News

Myth: Cash in circulation as percent of GDP and cost of payments to GDP is relevant

Friday, September 08, 2017

View Showroom

By Currency Research

The myth that cash in circulation is a percentage of total Eurozone GDP and thus somehow relevant to the case for cash in terms of cost and efficiency originates from a 2011 World Payments Report presented by Capgemini, RBS, the European Financial Management Association (EFMA), as well as a simple calculation by the Bank for International Settlement. There is a growing tendency of central banks and national payments plans to cite cash-to-GDP ratios as a justification to promote non-cash payment methods.

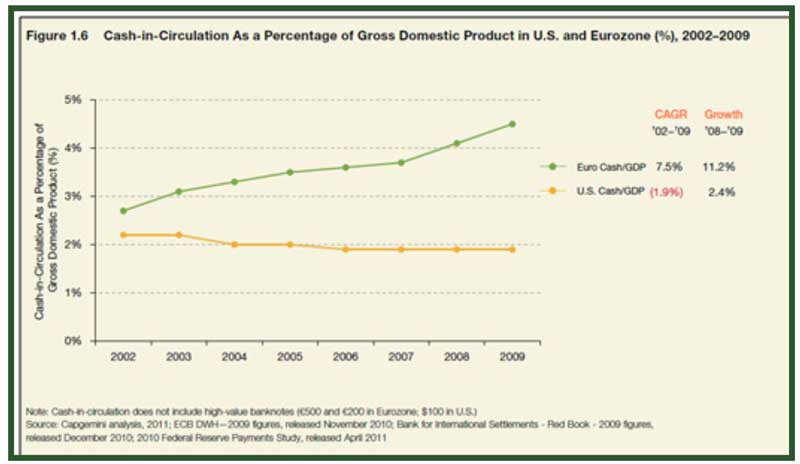

The 2011 World Payments Report presents the following figures and chart as evidence for this assertion:

It is very interesting to note that the above chart, unlike most other charts in the annual releases of the World Payments Report, has not been repeated for the 2012 and 2013 reports, appearing only in the 2011 edition. Yet this information about the efficiencies connected to the “Cash-in-Circulation to GDP” ratio was widely reported as “true” at the time.

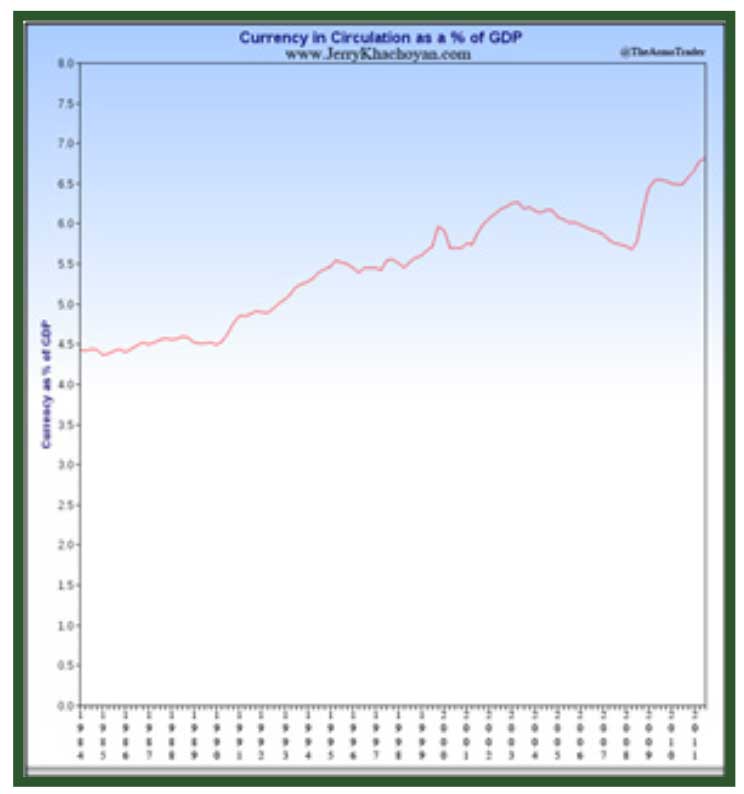

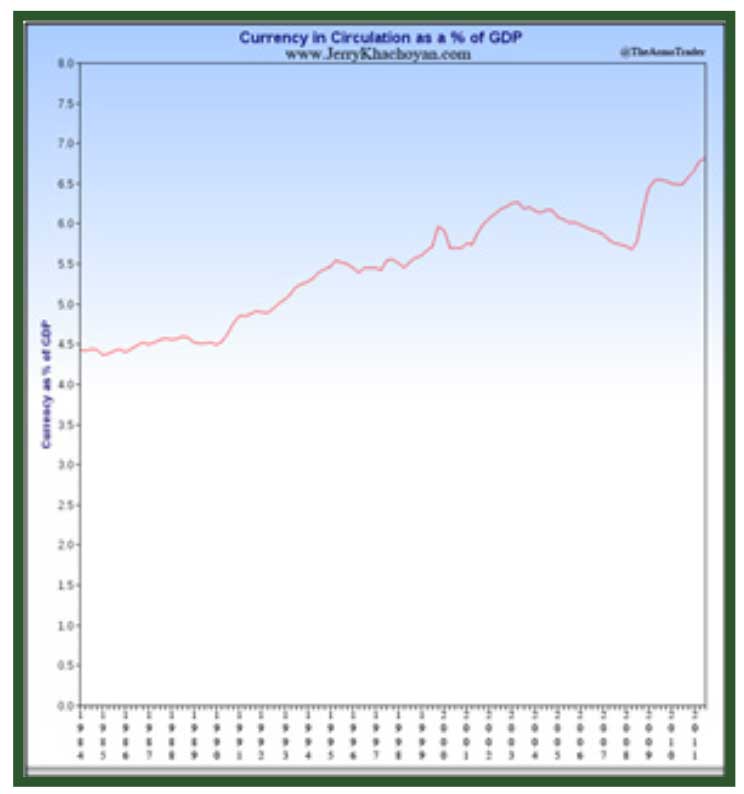

There are at least two counter arguments to this chart. First, it is misleading to not include high-value banknotes, such as the US $100 bill. Furthermore, as seen in the US cash-in-circulation to GDP ratio below, the calculation of 1.9% in the above chart is not accurate and is in reality approximately 8%: 152

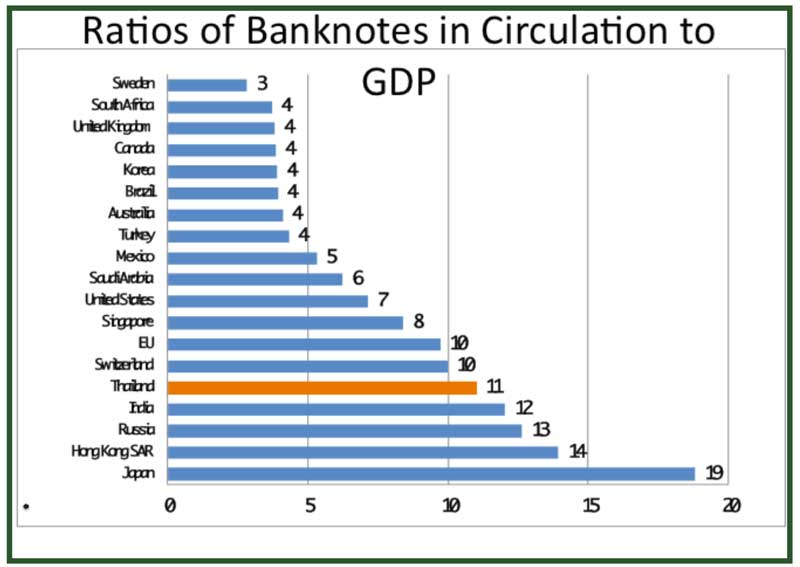

A presentation by the Bank of Thailand at the October 2013 ICCOS Cash Cycle Seminar (Asia) showed that the bank uses the cash-in-circulation to GDP measurement to indicate Thailand’s status as a cash society:

If the cash-in-circulation to GDP ratio was indeed relevant to efficiencies, then it may be concluded from the chart on the next page that South Africa, Brazil, and Turkey are more “efficient” than Singapore, Switzerland, and Japan.

Currency Research fails to see any relevance for this comparison beyond the opportunity to publish more misleading and sensational headlines.

Furthermore, this ratio is sometimes reported and/or confused with the “cost of payments” as a percentage of GDP measurement, without “payment costs” being defined. If there is a high cash-in- circulation to GDP ratio as well as a high payment cost to GDP, then the conclusion to be made is that cash must be inefficient and cash alone is the cause of the high costs!

Although by now an older study, the European Security Transport Association’s (ESTA) 2006 report, “Supporting the Case for Cash,” is one worth mentioning. The information presented in the ESTA report is particularly illuminating as it calls into question the high cash-to-GDP ratios conveniently cited by central banks to legitimize a cashless agenda. Furthermore, ESTA points out the social and economic benefits of seigniorage, something the central banks neglect to mention in their arguments:

As we have seen in Myth #1, reports that the cost of cash is more expensive than cards are overblown, misinformed, or just simply biased. Yet, central banks are using these misleading figures to justify policy changes that favor other payment methods, as the April 2014 issue of Currency News reports:

No argument can be made against Ireland’s desire for savings. However, the argument that the high cost of payments to GDP ratio is due to the inefficiencies of cash is rooted in myth. A closer read of Ireland’s National Payments Plan reveals that while the country advocates for increasing the use of electronic payment methods, it also reassures Irish consumers that cash is and will remain an essential payment instrument in a modern economy:

We have now seen that misinformation about the cash-in-circulation to GDP and cost of payments to GDP ratios and how they relate to cash and its efficiency has been widely circulated in recent years and used to justify the promotion of non-cash payments. We believe that these oft-quoted cost figures are not only misleading, but also neglect to factor in the great and ongoing strides in efficiency that have been implemented throughout the cash life-cycle over the last decade. Currency Research continues to support and advance these efficiencies through conferences, seminars, and training workshops.

As pointed out above in the 2006 ESTA report, at that time the cost of cash had the potential to be reduced by an estimated €10 billion in Europe alone with a concentrated stakeholder effort to re- engineer the cash life-cycle. We believe this effort is now happening in earnest and will be ongoing. Currency Research encourages central banks to examine the total societal costs and benefits of all payment instruments in order to draw their own conclusions and not to rely on broad meaningless statistics.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

151 http://www.capgemini.com/resource-file-access/resource/pdf/World_Payments_Report_2011.pdf

152 http://jerrykhachoyan.com/currency-in-circulation-as-a-percent-of-gdp/

153 http://www.currencyaffairs.org/templates/files/library/esta_supporting_cash.pdf

154 http://www.currency-news.com/apr-2014-highlights

155 https://www.centralbank.ie/paycurr/paysys/Documents/National%20Payments%20Plan%20-%20Final%20Version.pdf

The myth that cash in circulation is a percentage of total Eurozone GDP and thus somehow relevant to the case for cash in terms of cost and efficiency originates from a 2011 World Payments Report presented by Capgemini, RBS, the European Financial Management Association (EFMA), as well as a simple calculation by the Bank for International Settlement. There is a growing tendency of central banks and national payments plans to cite cash-to-GDP ratios as a justification to promote non-cash payment methods.

The 2011 World Payments Report presents the following figures and chart as evidence for this assertion:

Europe continues to incur significant costs from rising euro cash-in-circulation. The ratio of cash over gross domestic product (GDP) in the Eurozone is more than twice that of the U.S. If the Eurozone could reduce cash usage, even accounting for the inefficiencies created by fragmentation, it could save approximately €20 billion per year, just through the proportional reduction in euro cash-handling costs, and would probably improve tax transparency. 151

It is very interesting to note that the above chart, unlike most other charts in the annual releases of the World Payments Report, has not been repeated for the 2012 and 2013 reports, appearing only in the 2011 edition. Yet this information about the efficiencies connected to the “Cash-in-Circulation to GDP” ratio was widely reported as “true” at the time.

There are at least two counter arguments to this chart. First, it is misleading to not include high-value banknotes, such as the US $100 bill. Furthermore, as seen in the US cash-in-circulation to GDP ratio below, the calculation of 1.9% in the above chart is not accurate and is in reality approximately 8%: 152

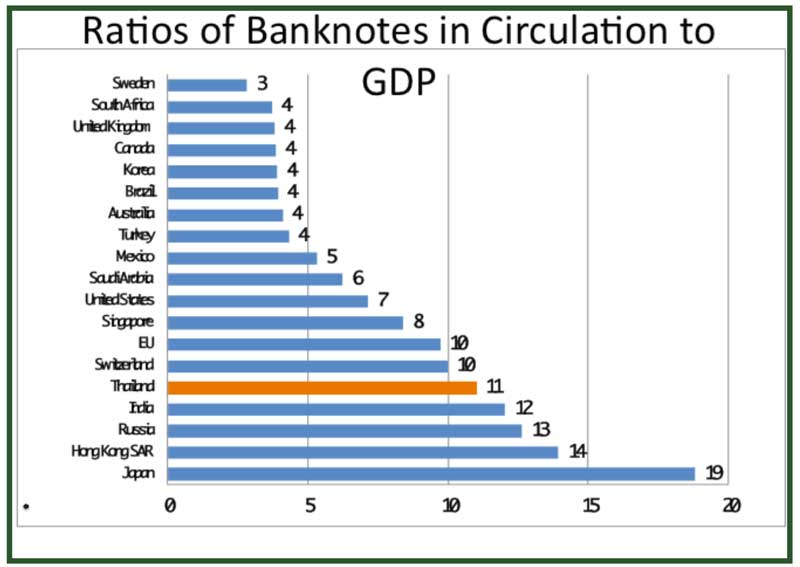

A presentation by the Bank of Thailand at the October 2013 ICCOS Cash Cycle Seminar (Asia) showed that the bank uses the cash-in-circulation to GDP measurement to indicate Thailand’s status as a cash society:

If the cash-in-circulation to GDP ratio was indeed relevant to efficiencies, then it may be concluded from the chart on the next page that South Africa, Brazil, and Turkey are more “efficient” than Singapore, Switzerland, and Japan.

Currency Research fails to see any relevance for this comparison beyond the opportunity to publish more misleading and sensational headlines.

Furthermore, this ratio is sometimes reported and/or confused with the “cost of payments” as a percentage of GDP measurement, without “payment costs” being defined. If there is a high cash-in- circulation to GDP ratio as well as a high payment cost to GDP, then the conclusion to be made is that cash must be inefficient and cash alone is the cause of the high costs!

Although by now an older study, the European Security Transport Association’s (ESTA) 2006 report, “Supporting the Case for Cash,” is one worth mentioning. The information presented in the ESTA report is particularly illuminating as it calls into question the high cash-to-GDP ratios conveniently cited by central banks to legitimize a cashless agenda. Furthermore, ESTA points out the social and economic benefits of seigniorage, something the central banks neglect to mention in their arguments:

Banks argue that cash is expensive to banks, while ignoring the benefits it brings to society as a whole. ESTA believes that the current cost of cash could be dramatically reduced by up to €10bn a year by a concerted effort involving all stakeholders to fundamentally re-engineer the inflow (depositing) cash cycle.

Cash-using EU citizens do not get their “cash for free” – they pay the issuer (the State) for it to the tune of some €16bn a year. This Seignorage tax on cash provides Member States with a significant revenue stream, that if lost would have to be replaced via increased taxation.

ESTA has commissioned Europe Economics, a respected economic research organisation, to provide an independent analysis of the issue: “We conclude by arguing that it is impossible to know the optimal balance between cash, electronic and other forms of payment (which will certainly vary between country and within countries between social classes) that will emerge from the market being allowed to function properly. It is therefore a mistake to favour one form of payment over another, even on grounds of efficiency, let alone the non- price preferences of consumers.”

... Particularly influential have been studies by Professor David Humphreys and a series of studies undertaken by Norges Bank (Central Bank of Norway). Humphreys identified that in the USA in 1997 payments as a whole could be estimated to cost 3% of GDP. This has almost passed into folklore and is often misused... In Europe, the most recent analysis by Benelux Central Banks indicates the cost of payments at between 0.65% and 0.74% of GDP. 153

As we have seen in Myth #1, reports that the cost of cash is more expensive than cards are overblown, misinformed, or just simply biased. Yet, central banks are using these misleading figures to justify policy changes that favor other payment methods, as the April 2014 issue of Currency News reports:

Ireland may soon be joining Finland and the Netherlands in dispensing with 1 and 2 euro cent coins...The trial is part of Ireland’s National Payments Plan, published in April, which is looking to reduce the economy’s dependence on cash and encourage the development of cashless and e-transactions.

According to this plan, the efficiency of Ireland’s existing payment systems infrastructure could be improved by changing behaviour to make more use of secure and efficient electronic payment methods leading to a reduction in the reliance on cash and paper instruments.

In particular, it notes that Irish people withdraw almost twice the amount the average European does from ATMs every year, and that it is one of the least efficient countries in Europe in terms of the ratio of cost of payments to GDP. The standard in the Eurozone is 1.2%, while the cost of Ireland’s payment system is estimated at 1.4%. If, says the plan, Ireland were to match best practice in Europe (ie. 0.6%), then savings of up to €1 billion per annum could be made to the economy. 154

No argument can be made against Ireland’s desire for savings. However, the argument that the high cost of payments to GDP ratio is due to the inefficiencies of cash is rooted in myth. A closer read of Ireland’s National Payments Plan reveals that while the country advocates for increasing the use of electronic payment methods, it also reassures Irish consumers that cash is and will remain an essential payment instrument in a modern economy:

Cash is still the predominant form of payment and remains important despite the increase in other forms of cashless payment methods in recent years. Three out of five of all consumer payments are made in cash.

Cash will continue to play an important role in the payment system in Ireland in the medium to long term. Ireland will not be a cashless society ...

Cash plays a critical role in providing a modern economy with an efficient, effective and resilient payments system. A smooth and efficient operation of payment systems requires a mix of instruments with different characteristics and merits and cash is one of them. This protects the best interests of all consumers...

Cash remains the most widely used payment method for transactions of approximately €10 or below. Further, it currently remains one of the only payment options in a number of circumstances, for example in many person-to- person payments such as a wedding gift.

In addition, cash remains a very important fall back option in times of crisis or disaster when card payments are not always possible. This was shown as recently as July 2012 when there was disruption to the operation of the Irish banking system, when many account holders had to be given access to their funds through cash. 155

We have now seen that misinformation about the cash-in-circulation to GDP and cost of payments to GDP ratios and how they relate to cash and its efficiency has been widely circulated in recent years and used to justify the promotion of non-cash payments. We believe that these oft-quoted cost figures are not only misleading, but also neglect to factor in the great and ongoing strides in efficiency that have been implemented throughout the cash life-cycle over the last decade. Currency Research continues to support and advance these efficiencies through conferences, seminars, and training workshops.

As pointed out above in the 2006 ESTA report, at that time the cost of cash had the potential to be reduced by an estimated €10 billion in Europe alone with a concentrated stakeholder effort to re- engineer the cash life-cycle. We believe this effort is now happening in earnest and will be ongoing. Currency Research encourages central banks to examine the total societal costs and benefits of all payment instruments in order to draw their own conclusions and not to rely on broad meaningless statistics.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

151 http://www.capgemini.com/resource-file-access/resource/pdf/World_Payments_Report_2011.pdf

152 http://jerrykhachoyan.com/currency-in-circulation-as-a-percent-of-gdp/

153 http://www.currencyaffairs.org/templates/files/library/esta_supporting_cash.pdf

154 http://www.currency-news.com/apr-2014-highlights

155 https://www.centralbank.ie/paycurr/paysys/Documents/National%20Payments%20Plan%20-%20Final%20Version.pdf

Additional Resources from ATM Industry Association

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- 4/18/2024 - ATMIA Joins Atlanta Fed Meeting on Best Practices for ATM Cash Replenishment

- Show All ATM Industry Association Press Releases / Blog Posts