News

Myth: Society benefits from convincing people cash is bad

Monday, August 21, 2017

View Showroom

By Currency Research

It should come as no surprise that Visa, MasterCard and Citibank, together with the Gates Foundation, are members of the Better than Cash Alliance (BCA). One would be led to believe that membership in the BCA is spurred solely by a humanitarian impulse to “empower people in emerging economies” and expand financial inclusion to all. 146 However, one thing is certain: the world would be a more profitable place for commercial banks and the card payment industry without cash.

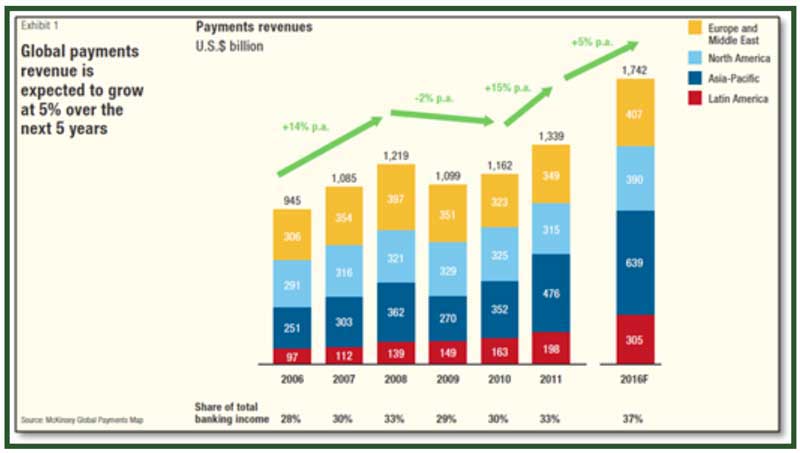

In 2011, the commercial banks generated revenue in excess of $1.3 trillion USD from the payments business. According to the Global Payments Map presented in the 2013 McKinsey on Payments report, this revenue is expected to top $1.7 trillion USD by 2016:

The McKinsey on Payments report also shows that the two major card companies are, of course, forever locked in stiff competition to increase fee and interest revenues and overall profit: 148

The massive earnings reported by both Visa and MasterCard have been well documented, as demonstrated in the two articles below. In the race to the top, both companies have expressed their intent on capturing even more business in new and emerging markets.

In 2013, Reuters reported on MasterCard’s victory as Visa’s profits declined:

More recently, Bloomberg reported on Visa’s rebounding and remarkable profits:

It is interesting to note that both companies express an intention to pursue and increase business in emerging markets. What better way to capture more of this profit-boosting business than, as in the case of the Nigerian identity cards cited above, to persuade governments that cash is somehow “bad” and to promote the use of their cards as universally beneficial?

Our conclusion is that the more the major banks and card companies can convince governments and consumers that the myths surrounding cash are true, the faster their profits will grow – mostly for the benefit of investors to the tune of “almost $17 billion” to date.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

146 http://betterthancash.org/about/our-vision-and-goals/

147 http://www.mckinsey.com/client_service/financial_services/latest_thinking/payments

148 Ibid.

149 http://www.cnbc.com/id/101155960

150 http://www.bloomberg.com/news/2014-01-30/visa-profit-beats-estimates-on-higher-card-spending.html

It should come as no surprise that Visa, MasterCard and Citibank, together with the Gates Foundation, are members of the Better than Cash Alliance (BCA). One would be led to believe that membership in the BCA is spurred solely by a humanitarian impulse to “empower people in emerging economies” and expand financial inclusion to all. 146 However, one thing is certain: the world would be a more profitable place for commercial banks and the card payment industry without cash.

In 2011, the commercial banks generated revenue in excess of $1.3 trillion USD from the payments business. According to the Global Payments Map presented in the 2013 McKinsey on Payments report, this revenue is expected to top $1.7 trillion USD by 2016:

GLOBAL PAYMENTS TRENDS: CHALLENGES AMID REBOUNDING REVENUES

Global payments revenue rebounded to $1.34 trillion in 2011, a steep increase from 2009’s $1.1 trillion. According to McKinsey’s Global Payments Map, global payments revenues will grow at a CAGR of 5 percent between 2011 and 2016, with emerging countries in Asia and Latin America contributing more than half of global payments revenue growth. 147

The McKinsey on Payments report also shows that the two major card companies are, of course, forever locked in stiff competition to increase fee and interest revenues and overall profit: 148

The massive earnings reported by both Visa and MasterCard have been well documented, as demonstrated in the two articles below. In the race to the top, both companies have expressed their intent on capturing even more business in new and emerging markets.

In 2013, Reuters reported on MasterCard’s victory as Visa’s profits declined:

MASTERCARD EARNINGS BEAT AS VISA PROFITS DECLINE

MasterCard reported earnings on Thursday that topped analysts expectations, a day after larger rival Visa posted lower profit, mainly due to a tax provision.

MasterCard and larger rival Visa have been trying to capture new business in emerging markets, where cash payments still dominate but use of cards is growing at a fast pace. 149

More recently, Bloomberg reported on Visa’s rebounding and remarkable profits:

VISA PROFIT BEATS ESTIMATES ON HIGHER CARD SPENDING

Visa Inc. (V), the biggest bank-card network, posted fiscal first-quarter profit that beat analysts’ estimates as card spending climbed.

Net income for the three months ended Dec. 31 rose 8.8 percent to $1.41 billion, or $2.20 a share, from $1.29 billion, or $1.93, a year earlier, the Foster City, California-based firm said today in a statement ...

Chief Executive Officer Charlie Scharf, 48, is seeking ways to increase business outside the U.S ... The firm has returned almost $17 billion to investors since its 2008 initial public offering and last year was the sixth-best performer in the Dow Jones Industrial Average, gaining 47 percent. 150

It is interesting to note that both companies express an intention to pursue and increase business in emerging markets. What better way to capture more of this profit-boosting business than, as in the case of the Nigerian identity cards cited above, to persuade governments that cash is somehow “bad” and to promote the use of their cards as universally beneficial?

Our conclusion is that the more the major banks and card companies can convince governments and consumers that the myths surrounding cash are true, the faster their profits will grow – mostly for the benefit of investors to the tune of “almost $17 billion” to date.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

146 http://betterthancash.org/about/our-vision-and-goals/

147 http://www.mckinsey.com/client_service/financial_services/latest_thinking/payments

148 Ibid.

149 http://www.cnbc.com/id/101155960

150 http://www.bloomberg.com/news/2014-01-30/visa-profit-beats-estimates-on-higher-card-spending.html

Additional Resources from ATM Industry Association

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- 4/18/2024 - ATMIA Joins Atlanta Fed Meeting on Best Practices for ATM Cash Replenishment

- 4/18/2024 - Cryptocurrency Legislation at the State Level Still Outpacing Other Types of Legislation

- Show All ATM Industry Association Press Releases / Blog Posts