News

ATM cash withdrawal volume grows 6 percent in 2016

Wednesday, December 20, 2017

View Showroom

From ATMmarketplace.com

In 2016, the number of cash withdrawals at ATMs worldwide was 107 billion, a 6 percent increase over 2015.

And though the total number of withdrawals is declining in some developed markets, the value of the cash withdrawn is increasing as consumers choose fewer, higher-value transactions, according to Global ATM Market and Forecasts to 2022, a report from the research and consultancy firm RBR.

According to the report, not only are ATM withdrawal volumes and values on the rise in most markets, but also real-time cash deposits.

According to the report, not only are ATM withdrawal volumes and values on the rise in most markets, but also real-time cash deposits.

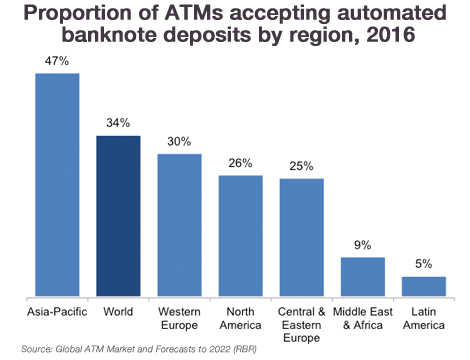

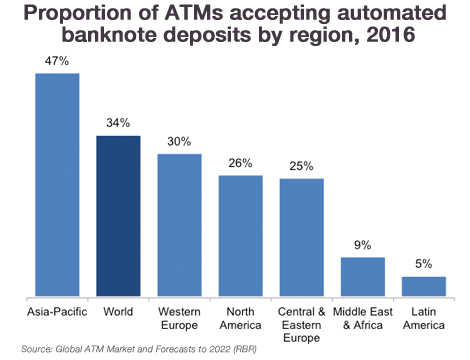

By the end of 2016, the number of ATMs that could be used to automatically deposit banknotes reached 1.1 million, or 34 percent of the global ATM total, RBR said in a press release.

By connecting additional facilities to the deposit module, deployers often enable customers to settle bills, transfer money, or pay for other goods and services with the deposited cash.

And just as the rise in ATM popularity meant that banks could rationalise their branch networks and redeploy staff to higher-value positions, automated deposit ATMs mean that they can continue to move staff members to other roles, such as sales.

For the customer, these ATMs mean that they can deposit their banknotes at more times of the day and in more locations, for greater convenience.

Recycling ATMs — automated deposit ATMs that also dispense the deposited banknotes — are growing in number. At the end of 2016, more than 670,000 ATMs at the end of 2016 were recyclers, up from 360,000 in 2012, RBR said.

In addition to staff redeployment or rationalisation, these machines also allow banks and independent ATM deployers to reduce their cash-in-transit costs, since fewer CIT visits may be required.

"Banks are improving the functionality of their ATMs so that more transactions can be migrated from the branch counter to self-service, freeing up staff to undertake sales and advisory tasks," said Rowan Berridge, research leader for the report. "Furthermore, they are increasingly rationalizing their branch networks and using ATMs to offer a wide range of services in areas that do not justify the presence of a traditional outlet."

In 2016, the number of cash withdrawals at ATMs worldwide was 107 billion, a 6 percent increase over 2015.

And though the total number of withdrawals is declining in some developed markets, the value of the cash withdrawn is increasing as consumers choose fewer, higher-value transactions, according to Global ATM Market and Forecasts to 2022, a report from the research and consultancy firm RBR.

According to the report, not only are ATM withdrawal volumes and values on the rise in most markets, but also real-time cash deposits.

According to the report, not only are ATM withdrawal volumes and values on the rise in most markets, but also real-time cash deposits.By the end of 2016, the number of ATMs that could be used to automatically deposit banknotes reached 1.1 million, or 34 percent of the global ATM total, RBR said in a press release.

By connecting additional facilities to the deposit module, deployers often enable customers to settle bills, transfer money, or pay for other goods and services with the deposited cash.

And just as the rise in ATM popularity meant that banks could rationalise their branch networks and redeploy staff to higher-value positions, automated deposit ATMs mean that they can continue to move staff members to other roles, such as sales.

For the customer, these ATMs mean that they can deposit their banknotes at more times of the day and in more locations, for greater convenience.

Recycling ATMs — automated deposit ATMs that also dispense the deposited banknotes — are growing in number. At the end of 2016, more than 670,000 ATMs at the end of 2016 were recyclers, up from 360,000 in 2012, RBR said.

In addition to staff redeployment or rationalisation, these machines also allow banks and independent ATM deployers to reduce their cash-in-transit costs, since fewer CIT visits may be required.

"Banks are improving the functionality of their ATMs so that more transactions can be migrated from the branch counter to self-service, freeing up staff to undertake sales and advisory tasks," said Rowan Berridge, research leader for the report. "Furthermore, they are increasingly rationalizing their branch networks and using ATMs to offer a wide range of services in areas that do not justify the presence of a traditional outlet."

Additional Resources from ATM Industry Association

- 4/18/2024 - Moving ATMs Into the Future with Cash Recycling

- 4/18/2024 - ATM Champions Cash! Join the Conversation at Upcoming Events!

- 4/16/2024 - Daventry Town Football Club's cashless goal disallowed by fans

- 4/15/2024 - Congrats to Venco Business Solutions, April's US Region ATMIA Member of the Month!

- 4/12/2024 - Cash Demand Driving ATM Deployment Worldwide

- Show All ATM Industry Association Press Releases / Blog Posts