Loading...

United States / Americas

Bookmark this page to keep informed of the latest news, as well as upcoming meetings and conferences.

David Tente, Executive Director

E: [email protected]

T: +1.407.833.7906

MEMBER OF THE MONTH

National ATM Systems is an ATM ISO and full service ATM company. Their expertise and knowledge in the ATM industry has propelled us forward as an industry leader. National ATM Systems' strategic alliances with ATM processors, ATM manufacturers, and other partners have allowed them to grow and maintain a level of service that exceeds the expectations of their customers.

National ATM Systems is an ATM ISO and full service ATM company. Their expertise and knowledge in the ATM industry has propelled us forward as an industry leader. National ATM Systems' strategic alliances with ATM processors, ATM manufacturers, and other partners have allowed them to grow and maintain a level of service that exceeds the expectations of their customers.

National ATM Systems takes great pride in their industry leading customer service. Expertise and knowledge in the ATM industry has propelled them forward as an industry leader. All repairs and issues are addressed within 24 hours of notification and are usually fixed within the same day.

Categorized as a full service ATM company, National ATM Systems is an ATM ISO. They offer a complete array of ATM services including ATM sales, ATM placement, ATM processing, ATM vault cash, ATM maintenance, and ATM ISO services. Tailored programs for large and small businesses within your industry are available.

U.S. Spotlight

The ATMIA 2023 Washington, DC Fly-In

On April 20, 2023, ATMIA attended the fourth Washington, DC Fly-in. What is a Fly-In? It is an opportunity to meet with legislators and staff and help them better understand the ATM industry and its issues.

Meetings included:

– Congressman John Rose (TN) and his legislative counsel, Graham Conlan: We have met with Rose several times now, and he is always very welcoming, friendly, and interested in our issues. Although we brought up the topic of ATM crime during our meeting last year, he knew very little about it. However, he ended up co-sponsoring the Safe Access to Cash Act last October.

Congressman Rose remains very supportive of an increase in ATM crime penalties. He informed us that he is looking for a Democrat member of the Judiciary Committee to co-sponsor a re-introduction of the bill. He is hopeful that could happen by June.

Rep. Rose still supports the Payment Choice Act but is uncertain about its future. He is also working on the framework of a stablecoin bill and does not see much happening regarding a CBDC.

– Senator Ben Ray Lujan (NM) and Sophia Bock, legislative aide: Senator Lujan is not on any of the primary committees of interest to ATMIA – Banking, Finance, and Judiciary – but he is on the Commerce Committee, which we mentioned, as a lead-in to a discussion of the Payment Choice Act.

– Senator Ben Ray Lujan (NM) and Sophia Bock, legislative aide: Senator Lujan is not on any of the primary committees of interest to ATMIA – Banking, Finance, and Judiciary – but he is on the Commerce Committee, which we mentioned, as a lead-in to a discussion of the Payment Choice Act.

Senator Lujan, too, raised the question of business rights to operate freely as a potential objection. We again emphasized the importance of consumer rights and financial inclusion. He will be discussing the bill with Representative Payne.

Senator Lujan was not familiar with the ATM crime bill but was eager to talk about it and will likely support it. Senator Lujan sits on a crypto committee in the Senate. That presented a great opportunity to voice our concerns about future regulation of the industry, as well as offer to discuss the issues in more detail.

– Rebecca Alcorn, Senior Policy Adviser to Senator Mike Crapo (Republican on the Finance Committee): She informed us that Mr. Crapo is not fully supportive of bans on cashless retail but would ask that he take another look at it. We stressed the importance of the financial inclusion aspect of that bill and as a back-up for failed payment systems.

Senator Crapo is very interested in the ATM crime issue and would support it if introduced. We informed Rebecca of our conversation with Rep Rose and his expectation that the measure would be introduced by June.

It was a successful event and objectives were accomplished. Planning for the 2024 Fly-in will begin this Summer. Anyone interested in sponsoring the 2024 event should contact David Tente. The earlier we receive a sponsor commitment, the longer the sponsor receives credit for their support.

Bans of Cashless Retail Establishments

CASHLESS NEWS!

|

Efforts to ban retail establishments from refusing cash payments are gaining momentum everywhere – at the city, state, and federal levels. The stated motivation in all of these instances is that a cashless environment discriminates against the poor and the unbanked. The issue, however, is much larger than that. Cashless retail severely limits consumer payment choice and eliminates the favored payment method for 26% of the population (Fed numbers).

Even those considering a cashless environment should take a moment to consider factors outside of payment choice. In times of crisis – regardless of the cause – cash is often the only option. Daily life, too, has its wrinkles – payment networks crash and power systems fail.

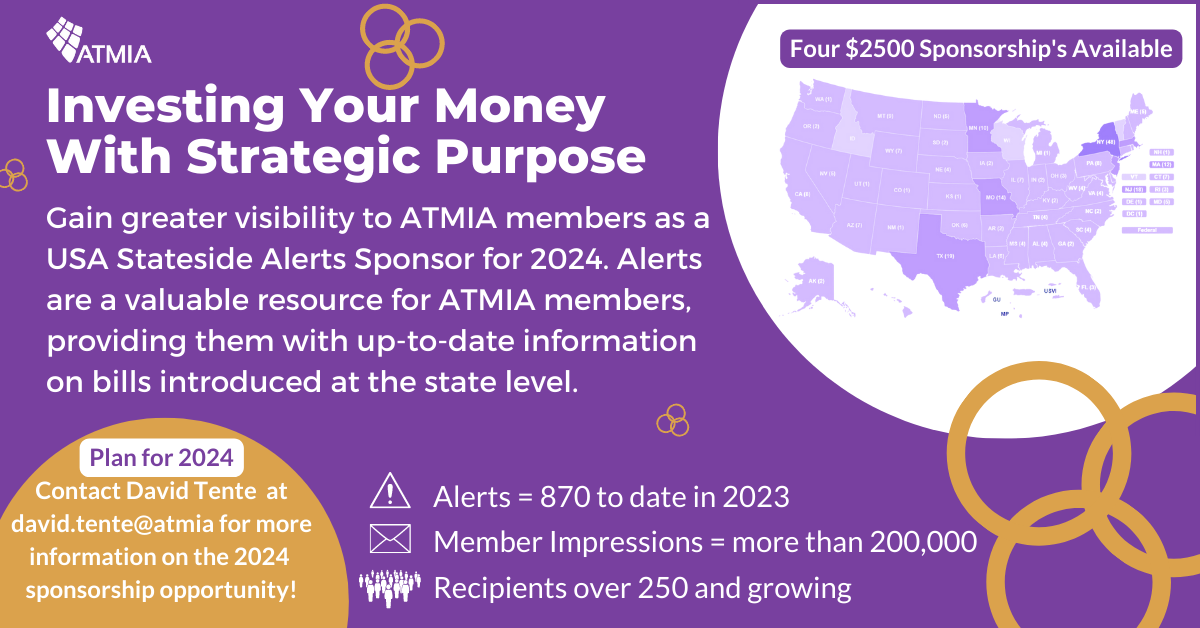

ATMIA USA is supporting all efforts to prohibit cashless retail businesses. The interactive map below displays current proposals and newly enacted law. Simply click on a state to display information about proposed legislation and/or a list of specific cities that have proposed new ordinances. ATMIA members have access to additional details about these measures.

New FinCEN Statement on IAD Fraud Risk

On June 22, 2022, FinCEN (Financial Crimes Enforcement Network, U.S. Department of the Treasury) released their "Statement on Bank Secrecy Act Due Diligence for Independent ATM Owners or Operators". That statement notes the issues that many IADs have had with getting and keeping the bank relationships that are necessary to operate their business – which "jeopardizes the important financial services they provide, including to persons in underserved markets".

"FinCEN reminds banks that not all independent ATM owner or operator customers pose the same level of money laundering, terrorist financing (ML/TF), or other illicit financial activity risk, and not all independent ATM owner or operator customers are automatically higher risk."

This recent statement essentially emphasizes the guidance provided in the independent operator section of the revised BSA/AML examination manual. The implementation of a risk-based approach is required for all bank customers. It also lists the types of information that the bank may wish to collect in making CDD decisions.

A full copy of the FinCEN statement may be downloaded here.

Sponsored By

Legend

Ban Progressing

Ban Approved

Ban Failed

Approved Bans: San Francisco, CA - Colorado - Connecticut - Delaware - Massachusetts - Montana - New Jersey - New York City, NY - Oregon - Philadelphia, PA - Rhode Island - Tennessee

Faster Payments – why should we care?

Should the ATM channel even care about the direction of so-called ‘Faster Payments”? The first reaction for some might be to wonder what all the fuss is about. After all, how much faster can an ATM transaction get, than it already is? And would it really matter? The answer is ‘Yes’ – and we should care a lot. The real excitement and enthusiasm for Faster Payments is about the ‘rails’ that they would travel – not necessarily the few seconds it might shave off of transaction times.

It is precisely for this reason that ATMIA became a founding member of the U.S. Faster Payments Council (FPC) and has also joined the FedNow Community. The FPC is building on the work of the Faster Payments Task Force, which was setup to create the foundation of and the governance for Faster Payments in the U.S. One of its major objectives is to foster ubiquity of Faster Payments services through interoperability.

Interoperability in a faster payment system can help achieve seamless processing – both sending and receiving – of payment instructions across various payment solutions. This can significantly benefit all players in the ecosystem if it provides access and reach to any end-user, regardless of the network their financial institution connects to. Through interoperability, the ecosystem can promote competition, reach and scale. All of which can be done without the need for a traditional debit card.

Faster Payments offers fintechs a broad range of opportunities to help create and build these new systems. Digital wallets are already moving into the realm of the ATM. Now imagine a cardless/contactless ATM wallet that can directly access your bank account, interact with the ATM, and dispense your cash, using the rails of a new fintech Faster Payments service.

Or perhaps by utilizing the Federal Reserve Banks’ FedNow system, slated for deployment in the 2023/4 time frame. FedNow will be a new interbank 24x7x365 real-time gross settlement (RTGS) service with integrated clearing functionality. The service will help enable financial institutions to deliver end-to-end faster payment services to their customers. Through the FedNow network, you can be provided the ability to send and receive payments any time, any day, and have full access to those funds within seconds.

Our ability to dispense cash without the use of a card for most ATM transactions, thus improving the customer experience, reducing risk, and heightening security, may be closer than you imagined. For more information about the U.S. Faster Payments Council, visit their website. ATMIA will also keep its members informed on a regular basis of progress being made in these areas. A copy of the FPC Network Committee’s newly published White Paper on “Faster Payments Interoperability” is available for download here from the ATMIA website.

Regulator meetings - June, 2019

IAD (Independent ATM Deployer) bank account closure concerns are now extending to business operating accounts. Past account closures involved cash settlement accounts held by IADs; almost exclusively. In recent months, however, we are seeing a growing number of ordinary business operating accounts – payroll, loan payments, operating expenses, etc. – also being closed. In some cases, this new trend is even impacting ATM businesses that outsource all their cash services, which means that they don’t even have a cash settlement account.

Another area of concern was highlighted by ATMIA’s 2019 Cash Settlement Account Closure Survey, which found that respondent IADs were often told that they are classified as an MSB (Money Services Business) – a type of business the prospective bank does not accept. Of those who were given a reason for their account closure, that was the most common – 29% of respondents. However, owning/operating an ATM clearly falls outside of the FinCEN/FDIC definition of an MSB.

ATMIA USA executive director, David Tente, and EFTA president and CEO, Kurt Helwig, met with the OCC, FDIC, and CFPB to discuss these issues on June 13th. These three agencies, along with the NCUA (National Credit Union Administration) are the primary contributors to the FFIEC Bank Examination Manual. Download the full report . . .

2019 Washington DC Fly-In

This year the environment in Washington, DC was quite different than last year. Since we have not had as much contact with the Democrat side, our first objective was to introduce ATMIA and provide some education on our industry.

As discussed in many of the in-person committee meetings at the U.S. conference in February, ATMIA has taken up the need for bans on cashless retail establishments as our major advocacy issue for 2019. The closure of IAD bank accounts is still an important one that we continue to pursue. But continued growth of cashless retail establishments is a situation that could be a truly existential threat to the industry. And we thought that opposing the disenfranchisement of poor and unbanked consumers by cashless merchants would be an issue that Democrats would eagerly support. Download the full overview . . .

2019 Cash Settlement Account Closure Survey Report

Despite the DOJ’s (Department of Justice) proclamation in 2017 that Operation Choke Point (OCP) had been terminated, many ATM operators have continued to have their cash settlement and other business accounts, apparently in good standing, closed for questionable reasons. Speculation is increasing that current closures may be tied more to bank de-risking strategies or profitability criteria than direct pressure from regulators.

Despite the DOJ’s (Department of Justice) proclamation in 2017 that Operation Choke Point (OCP) had been terminated, many ATM operators have continued to have their cash settlement and other business accounts, apparently in good standing, closed for questionable reasons. Speculation is increasing that current closures may be tied more to bank de-risking strategies or profitability criteria than direct pressure from regulators.

ATMIA created the 2019 IAD Cash Settlement Account Closure Survey to evaluate the impact of sudden cash settlement account closures experienced by many IADs (Independent ATM Deployers). It sought to determine how widespread this problem is, what circumstances surround a typical account closure, and how operators are dealing with it. The survey was open to all independent ATM operators/owners/acquirers – both ATMIA members and non-members. Download the report . . .

Industry highlights

IADs are encouraged to talk with their state and federal

There is no more effective conversation with a state or federal legislator than the one you have with your representative. And they are particularly interested in hearing from their constituents who own or manage local businesses. But keep in mind that they probably know very little, if anything, about how the ATM industry works. Helping them understand our industry will help them recognize the potential impact of new regulatory measures.

There is no more effective conversation with a state or federal legislator than the one you have with your representative. And they are particularly interested in hearing from their constituents who own or manage local businesses. But keep in mind that they probably know very little, if anything, about how the ATM industry works. Helping them understand our industry will help them recognize the potential impact of new regulatory measures.

Emphasize the benefits of convenient access to cash for their constituents, and consumers in general. And how that cash can boost in-store revenue, benefiting small retail merchants. Talk specifically about what your company does and its role in the industry. Always keep the conversation positive - our industry plays a very important part in the economy.

ATMIA created a "leave-behind" piece for its recent Washington DC Fly-In event. You may find it helpful in creating your talking points. Leave a copy for your representative, as it provides an excellent overview of ATMIA, the ATM industry, and several key issues. Download a copy here.

ATMIA gathers feedback on EMV migration and post-migration issues.

ATMIA recently completed a new survey to gauge the progress of EMV migration in the U.S. While the primary objective was to assess how complete EMV migration is in the ATM channel, ATMIA was also seeking feedback on post-migration issues like card and card reader problems, as well as thoughts on deployment of NFC technology, cardless solutions, and new ATM functionality.

Analysis of survey results is now available. ATMIA members can download the report from our Market Research page. Non-member participants received a code with which to claim a copy of the full report. Questions or requests for more information about the survey project should be directed to David Tente, Executive Director, ATMIA USA & Americas (+1.407.833.7906)

CNBC shoots another feature piece with ATMIA USA

A follow-up piece to the feature on preventing ATM skimming is due out toward the end of July. CNBC sent a remote crew out to the office of ATMIA USA executive director, David Tente to record the interview.

A follow-up piece to the feature on preventing ATM skimming is due out toward the end of July. CNBC sent a remote crew out to the office of ATMIA USA executive director, David Tente to record the interview.

The questions focused on cyber crimes and new types of attacks the industry is now dealing with. A hot topic for many is the dearth of information available on current crime activity. ATMIA ASA committee groups have begun to explore options for creating a system that would allow operators to share information. "Stay tuned for more details . . ."

ATMIA Advocacy Milestones

The real story behind eliminating Reg E fee placard requirements

Without question, the ATM industry’s most significant regulatory success has been the elimination of Reg E requirements for posting physical signage on the ATM to disclose surcharge fees - with respect to both the broad support the effort garnered and the speed with which it was accomplished.

Those requirements were relics of the days before ATMs were capable of disclosing convenience fees on the terminal screen, and requiring that the cardholder accept the fees before a transaction could be completed. It was a very typical example of laws not keeping up with technology. In addition to being duplicative and unnecessary, the placard requirement also created new opportunities for fraudsters – filing costly lawsuits against ATM operators for missing placards, even if they were missing due vandalism or removal by the fraudsters themselves.

Discussions about the need to change this law actually began with a meeting between the EFTA, which partners with ATMIA on federal regulatory matters, and Rep. Blaine Luetkemeyer in the summer of 2011. H.R.4367, sponsored by Congressman Luetkemeyer, was introduced in the House on April 17, 2012 and was passed on July 9, 2012 by a 371-0 margin.

Meanwhile, the Senate produced two companion bills, S. 3204 (Sen. Mike Johanns) and S. 3394 (Sen. Tim Johnson) – neither of which was even considered by the Committee on Banking. Both bills contained additional language that had little support. The first and final action on the second Senate bill, S. 3394 was its introduction on July 17, 2012.

The House bill was supported and promoted by a huge industry coalition that included ATMIA, EFTA, ETA, ABA, all state bank associations, NAFCU, state credit union leagues, the U.S. Chamber of Commerce, Food Marketing Institute, Merchant Advisory Group, Consumer Action, NACS, and many others. A total of 148 House co-sponsors eventually signed-on to support the measure.

After being passed by the House, H.R.4367 – “To amend the Electronic Fund Transfer Act to limit the fee disclosure requirement for an automatic teller machine to the screen of that machine” – was passed in the Senate, without amendment, by unanimous consent on December 11, 2012 and signed into law on December 20, 2012 by President Obama.

To learn more about the history of these bills, use the links above to visit the congressional archives, or download a brief summary from the ATMIA website.

Engaging with the ATM and U.S. payments industries

As part of its mission to serve as a voice for the ATM industry, ATMIA USA is actively engaged with a variety of industry and government bodies. Despite frequent predictions for the demise of cash, by a few pundits, it remains a key component of the payments ecosystem. ATMIA’s ongoing participation in these industry dialogues ensures that the needs of our industry receive appropriate consideration.

The Federal Reserve Faster Payment Task Force

The mission of the Faster Payments Task Force is to identify and evaluate alternative approaches for implementing safe, ubiquitous, faster payments capabilities in the United States that advance the following desired outcome:

A ubiquitous, safe, faster electronic solution(s) for making a broad variety of business and personal payments, supported by a flexible and cost-effective means for payment clearing and settlement groups to settle their positions rapidly and with finality.

ATMIA was part of the Faster Payments Task Force and worked to ensure that any new payments platform can be successfully integrated into the U.S. ATM channel.

U.S. Payment Forum (formerly the EMV Migration Forum)

As of August 1, 2016, the EMV Migration Forum has become the U.S. Payments Forum. With much of the EMV migration process behind, the group is broadening its mission.

The EMF was formed an independent, cross-industry body by the Smart Card Alliance on July 31, 2012 to address issues that require broad cooperation and coordination across many constituents in the payments space in order to successfully introduce secure EMV contact and contactless technology in the United States.

Led by numerous members of ATMIA, a new ATM Working Committee was set up in December, 2012 and formally approved by the EMF Steering Committee shortly thereafter. The group is co-chaired by ATMIA USA Executive Director David Tente and two other ATMIA members.

The EMF also maintains a Knowledge Center as a public repository of information relative to EMV migration. Documents can be searched by Category, Stakeholder or Title. ATMIA members have been instrumental in creating the “Implementing EMV at the ATM” white paper which is available in the Knowledge Center and the ATMIA website White Papers section.

Introducing the new $20, $10 and $5

Building on tremendous feedback from Americans across our country about the theme of democracy, the Treasury Department will create new design concepts for the $20, $10, and $5 dollar notes. Find out more.

Helpful Links

Explore ATMIA's active committees and how to join.

(This is a member benefit and you will be asked to login.)

Working to protect the health & vitality of the U.S. ATM Industry. Find out how you can contribute.

Online training and certification program for ATM Operators.

Read the latest edition.

Make connections with ATMIA's full member directory.