News

Citizens Trust Cash

Wednesday, November 01, 2017

View Showroom

By Currency Research

Currency is trust. To the public, currency is represented physically as banknotes and coins.

There are a number of reasons why currency embodies trust to the public, but the strongest is the extensive history of consumer use and trust in banknotes and coins without being ‘betrayed’ by the Central Bank and government.

More specifically, citizens trust the many features of cash that make it secure, including its anonymity and personal data protection. The Central Bank and government’s support of cash further compounds this trust.

The tagline of SICPA, the well-known security ink manufacturer, is “enabling trust” to ensure that the public maintains its confidence in banknotes:

Referring specifically to banknotes and coins during a 2013 speech delivered at the Bank of England, Mark Carney, the Governor of the Bank of England, remarked:

The European Central Bank (ECB) Working Paper Series cover page to the right illustrates the intimate relationship perceived between physical banknotes and trust6 by both Central Banks and the public. On the front page of the report, an image of the €5 banknote represents trust. The ECB is committed to maintaining the public’s trust in the Central Bank as well as its currency.

The European Central Bank (ECB) Working Paper Series cover page to the right illustrates the intimate relationship perceived between physical banknotes and trust6 by both Central Banks and the public. On the front page of the report, an image of the €5 banknote represents trust. The ECB is committed to maintaining the public’s trust in the Central Bank as well as its currency.

For the simple reason that banknotes are among the most trusted national symbols, they are globally understood to symbolize the Central Bank and its governance as a trusted institution. In a 2007 article, Matthias Kaelberer examines how governments facilitate trust in newly created currencies:

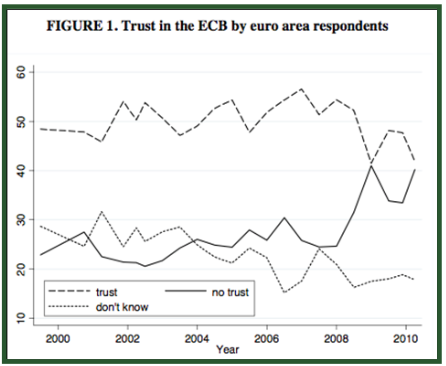

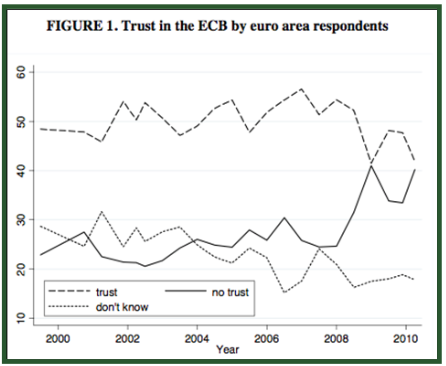

As part of its commitment to maintaining public trust in currency, the ECB measures “net trust” annually using relevant data from the European Commission’s (EC) Eurobarometer survey. This survey is conducted at least twice a year in 27 EU countries. In the 2012 ECB Working Paper, “Explaining EU Citizens’ Trust in the ECB in Normal and Crisis Times,” the “determinants of trust in the ECB” are analysed in the context of the results of the EC’s Eurobarometer survey.8

The survey poses questions to determine public support for the euro and the ECB over time. The findings revealed that “it is notable that the ECB started with a high level of trust right from the outset,” which is “remarkable for a newly established institution.”9 The results for the question “Please tell me if you tend to trust the European Central Bank or not to trust it?” are indicated in percentages in the chart below:10

Meanwhile, the ongoing American data breach crisis has attracted renewed attention to consumer trust in banknotes and coins. For example, a 2014 online consumer behavior poll conducted among 1,060 American adults by the Associated Press and GfK Public Affairs & Corporate Communications posed the following question:

Over 70% of the participants responded that they are extremely/very concerned or somewhat concerned about the security of their personal information when making purchases in a store, over the web, or when using mobile payment methods.12

As one response to these ongoing information security threats, a service fittingly called “TrustCash” now exists that allows consumers to use cash payments for online shopping.

A 2014 Forbes article by Paula Rosenblum looks at a number of recent high-profile data breaches and examines a number of related recent consumer confidence studies that reveal increasing distrust in credit/debit card safety, especially among younger consumers. In light of the notable increase in cash transactions due to this growing consumer distrust, Forbes pronounces that cash is, once again, king:

The ever-increasing number of data breaches and related criminal activity in recent years has amplified the need for consumers to protect their personal information. As a result, the trust that citizens have in cash, and Central Banks by extension, has become more apparent. If Central Banks should cease to actively support cash, by default the Central Bank would likely lose the trust of citizens, who seek primarily to protect their own consumer and financial interests. Legislation, as demonstrated repeatedly, is reactive rather than pro- active in protecting consumers. Central Banks provide a proactive choice that consumers can trust and that offers the protection that they need: banknotes and coins.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

4 http://www.sicpa.com/mission-vision/mission-and-vision

5 http://www.bankofengland.co.uk/publications/Documents/speeches/2013/speech700.pdf

6 https://ideas.repec.org/p/ecb/ecbwps/20131584.html

7 http://www.tandfonline.com/doi/full/10.1080/14616690701374923#.VFS8BudzMXg

8 http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1501.pdf

9http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1501.pdf

10 Ibid.

11 http://ap-gfkpoll.com/featured/ap-gfk-poll-breaches-not-changing-peoples-habits

12 Ibid.

13 http://www.trustcash.com/whytrustcash/consumers/

Currency is trust. To the public, currency is represented physically as banknotes and coins.

There are a number of reasons why currency embodies trust to the public, but the strongest is the extensive history of consumer use and trust in banknotes and coins without being ‘betrayed’ by the Central Bank and government.

More specifically, citizens trust the many features of cash that make it secure, including its anonymity and personal data protection. The Central Bank and government’s support of cash further compounds this trust.

The tagline of SICPA, the well-known security ink manufacturer, is “enabling trust” to ensure that the public maintains its confidence in banknotes:

We build on our leading position as an independent and trusted partner to anticipate evolving security needs and develop solutions that bring value to our customers and protect their interests. We innovate continually to enable trust by developing reliable, secure and technologically advanced solutions and services for identification, traceability and authentication.4

Referring specifically to banknotes and coins during a 2013 speech delivered at the Bank of England, Mark Carney, the Governor of the Bank of England, remarked:

Ensuring public trust and confidence in money is at the heart of what central banks do. Money can only play its invaluable role in our economy if that trust and confidence is maintained. That motivates the Bank of England’s core objectives of price stability, so that people can be confident of the value of their money over time, and financial stability so that they will be able to access and use money when they want to.

It is also why we place such importance on maintaining confidence in our banknotes, the most tangible form of money. Our job is to ensure that the banknotes people use are high quality and genuine.5

The European Central Bank (ECB) Working Paper Series cover page to the right illustrates the intimate relationship perceived between physical banknotes and trust6 by both Central Banks and the public. On the front page of the report, an image of the €5 banknote represents trust. The ECB is committed to maintaining the public’s trust in the Central Bank as well as its currency.

The European Central Bank (ECB) Working Paper Series cover page to the right illustrates the intimate relationship perceived between physical banknotes and trust6 by both Central Banks and the public. On the front page of the report, an image of the €5 banknote represents trust. The ECB is committed to maintaining the public’s trust in the Central Bank as well as its currency.For the simple reason that banknotes are among the most trusted national symbols, they are globally understood to symbolize the Central Bank and its governance as a trusted institution. In a 2007 article, Matthias Kaelberer examines how governments facilitate trust in newly created currencies:

TRUST IN THE EURO: EXPLORING THE GOVERNANCE OF A SUPRA-NATIONAL CURRENCY

This article starts from a pervasive puzzle that characterizes the use of all money: Why would anyone actually exchange real goods and services for a piece of paper, a token coin or an electronic blip? The author of this article argues that market participants accept money in an exchange based on the trust that others will do exactly the same. While it is the basis of any existing monetary order, trust becomes particularly relevant in the case of a newly created currency such as the euro.7

As part of its commitment to maintaining public trust in currency, the ECB measures “net trust” annually using relevant data from the European Commission’s (EC) Eurobarometer survey. This survey is conducted at least twice a year in 27 EU countries. In the 2012 ECB Working Paper, “Explaining EU Citizens’ Trust in the ECB in Normal and Crisis Times,” the “determinants of trust in the ECB” are analysed in the context of the results of the EC’s Eurobarometer survey.8

The survey poses questions to determine public support for the euro and the ECB over time. The findings revealed that “it is notable that the ECB started with a high level of trust right from the outset,” which is “remarkable for a newly established institution.”9 The results for the question “Please tell me if you tend to trust the European Central Bank or not to trust it?” are indicated in percentages in the chart below:10

Meanwhile, the ongoing American data breach crisis has attracted renewed attention to consumer trust in banknotes and coins. For example, a 2014 online consumer behavior poll conducted among 1,060 American adults by the Associated Press and GfK Public Affairs & Corporate Communications posed the following question:

Overall, how concerned are you about retailers’ ability to keep your personal information secure when you make purchases in each of the following ways: In a store; On a website; Using your mobile phone.11

Over 70% of the participants responded that they are extremely/very concerned or somewhat concerned about the security of their personal information when making purchases in a store, over the web, or when using mobile payment methods.12

As one response to these ongoing information security threats, a service fittingly called “TrustCash” now exists that allows consumers to use cash payments for online shopping.

CONSUMERS WITH TRUSTCASH DEPOSIT, IT’S EASY TO PAY ONLINE USING CASH.

Until TrustCash, consumers had to rely on credit cards and bank transfer payments when paying online. But now there’s a cash alternative for consumers who prefer to limit the amount of personal information they give out, which means protection from falling victim to fraud, theft, or identity theft. And an alternative for consumers with insufficient access to credit.13

A 2014 Forbes article by Paula Rosenblum looks at a number of recent high-profile data breaches and examines a number of related recent consumer confidence studies that reveal increasing distrust in credit/debit card safety, especially among younger consumers. In light of the notable increase in cash transactions due to this growing consumer distrust, Forbes pronounces that cash is, once again, king:

IN WAKE OF TARGET DATA BREACH, CASH BECOMING KING AGAIN

Evidence is emerging that the Target data breach and other recent high-profile security failures have altered the behavior of shoppers, shaking their confidence in debit and credit card transactions. Along with generating some interest in alternative currencies like Bitcoin, it appears as if old-fashioned cash is being used more frequently in stores (grocers in particular) than it was before the Target breach. And the trend has only just begun.

Cash transactions are on the rise. Thirty-two percent reported they would be using cash as a method of payment more frequently. Ninety-five percent of survey respondents heard of the Target data breach. More surprising, even though those youngest shoppers claim to be the most confident in credit/debit, their stated plans seem to tell a different story: 46 percent plan to use cash more, a higher percent than any other age group.14

The ever-increasing number of data breaches and related criminal activity in recent years has amplified the need for consumers to protect their personal information. As a result, the trust that citizens have in cash, and Central Banks by extension, has become more apparent. If Central Banks should cease to actively support cash, by default the Central Bank would likely lose the trust of citizens, who seek primarily to protect their own consumer and financial interests. Legislation, as demonstrated repeatedly, is reactive rather than pro- active in protecting consumers. Central Banks provide a proactive choice that consumers can trust and that offers the protection that they need: banknotes and coins.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

4 http://www.sicpa.com/mission-vision/mission-and-vision

5 http://www.bankofengland.co.uk/publications/Documents/speeches/2013/speech700.pdf

6 https://ideas.repec.org/p/ecb/ecbwps/20131584.html

7 http://www.tandfonline.com/doi/full/10.1080/14616690701374923#.VFS8BudzMXg

8 http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1501.pdf

9http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1501.pdf

10 Ibid.

11 http://ap-gfkpoll.com/featured/ap-gfk-poll-breaches-not-changing-peoples-habits

12 Ibid.

13 http://www.trustcash.com/whytrustcash/consumers/

Additional Resources from ATM Industry Association

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- 4/18/2024 - ATMIA Joins Atlanta Fed Meeting on Best Practices for ATM Cash Replenishment

- Show All ATM Industry Association Press Releases / Blog Posts