Mexicans in towns with up to 14,999 inhabitants dropped from 57.1% in 2018 to 56.1%. Financially-included adults living in places with 15,000 or more inhabitants went from 74.4% in 2018 to 74.2% in 2021 (INEGI 2022: 10).

- The most financially-inclusive areas were the Mexican Northwest (with 75.7% of adults), the Northeast (77%), and Mexico City (74.2%). The Southern states saw a decrease in financial inclusion, going from 67.6% of adults in 2018 to 60.1% in 2021. Interestingly, unbanked Mexicans increased in Northwestern states, too, as banked adults comprised 82.3% of their population in 2018 (INEGI 2022: 8).

Cash, Covid-19 and Stagflation

Cash in circulation rose a staggering 30.33% from March 2020 to March 2021 before Mexico sourced Covid-19 vaccines. The country’s weak economic recovery with persistent inflation and a likely global recession will undoubtedly reinforce the dominance of cash in Mexico.

- Most Mexicans (58.4%) said that the Covid-19 pandemic worsened their financial situation: 95.3% said they cut their expenditures, 79.9% employed savings to make up for lost income, 40% borrowed from relatives or acquaintances, and 18.6% sold or pawned a possession (CNBV 2021: 2).

- In 2021, most Mexicans partitioned their income between regular expenses and debt service (51.4%). A plurality kept track of their debts (41.5%). A minority registered their daily expenditures (25.1%) and held a budget (22.5%). A small share (17.6%) reported using a smartphone app to handle their finances (INEGI 2022: 28).

Cash Remains the Most Used Payment InstrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More

Most Mexicans have long preferred to use cash in payments. Cash remains dominant, even if its usage declined slightly during the Covid-19 pandemic (see Graph 1).

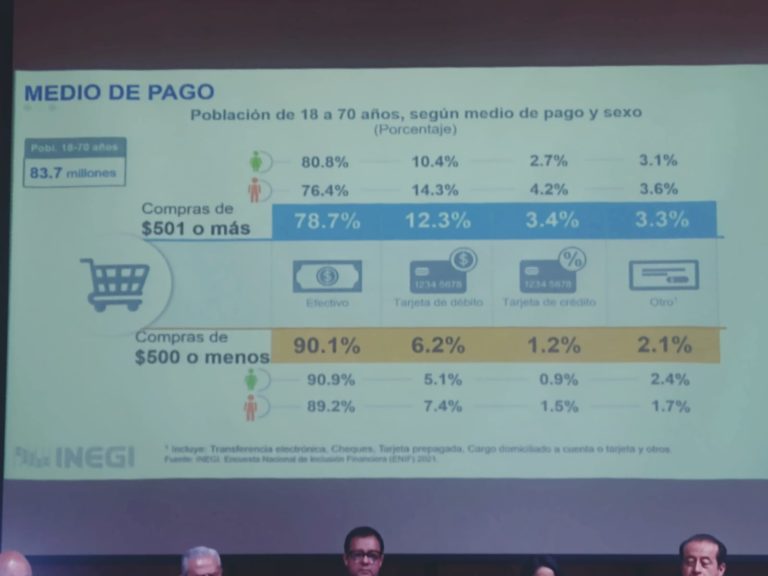

- In 2021, cash was the most used paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More instrument in purchases of MXN500 (USD24.79) or less. To pay for these purchases, 90.1% of Mexicans (75.4 million people) used cash, 6.2% used debit cards, 1.2% used credit cards, and 2.1% used other payment instruments, including electronic transfers, checks, prepaid cards, etc. (INEGI 2022: 25).

- Cash was also the most used payment instrument in purchases of MXN501 (USD24.84) or more. For these higher-value purchases, 78.7% of Mexicans (65.9 million people) used cash, 12.3% paid with debit cards, 3.4% used credit cards, and 3.3% used other payment instruments (INEGI 2022: 25).

Graph 1. Mexico: Adult Population’s Payment Habits, per Payment Instrument and Gender, 2022

The regions with the highest use of non-cash alternatives (payment cards, electronic transfers, checks, prepaid cards, etc.) for higher-value purchases were Mexico City (28.7% of adults), the Mexican Northwest (22.9%), and the Northeastern states (21.5%). Southern Mexicans conspicuously prefer cash: just 12.4% paid with an instrument other than cash for these purchases (INEGI 2022: 25).

CoDi? Who’s That?

In 2021, just 32.7% of adults (27.4 million people) had access to formal credit in Mexico. The Mexican Northwest (41.2%), the Northeast (38.9%), and the Western and Central states (34.7%) had the highest ratios of adults with formal credit. The percentage of Mexicans with credit cards issued by department stores increased from 19.2% to 20% between 2018 and 2021; bank-issued credit cards remained the same, at 11% (CNBV 2022: 14, 16).

A little more than a third of Mexicans (34%) reported knowing about CoDi, the mobile payments platform developed by Banco de México. Although adults in Mexico City (49.3%) were the most aware, only 11.8% had used CoDi (INEGI 2022: 27).

According to Ana Laura Martínez, professor of public policy at CIDE, CoDi’s launch lacked awareness campaigns, rewards for usage, and user accompaniment. Banco de México’s bet on CoDi fell short as Mexican consumers demand information, rewards and prizes to changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More their payment habits.

Cash and Banking Infrastructure

Mexico’s financial infrastructure is insufficient, particularly in the poorest states, including Chiapas, Oaxaca, and Guerrero (see Map 1).

- On average, it takes 29 minutes for Mexicans in Southern states to go to a bank branch, nearly double the time of those in Mexico City.

- Mexicans in rural areas need 23 minutes more to go to a bank branch than those living in urban areas (CNBV 2021: 3).

Map 1. Mexico: Average Time Employed to Go to a Bank Branch, 2021 (Minutes)

Source: CNBV (2022: 3).

In the past three years, Mexican increased their usage of ATMs and financial correspondents, whereas they went less to bank branches (INEGI 2022: 24).

- Population using ATMs jumped from 44.9% in 2018 to 52.1% in 2021.

- Users of financial correspondents (non-bank commercial establishments) increased from 39.8% in 2018 to 43.9% in 2021.

- Bank branches’ users decreased from 43.1% in 2018 to 41.5% in 2021.

Fintech Revolution? Thanks, but We’ll Stick with Cash

Regulators and innovators implement supply-side innovations and products, thinking that demand will arrive eventually, but consumers are not demanding cash alternatives in Mexico (Fundef 2019: 9; Fundef 2020: 22, 33, 36-37). Mexicans remain conspicuous cash users, despite a booming fintech scene with many banking incumbents and startups.

- “This is a call for action. [… Mexico’s] financial inclusion [reveals there] is a social gap […]. These results indicate that we must acknowledge this gap in our public policy decisions and in the [private sector’s] product design,” said Gabriel Yorio, undersecretary of Finance.

- “Fintech innovators have not yet delivered on their potential to build solutions that are centered on underserved communities,” said Maelis Carraro, managing director at consulting firm BFA Global.

- Fintechs demand more government support: “until more digital players become [licensed as] banks, inclusion will continue to hit a ceiling,” said Juan Guerra, Revolut’s Mexico CEO.

“The above raises a key policy question: should the government subsidize fintech and digital payment providers to increase financial inclusion, or should it provide cash transfers to lower-income groups to lift them out of poverty?” said Guillaume Lepecq, chair of Cash Essentials.