Transaction Network Services (TNS Inc)

Transaction Network Services (TNS) offers a complete array of secure, reliable and flexible network connectivity and value-added services that help merchant acquirers, processors, payments innovators, retailers and financial institutions simplify complex payments infrastructures to easily conduct business anywhere in the world.

We provide secure, mission-critical communications platforms which enable customers to confidently exchange information and handle billions of POS and ATM transactions worldwide every year. TNS operates some of the largest real-time networks in the payments industry and provides access to more than 400 acquirers, processors and banks across over 60 countries.

TNS is a Level 1 PCI DSS certified service provider.

Visit Transaction Network Services for more information or email [email protected] to inquire about specific products and services.

TNS Secure SD-WAN

TNS Secure SD-WAN is a fully integrated, end-to-end managed solution that can simplify a retailers’ operations by centrally managing their network and addressing the complexity that always-connect commerce presents for merchants. With TNS, retailers can securely connect, among other things, online eCommerce gateways, ATMs, POS terminals, cash registers, printers, back office computing, forecourt tank gauges, CCTV cameras, number plate recognition technology, and even guest customer Wi-Fi. TNS Secure SD-WAN combines proven managed payment services with next generation network security.

TNS Secure SD-WAN is a fully integrated, end-to-end managed solution that can simplify a retailers’ operations by centrally managing their network and addressing the complexity that always-connect commerce presents for merchants. With TNS, retailers can securely connect, among other things, online eCommerce gateways, ATMs, POS terminals, cash registers, printers, back office computing, forecourt tank gauges, CCTV cameras, number plate recognition technology, and even guest customer Wi-Fi. TNS Secure SD-WAN combines proven managed payment services with next generation network security.

TNSLink: Wired & Wireless Remote ATM Connectivity

TNSLink is a fully managed communications solution for ATMs, POS terminals, and self-service Kiosks worldwide. TNSLink is designed to improve uptime, increase revenues, decrease costs, and simplify operations with a highly secure solution that has a proven track record in the payments industry. TNSLink features flexible connectivity, state-of-the-art technology, secure communications, service availability qualification, multiple back-up options and an online portal providing visibility across your entire estate.

TNSLink is a fully managed communications solution for ATMs, POS terminals, and self-service Kiosks worldwide. TNSLink is designed to improve uptime, increase revenues, decrease costs, and simplify operations with a highly secure solution that has a proven track record in the payments industry. TNSLink features flexible connectivity, state-of-the-art technology, secure communications, service availability qualification, multiple back-up options and an online portal providing visibility across your entire estate.

TNS Secure Internet Gateway

TNS Secure Internet Gateway is a payment delivery solution for IP-based transactions. It is a payment transaction only SSL/TLS gateway offering ultra-high availability, redundant access points, 24x7x365 support and a seamless migration path for acquirers and ISOs to deliver IP transactions securely and reliably to their processing hosts. Features include a dedicated SSL/TLS gateway, an online management reporting and configuration portal, host isolation, protocol and message conversion, and additional capabilities such as DDoS protection, terminal white/black listing, pre-shared key authentication and X.509 client authentication.

TNS Secure Internet Gateway is a payment delivery solution for IP-based transactions. It is a payment transaction only SSL/TLS gateway offering ultra-high availability, redundant access points, 24x7x365 support and a seamless migration path for acquirers and ISOs to deliver IP transactions securely and reliably to their processing hosts. Features include a dedicated SSL/TLS gateway, an online management reporting and configuration portal, host isolation, protocol and message conversion, and additional capabilities such as DDoS protection, terminal white/black listing, pre-shared key authentication and X.509 client authentication.

TNS Dial

TNS Dial is the payment industry’s leading, managed dial payment transaction solution designed to securely and reliably deliver transactions from all types of terminals. TNS Dial has an impressive track record in the electronic payments industry. Over the past decade, it has securely delivered billions of transactions to their destinations and has built a reputation on security and reliability second to none amongst the leading processors and acquirers in the industry. Features include specialized architecture and message handling, monitoring and reporting, high availability, and global network reach. TNS Dial can simplify operation and save money while improving resiliency and security.

TNS Dial is the payment industry’s leading, managed dial payment transaction solution designed to securely and reliably deliver transactions from all types of terminals. TNS Dial has an impressive track record in the electronic payments industry. Over the past decade, it has securely delivered billions of transactions to their destinations and has built a reputation on security and reliability second to none amongst the leading processors and acquirers in the industry. Features include specialized architecture and message handling, monitoring and reporting, high availability, and global network reach. TNS Dial can simplify operation and save money while improving resiliency and security.

Managed Point-to-Point Encryption

Eliminate ‘clear’ cardholder data from your environment and simplify your compliance requirements with TNS’ suite of fully managed end-to-end POS encryption solutions. Supporting a range of hardware solutions from major terminal providers, TNS’ Managed Point-to-Point Encryption removes cardholder data from merchant POS applications, networks and servers, and securely delivers transactions to the appropriate processor(s).

Eliminate ‘clear’ cardholder data from your environment and simplify your compliance requirements with TNS’ suite of fully managed end-to-end POS encryption solutions. Supporting a range of hardware solutions from major terminal providers, TNS’ Managed Point-to-Point Encryption removes cardholder data from merchant POS applications, networks and servers, and securely delivers transactions to the appropriate processor(s).

Global Wireless Access

Global Wireless Access is a wireless m2m solution for POS terminals, specifically designed for the needs of the payments industry. It combines industry-leading features, such as strongest signal SIMs, enhanced SIM management, an advanced diagnostics portal and a dedicated terminal application. With comprehensive coverage across Europe, the Americas and Asia Pacific region, Global Wireless Access helps to significantly simplify the deployment and management of mobile POS terminals.

Global Wireless Access is a wireless m2m solution for POS terminals, specifically designed for the needs of the payments industry. It combines industry-leading features, such as strongest signal SIMs, enhanced SIM management, an advanced diagnostics portal and a dedicated terminal application. With comprehensive coverage across Europe, the Americas and Asia Pacific region, Global Wireless Access helps to significantly simplify the deployment and management of mobile POS terminals.

TNSConnect

TNSConnect provides secure, fully managed, resilient connectivity for the transmission of high volumes of credit, debit, gift, loyalty, eCommerce and other transaction types to leading acquirers, banks, processors and the wider payments community. Managing many connections to partners around the globe is costly and introduces multiple new risks. Additionally, trying to expand connections into new countries can be time consuming and can expose your organization to compliance risks. Utilize TNSConnect to simplify this process and expand your business faster in a more cost effective secure manner. A new cloud version can now connect cloud services to the global payments ecosystem and facilitates the delivery of payments transactions from devices to terminal driving hosts domiciled in cloud environments.

TNSConnect provides secure, fully managed, resilient connectivity for the transmission of high volumes of credit, debit, gift, loyalty, eCommerce and other transaction types to leading acquirers, banks, processors and the wider payments community. Managing many connections to partners around the globe is costly and introduces multiple new risks. Additionally, trying to expand connections into new countries can be time consuming and can expose your organization to compliance risks. Utilize TNSConnect to simplify this process and expand your business faster in a more cost effective secure manner. A new cloud version can now connect cloud services to the global payments ecosystem and facilitates the delivery of payments transactions from devices to terminal driving hosts domiciled in cloud environments.

Offices in US, UK, Ireland, France, Germany, Italy, Spain, Australia, Hong Kong, India, Japan, Philippines, South Korea, Singapore, Taiwan, Thailand, Malaysia, Brazil and New Zealand.

Global

John Tait

Global Managing Director

+61 1 800 155 510

[email protected]

Regional contacts:

Europe & UK

Mark Collins

Managing Director, Payments Market, Europe

+353 186 59201

[email protected]

Transaction Network Services (UK) Ltd

5 Europa View

Sheffield Business Park

Sheffield

S9 1XH

UK

Transaction Network Services Ireland Ltd

Suite 2, Third Floor

23 Shelbourne Road

Ballsbridge

D04 PY68, Dublin 4

Ireland

Transaction Network Services S.A.S

1 Rue Saint Georges

5th Floor

75009 Paris

France

Asia Pacific

Michael Johnson

Managing Director, Payments Market, Asia Pacific

+61 2 9959 0831

[email protected]

Transaction Network Services Australia Pty Ltd

Suite 1, Level 10, Angel Place

123 Pitt Street

Sydney

NSW 2000

Australia

U.S.

Shaun Donaghey

SVP, Payments Market, North America

+1 866 523 0661

[email protected]

Transaction Network Services Inc.

10740 Parkridge Boulevard, Suite 100

Reston

Virginia 20191

USA

Why Payments is the Perfect Application for SD-WAN

Why Payments is the Perfect Application for SD-WAN

The old days of retail transactions were a simpler time. Your customers paid cash for their products and services — money you could hold in your hand. If your customers didn’t have cash, well, then they didn’t get their goods or services.

Wilson Parking Australia Provides Flexible and Safe Options to Its Customer

Wilson Parking Australia Provides Flexible and Safe Options to Its Customer

It is of course challenging times for most industries at the moment, and parking is no exception. Across the industry, global customers of TNS’ ADVAM solution have seen a decline in parking transactions. As cities across the world go into lockdown, workplaces are mainly closed and people are only going out for essentials, it’s obvious that people will be parking less.

Global Opportunities for Secure Commerce at the Pump

Global Opportunities for Secure Commerce at the Pump

In a world where technology and convenience have turned customer demand into customer expectation, a new report published by Transaction Network Services (TNS) suggests that the majority of consumers are open to new experiences when they pay-at-the-pump.

What Next for the Payments Industry in 2020?

What Next for the Payments Industry in 2020?

Wow. 2019 has been filled with mega-mergers, more consumer experience changes and another demanding period of evolution for the payments industry. A multitude of alternative payment methods hedging forward, security breaches with greater sophistication, and open banking offering as much promise as it does confusion. All that and we have a mixture of regulatory participation in many developed markets. So, what’s in store for 2020? TNS’ Vice President of Payment Solutions, Brian DuCharme gives us his insights and predictions into the potential developments and possible disruptions in 2020.

Melbourne Museum Uses Customer Insights to Improve the Parking Experience

Melbourne Museum Uses Customer Insights to Improve the Parking Experience

Located in the city of Melbourne, Australia, Melbourne Museum is the largest museum in the southern hemisphere and is part of Australia’s largest public museum organisation. Voted as one of Australia’s most popular tourist attractions, Melbourne Museum attracts two million visitors every year and is supported by more than 600 staff and 500 volunteers.

Deploying Cloud Based Systems in the Payments Industry

Deploying Cloud Based Systems in the Payments Industry

Cloud based systems are still relatively new to the payments industry and recent figures suggest that of the nearly 500 billion non-cash transactions around the world, more than 95% leverage legacy payment schemes which rely on point-to-point interconnectivity. That said, leveraging cloud technology is key to advancing any distributed business which relies on big data; therefore, it is a strategic consideration which cannot be ignored.

Bridging Physical and Digital Parking

Bridging Physical and Digital Parking

The parking business has come a long way – from the first multi-storey car park built for the LaSalle Hotel in 1918 in Chicago to the first working parking meter built in 1920’s/1930’s to regulate parking time in Oklahoma City.

Pressure Mounts on Retailer Store Networks

Pressure Mounts on Retailer Store Networks

Retailers around the world are facing overwhelming pressures from multiple sources which are impacting store networks. Katherine Brown, Director of Product Management, at TNS explores the latest challenges and how retailers can use payments technology to ease this burden.

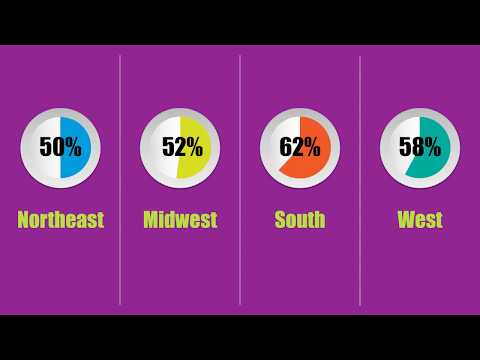

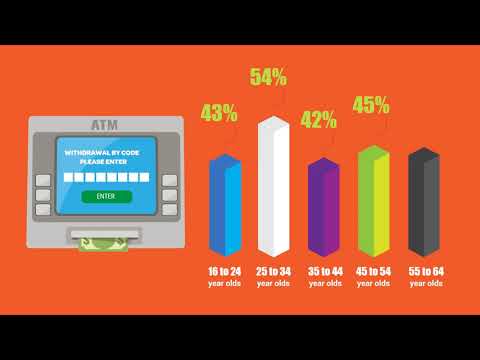

Survey Reveals Variances in US/UK ATM Attitudes

Survey Reveals Variances in US/UK ATM Attitudes

It’s more than 50 years now since the introduction of the ATM and with its proliferation around the world, the majority of consumers take these facilities for granted and many have never experienced life without this invention. TNS commissioned an independent survey of US and UK adults to find out how these cornerstones of the payments industry are now viewed in today’s dynamic world. Tiffany Trent-Abram takes us through some of the key findings.

Payments Advice for 4G Router Deployment

Payments Advice for 4G Router Deployment

Whether it’s to get ahead of the competition or being driven by the global shut down of 2G and 3G networks, the payments industry is migrating to 4G technology in growing numbers. TNS Product Manager Chris Walker is playing a pivotal role in supporting this transition for TNS customers. In this blog Chris provides some vital insights into how to overcome the most common issue when swapping in new 4G equipment – signal strength.

Does Migrating to the Cloud Put Payment Data at Risk?

Does Migrating to the Cloud Put Payment Data at Risk?

Mark Collins, Managing Director of Transaction Network Services’ FinTech Solutions business in Europe, gives us his insights on how you can safely and securely insert cloud services into your payments infrastructure.

Security Fears Threaten Biometric Payments Growth

Security Fears Threaten Biometric Payments Growth

Biometric payments are poised for significant growth, but substantial consumer security concerns could put its future at risk according to a report from TNS. Bill Versen, TNS’ Chief Product Officer, shares some key insights.

Make Time to Address 4G Migration Before It’s Too Late

Make Time to Address 4G Migration Before It’s Too Late

Mark Collins, Managing Director of Transaction Network Services’ FinTech Solutions business in Europe, addresses concerns about the growing number of 2G and 3G networks that are shutting down.

Significant Growth Opportunities for Unattended Terminals

Significant Growth Opportunities for Unattended Terminals

70% of consumers want unattended terminals to accept both card and cash payments and a significant number are willing to use wearable devices or digital wallets at these locations, according to a survey* of US, UK and Australian adults commissioned by TNS. Bill Versen, Chief Product Officer at TNS, talks us through some of the key findings.

Is the Industry Prepared for Next Gen ATMs? | Cash | Banks | Wireless ATM

Is the Industry Prepared for Next Gen ATMs? | Cash | Banks | Wireless ATM

With bank branches closing, ATMs are becoming the major touchpoint with the customer and extending their features to provide replacement services. This video explores the potential and challenges surrounding Next Gen ATMs and how these can be addressed.

Will Security Concerns Impact Smart Payments Potential? Research | Connected cars | Voice assistants

Will Security Concerns Impact Smart Payments Potential? Research | Connected cars | Voice assistants

Smart payments are on the rise and consumers now have the option of making payments via a mobile device, household appliance or even their car dashboard. Our video shows which country is leading the way in adopting smart payments, who has the most security

The move to wireless ATM deployments in Asia Pacific, current trends and future direction

The move to wireless ATM deployments in Asia Pacific, current trends and future direction

TNS’ Director of Product Management, Katherine Brown and Managing Director for Asia Pacific, Michael Johnson take part in an ATMIA webinar about wireless ATM adoption. ATM telecommunications, particularly off premise deployments, continue to represent the second largest operating cost for deployers behind cost of cash. Listen to Katherine and Michael discuss wireless ATMs, what models have deployers chosen to adopt, and do they deliver the in-principle benefits of speed to market, operational efficiency around IMAC and good or better uptime versus traditional methods? What trends are there in other global territories that we don’t see in Asia Pacific?

US ATM Usage Remains Strong But Consumers Split on Latest Innovations

US ATM Usage Remains Strong But Consumers Split on Latest Innovations

A recent independent survey* commissioned by Transaction Network Services (TNS) has revealed that the ATM remains a firm cornerstone of the US payments industry, however, attitudes to new innovations, such as the ability to obtain foreign currency, lottery tickets and other services appear mixed. This video presents some of the key findings.

How Will The Payments Landscape Evolve in 2019?

How Will The Payments Landscape Evolve in 2019?

Over the last few years, the variety of payment methods available has expanded dramatically, fueled by significant consumer adoption on a global level. This infographic considers the key developments which could shape the payments industry in 2019.

Interesting Findings in UK Survey of ATM Usage

Interesting Findings in UK Survey of ATM Usage

Are consumers happy with the service and quantity of ATMs found in the UK and abroad? A recent survey carried out by Transaction Network Services on UK adults shows some interesting findings in the way we use ATMs in today’s ever advancing technological world.

- 10/6/2020 - How Can Merchants Adapt to Meet Consumer Expectations and The “New Normal?”

- 10/6/2020 - How Can Retailers Combine Frictionless Payments with Enhanced Security?

- 12/3/2019 - US Consumers Want More Secure Commerce Opportunities at the Pump

- 11/26/2019 - Consumers Globally Welcome Secure Commerce at the Pump Opportunities

- 11/26/2019 - Young Australians Ready to Embrace Secure Commerce at the Pump

- Show All Transaction Network Services (TNS Inc) White Papers

- 4/16/2024 - TNS Launches Complete Commerce - an End-to-End Payments Solutions Stack

- 9/19/2023 - Euro Automatic Cash Links with TNS to Provide Nationwide Managed Connectivity for ATMs

- 6/26/2023 - TNS Upgrades European Backbone

- 5/23/2023 - TNS Launches Full-Suite of Financial Infrastructure Services Across Canada

- 5/1/2023 - TNS Enterprise Branded Calling Receives 2023 CUSTOMER Product of the Year Award

- Show All Transaction Network Services (TNS Inc) Press Releases / Blog Posts