News

ATM growth slows in China, India, picks up in new markets

Monday, November 13, 2017

View Showroom

From ATMmarketplace.com

The number of ATMs worldwide reached a record 3.3 million in 2016, however, the rate of expansion slowed to 3 percent, down from 5 percent in 2015, according to the RBR report, Global ATM Market and Forecasts to 2022.

The decline has largely resulted from rationalization in western Europe and markets such as Brazil and Russia, accompanied by a marked slowdown in the rate of new installations in China and India, the report finds.

RBR reports that large banks in China and India are moving away from a strategy of expansion toward one of ATM network optimization.

Additionally, the firm says, the number of ATMs deployed by nonbank providers is shrinking in China and not growing as fast as expected in India.

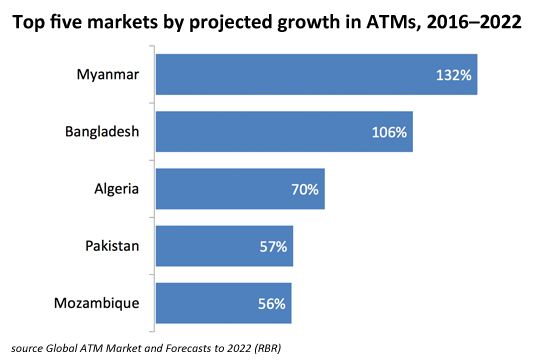

Despite the maturity of many markets, room for expansion still exists, according to the report. RBR provides forecasts for many smaller markets, revealing a wealth of growth opportunities in south Asia and Africa.

Myanmar is primed for the fastest growth over the next five years, according to RBR. The number of ATMs in the country grew from zero in 2011 to almost 2,500 by the end of 2016, driven primarily by economic reforms.

The ATM market in neighboring Bangladesh has been booming since early 2015, when relaxed regulations triggered a surge in deployments that shows few signs of slowing, RBR finds.

As banking services and economies continue to expand in both nations, RBR forecasts that numbers will more than double by 2022, to 18,000 and 6,000 in Bangladesh and Myanmar, respectively.

Recent growth in the Middle East and Africa has been strong, and RBR expects this to continue, especially in many African markets. Algeria could see the region's fastest ATM growth as banks follow the national postal service in building coverage rapidly across the country.

"[A]lthough most major ATM markets are now growing more slowly, or even contracting in some cases, many smaller, developing countries continue to have huge potential," RBR research leader Rowan Berridge said.

"These markets are characterized by a low density of ATMs to population — fewer than 100 machines per million people — but are enjoying rapid economic growth and benefiting from state-driven programs to increase financial inclusion. Cash is set to remain hugely important in these markets and prospects for growth in ATM deployment are excellent."

The number of ATMs worldwide reached a record 3.3 million in 2016, however, the rate of expansion slowed to 3 percent, down from 5 percent in 2015, according to the RBR report, Global ATM Market and Forecasts to 2022.

The decline has largely resulted from rationalization in western Europe and markets such as Brazil and Russia, accompanied by a marked slowdown in the rate of new installations in China and India, the report finds.

RBR reports that large banks in China and India are moving away from a strategy of expansion toward one of ATM network optimization.

Additionally, the firm says, the number of ATMs deployed by nonbank providers is shrinking in China and not growing as fast as expected in India.

Despite the maturity of many markets, room for expansion still exists, according to the report. RBR provides forecasts for many smaller markets, revealing a wealth of growth opportunities in south Asia and Africa.

|

Myanmar is primed for the fastest growth over the next five years, according to RBR. The number of ATMs in the country grew from zero in 2011 to almost 2,500 by the end of 2016, driven primarily by economic reforms.

The ATM market in neighboring Bangladesh has been booming since early 2015, when relaxed regulations triggered a surge in deployments that shows few signs of slowing, RBR finds.

As banking services and economies continue to expand in both nations, RBR forecasts that numbers will more than double by 2022, to 18,000 and 6,000 in Bangladesh and Myanmar, respectively.

Recent growth in the Middle East and Africa has been strong, and RBR expects this to continue, especially in many African markets. Algeria could see the region's fastest ATM growth as banks follow the national postal service in building coverage rapidly across the country.

"[A]lthough most major ATM markets are now growing more slowly, or even contracting in some cases, many smaller, developing countries continue to have huge potential," RBR research leader Rowan Berridge said.

"These markets are characterized by a low density of ATMs to population — fewer than 100 machines per million people — but are enjoying rapid economic growth and benefiting from state-driven programs to increase financial inclusion. Cash is set to remain hugely important in these markets and prospects for growth in ATM deployment are excellent."

Additional Resources from ATM Industry Association

- 4/18/2024 - Moving ATMs Into the Future with Cash Recycling

- 4/18/2024 - ATM Champions Cash! Join the Conversation at Upcoming Events!

- 4/16/2024 - Daventry Town Football Club's cashless goal disallowed by fans

- 4/15/2024 - Congrats to Venco Business Solutions, April's US Region ATMIA Member of the Month!

- 4/12/2024 - Cash Demand Driving ATM Deployment Worldwide

- Show All ATM Industry Association Press Releases / Blog Posts