News

Cash is the (only) means of exchange and stored value in times of crisis

Monday, November 27, 2017

View Showroom

By Currency Research

From climate change and pandemics to financial instability and conflicts around the world, crises take many forms. What these crises have in common is the immediate requirement for physical currency both as a stored value to be placed aside as a contingency and as a universally accepted medium of exchange.

From climate change and pandemics to financial instability and conflicts around the world, crises take many forms. What these crises have in common is the immediate requirement for physical currency both as a stored value to be placed aside as a contingency and as a universally accepted medium of exchange.

Financial advisors worldwide recommend that people store cash savings in an emergency fund. For a conservative citizen, this translates to saving the equivalent of at least six months of pay as insurance against a potential crisis. According to Paul Sisolak at GO Banking Rates, “Cash can be your biggest protection against a national emergency or disaster if circumstances prevent you from withdrawing cash from the bank. It’s kind of like insurance — we pay into it hoping we never need it.”22

The chair of Currency Research opened the 2013 Athens Currency Conference with the slides below, detailing a personal synopsis of his experiences during the March 2013 Cyprus Financial Crisis:

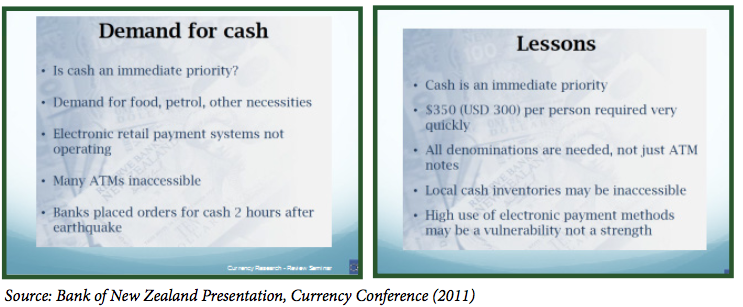

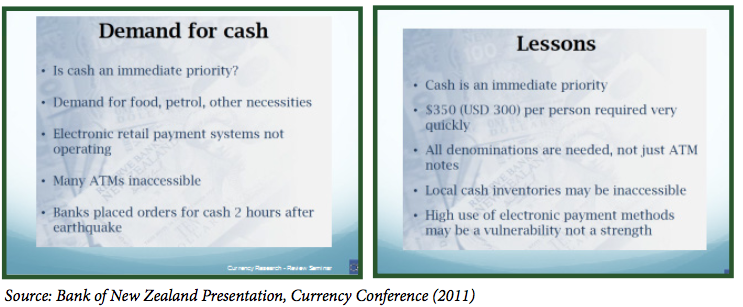

In crisis after crisis, cash becomes an immediate priority. For example, the Reserve Bank of New Zealand’s experience after the 2011 Christchurch earthquake illustrated the immediate need for access to cash in times of disaster:

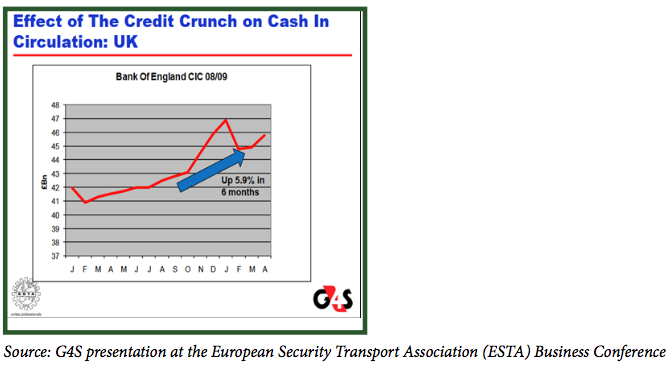

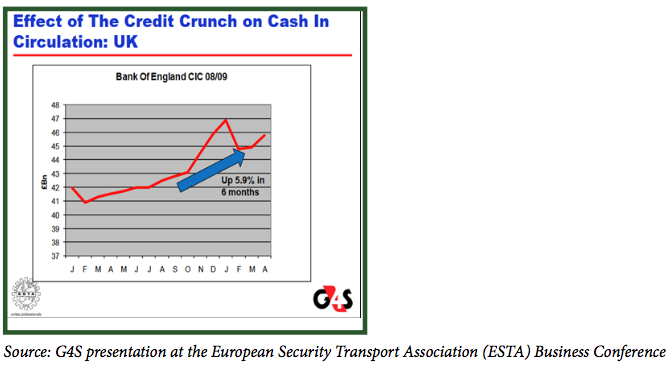

To further underscore this point, UK banknote volume trends after the 2008 financial crisis indicated an upward swing:

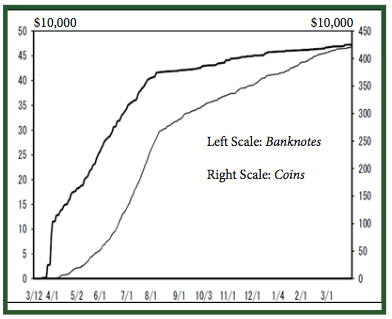

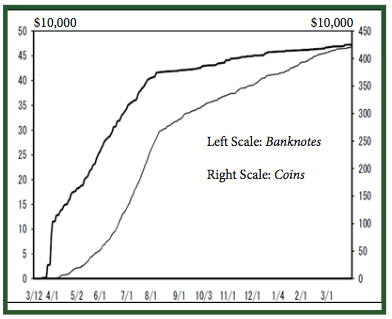

Finally, the Bank of Japan’s post-tsunami presentation at the 2011 Currency Conference showed a similar upward trend in overall banknote and coin volumes:

From the United States, Europe, and Thailand, to the United Kingdom, India, and, with one or two exceptions, all other countries, historical trends of currency volumes indicate that although cash as a percentage of transactions is in some cases declining, cash in circulation is increasing. As more potential economic upheavals and unstable times loom, cash remains the preferred means of stored value. Without power, telecommunications, and general access to electronic payments, cash becomes the only universally recognized, reliable, and trusted means of exchange.

Based on sound research and public policy grounds, the Case for Cash Part One: Myths Dispelled discussed the various reasons why cash is indispensable as a stored value.23 To illustrate, a 2010 Reserve Bank of New Zealand consumer study found that 52% of New Zealanders held cash for emergency purposes.24 Even in the absence of a crisis, cash savings have long been viewed as a budgeting tool used to save for substantial and meaningful purchases, such as a holiday, education, or car.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

22 http://www.gobankingrates.com/savings-account/how-much-physical-cash-need-hand-case-national-emergency/

23 For more details about the indispensability of cash as stored value, see Myth #11 in the Case for Cash Part One: “Only Criminals Use Banknotes.”

24 http://www.rbnz.govt.nz/notes_and_coins/banknote_upgrade/4436446.pdf

From climate change and pandemics to financial instability and conflicts around the world, crises take many forms. What these crises have in common is the immediate requirement for physical currency both as a stored value to be placed aside as a contingency and as a universally accepted medium of exchange.

From climate change and pandemics to financial instability and conflicts around the world, crises take many forms. What these crises have in common is the immediate requirement for physical currency both as a stored value to be placed aside as a contingency and as a universally accepted medium of exchange.Financial advisors worldwide recommend that people store cash savings in an emergency fund. For a conservative citizen, this translates to saving the equivalent of at least six months of pay as insurance against a potential crisis. According to Paul Sisolak at GO Banking Rates, “Cash can be your biggest protection against a national emergency or disaster if circumstances prevent you from withdrawing cash from the bank. It’s kind of like insurance — we pay into it hoping we never need it.”22

The chair of Currency Research opened the 2013 Athens Currency Conference with the slides below, detailing a personal synopsis of his experiences during the March 2013 Cyprus Financial Crisis:

In crisis after crisis, cash becomes an immediate priority. For example, the Reserve Bank of New Zealand’s experience after the 2011 Christchurch earthquake illustrated the immediate need for access to cash in times of disaster:

To further underscore this point, UK banknote volume trends after the 2008 financial crisis indicated an upward swing:

Finally, the Bank of Japan’s post-tsunami presentation at the 2011 Currency Conference showed a similar upward trend in overall banknote and coin volumes:

From the United States, Europe, and Thailand, to the United Kingdom, India, and, with one or two exceptions, all other countries, historical trends of currency volumes indicate that although cash as a percentage of transactions is in some cases declining, cash in circulation is increasing. As more potential economic upheavals and unstable times loom, cash remains the preferred means of stored value. Without power, telecommunications, and general access to electronic payments, cash becomes the only universally recognized, reliable, and trusted means of exchange.

Based on sound research and public policy grounds, the Case for Cash Part One: Myths Dispelled discussed the various reasons why cash is indispensable as a stored value.23 To illustrate, a 2010 Reserve Bank of New Zealand consumer study found that 52% of New Zealanders held cash for emergency purposes.24 Even in the absence of a crisis, cash savings have long been viewed as a budgeting tool used to save for substantial and meaningful purchases, such as a holiday, education, or car.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

22 http://www.gobankingrates.com/savings-account/how-much-physical-cash-need-hand-case-national-emergency/

23 For more details about the indispensability of cash as stored value, see Myth #11 in the Case for Cash Part One: “Only Criminals Use Banknotes.”

24 http://www.rbnz.govt.nz/notes_and_coins/banknote_upgrade/4436446.pdf

Additional Resources from ATM Industry Association

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- 4/18/2024 - ATMIA Joins Atlanta Fed Meeting on Best Practices for ATM Cash Replenishment

- 4/18/2024 - Cryptocurrency Legislation at the State Level Still Outpacing Other Types of Legislation

- 4/18/2024 - Moving ATMs Into the Future with Cash Recycling

- Show All ATM Industry Association Press Releases / Blog Posts