News

Cash is Financial Inclusion

Friday, November 10, 2017

View Showroom

By Currency Research

Cash is easy to understand and to use, and does not discriminate based on race, religion, or economic status or any other factor; unlike other payment methods, it facilitates financial inclusion rather than financial exclusion.

The key roles of the Central Bank are to protect and stimulate the country’s financial health, but also and equally important, to protect financially vulnerable members of society. The latter role promotes financial growth and serves the interests of national stability, which in turn also promotes growth.

The Central Bank of Ireland’s 2013 National Payments Plan (NPP), excerpted below, concluded that barriers to electronic payments contribute to financial exclusion. The NPP found that cash-based money management fostered financial inclusion and offered low-income consumers, from a range of diverse demographics, increased control over their spending:

The universality of cash ensures that all members of society can use it. For the more financially excluded members of society in particular, cash represents a simple, effective, and trusted means of payment. Central Banks have a duty and obligation to support individuals experiencing financial exclusion. These individuals are often considered ‘unprofitable’ and therefore overlooked by commercial financial institutions and other payment providers. Few, if any, commercial institutions target the groups listed in the NPP, as they are perceived to be commercially unviable.

As mentioned above, cash does not discriminate. While one hopes that modern society would not tolerate discrimination on any basis, this unfortunately is often not the case. Unlike many other payment instruments, cash protects against discrimination and financial exclusion since it is universal and always accepted. The Australian Institute of Criminology, in its report on identity-related economic crime, comments on the exclusionary effects of technology on the more vulnerable members of society:

For these individuals, cash remains the only option.

Kenya presents a noteworthy example of how to boost financial inclusion by increasing access to cash and cash usage. In its 2013 Annual Report, the Central Bank of Kenya reports on its financial inclusion goals, which focus on increasing and enhancing market access to diverse groups:

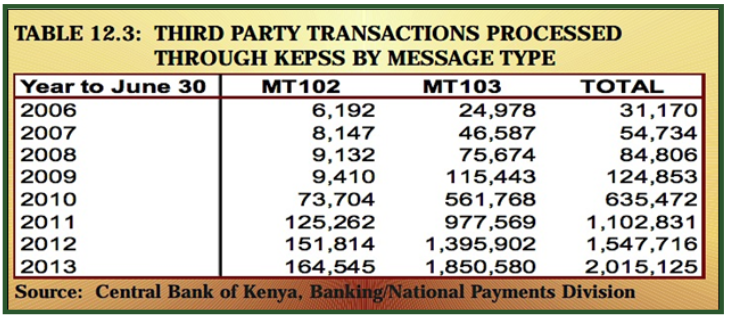

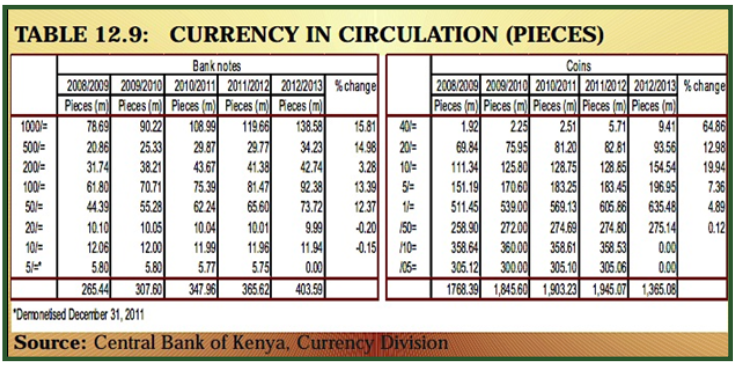

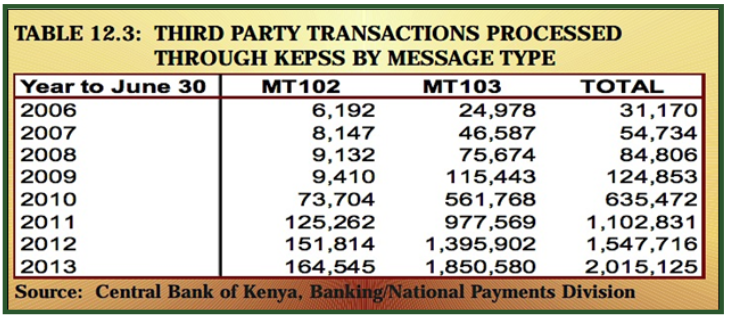

As shown in the following tables, the figures collected by the Central Bank of Kenya from 2006 to 2013 point to success in their stated goal to increase financial inclusion by offering a range of accessible payment methods.18 Table 12.3, below, shows the increasing volume of transactions moved through the Kenya Electronic Payment and Settlement System (KEPSS) from 2006 to 2013. These numbers represent single customer payment transfers, usually low value payments, that credit multiple or single beneficiaries (MT102 and MT103 respectively).

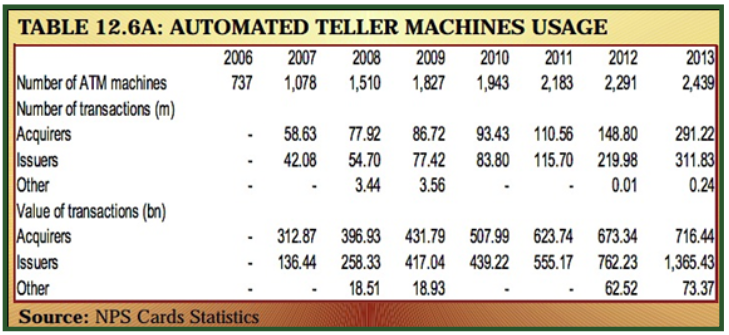

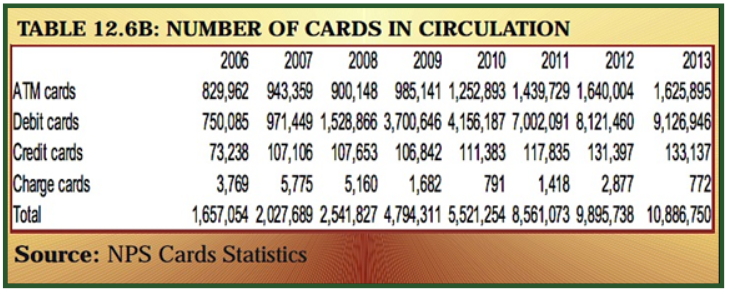

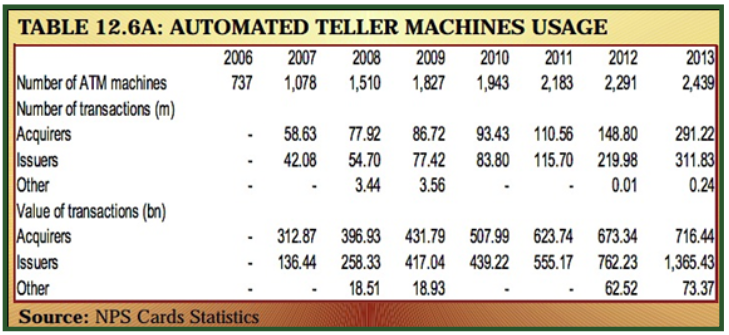

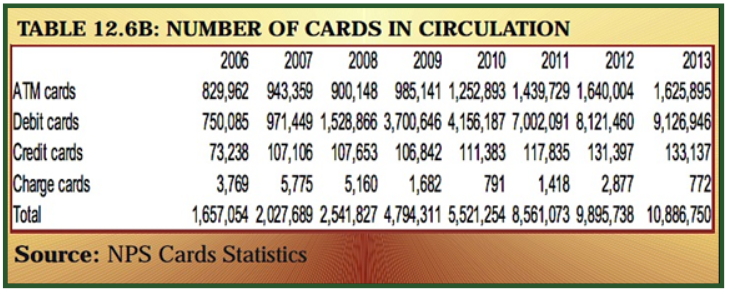

To further illustrate the Central Bank of Kenya’s support of a range of payment methods, Table 12.6A, below, shows an increase in the usage of automated teller machines, while Table 12.6B shows a steady increase in the number of payment cards in circulation.

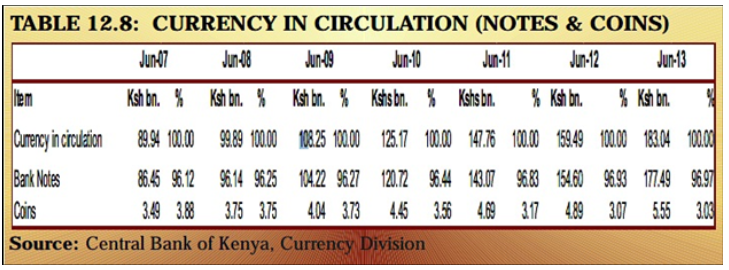

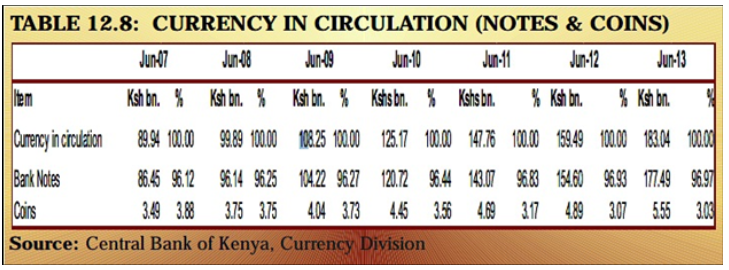

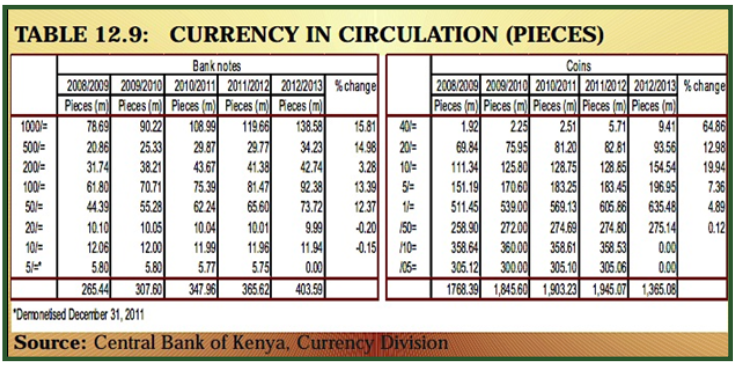

At the same time, Kenya’s currency in circulation (banknotes) grew steadily, increasing by 14% from June 2012 to June 2013 alone:

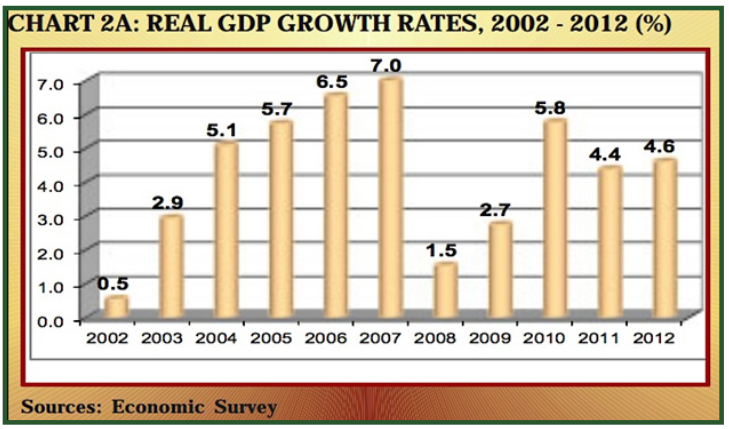

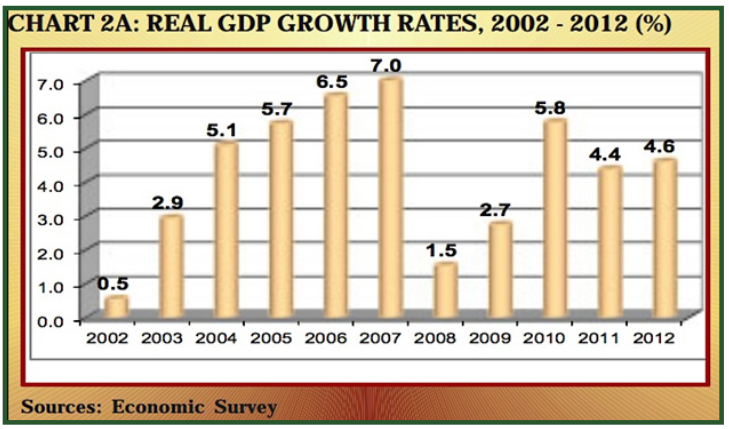

Currency Research believes financial inclusion stimulates overall improvements to a nation’s GDP, including improvements to transportation, banking, and communications infrastructure. These improvements, as shown in the Central Bank of Kenya’s Chart 2A below, lead to enhanced growth and prosperity, which then requires additional currency in circulation.19

November 2014 report by the Sveriges Riksbank (Bank of Sweden), “Does Cash Have Any Future as Legal Tender?”, acknowledges the role cash plays in advancing social inclusion:

In light of these compelling reasons, the Riksbank concludes that cash indeed has a future as legal tender:

Card issuers would prefer the public to believe that currency and financial inclusion are mutually exclusive. We firmly believe that the reality is quite the contrary. Increased currency circulation promotes financial inclusion, as illustrated in the Kenyan example cited above, where financial inclusion has increased from below 30% to above 70% over the last decade, while cash in circulation has continued year on year growth.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

15 https://www.centralbank.ie/paycurr/paysys/Documents/National%20Payments%20Plan%20-%20Final%20Version.pdf

16Russell G. Smith, “Identity-Related Economic Crime: Risks and Countermeasures,” trends & issues No. 129: http://aic.gov.au/documents/D/6/ E/%7BD6E60060-303B-4C82-A6EF-88570F8B950F%7Dti129.pdf

17https://www.centralbank.go.ke/images/docs/CBKAnnualReports/2013annualreport.pdf

18Ibid. In Table 12.3, KEPSS is the Kenya Electronic Payment and Settlement System.

19https://www.centralbank.go.ke/images/docs/CBKAnnualReports/2013annualreport.pdf

20 http://www.riksbank.se/Documents/Rapporter/Ekonomiska_kommentarer/2014/rap_ek_kom_nr09_141125_eng.pdf

21 Ibid.

Cash is easy to understand and to use, and does not discriminate based on race, religion, or economic status or any other factor; unlike other payment methods, it facilitates financial inclusion rather than financial exclusion.

The key roles of the Central Bank are to protect and stimulate the country’s financial health, but also and equally important, to protect financially vulnerable members of society. The latter role promotes financial growth and serves the interests of national stability, which in turn also promotes growth.

The Central Bank of Ireland’s 2013 National Payments Plan (NPP), excerpted below, concluded that barriers to electronic payments contribute to financial exclusion. The NPP found that cash-based money management fostered financial inclusion and offered low-income consumers, from a range of diverse demographics, increased control over their spending:

FINANCIAL EXCLUSION

Sections of Irish society may find it difficult to make the transition to electronic forms of payment from the traditional paper based methods such as cash...The two key issues here relate to financial exclusion and barriers to electronic payments.

For many, the problem is one of financial exclusion... One fifth (20%) of Irish households do not have a current account and low income has the biggest impact on being financially excluded.

Low income consumers (whether banked or unbanked) face a number of barriers in using electronic payments which remain a less attractive proposition than cash based money management.

• Elderly: There are groups of older people for whom changing to modern payment methods may tend to be difficult, impractical and/or problematic. This includes those who do not currently have a current account and for whom cash is their only form of payment method, those who do not have IT skills, those on very low incomes, and those with reduced mental capacity;

• Members of the Travelling Community: Many Travellers on low income who have never operated a bank account will have extreme difficulty in managing a low income electronically;

• People in Debt: A concern was expressed is that if people in debt used electronic transaction methods rather than cash that all income they would receive or generate would be offset in the first instance against any overdue debts they may have;

• People with low levels of financial awareness: Such people may not understand how to budget and deal with their finances in a manner that will keep their debt to a minimum;

• Rural Dwellers and people in outlying, peripheral urban areas: People living in rural Ireland whose only financial transactions take place in shops, post offices and other services which do not currently cater for electronic transactions. In addition the availability of appropriate and secure ICT infrastructure direct to the home, particularly in older properties and in rural locations, can be an issue;

• People with low literacy and numeracy: People with literacy and numeracy challenges may have difficulty or need support with reading terms and conditions and statements related to transactions and banking. Issues with numeracy may be more difficult with the absence of ‘cash in hand’, which is more tangible and ‘see-able’ than electronic money;

• People with limited computer literacy and computer access: Anybody who is not computer literate or without the appropriate equipment will find it very difficult to make a change. This would include older people, but also households without access to a home computer or smartphone;

• Migrants: Migrants and minority ethnic groups may face particular challenges with regard to lack of knowledge of the Irish financial services system, language issues, and religious issues regarding financial services.15

The universality of cash ensures that all members of society can use it. For the more financially excluded members of society in particular, cash represents a simple, effective, and trusted means of payment. Central Banks have a duty and obligation to support individuals experiencing financial exclusion. These individuals are often considered ‘unprofitable’ and therefore overlooked by commercial financial institutions and other payment providers. Few, if any, commercial institutions target the groups listed in the NPP, as they are perceived to be commercially unviable.

As mentioned above, cash does not discriminate. While one hopes that modern society would not tolerate discrimination on any basis, this unfortunately is often not the case. Unlike many other payment instruments, cash protects against discrimination and financial exclusion since it is universal and always accepted. The Australian Institute of Criminology, in its report on identity-related economic crime, comments on the exclusionary effects of technology on the more vulnerable members of society:

In the future, in order to pay for goods and services purchased via the Internet, we will have to obtain a cryptographic key pair for use in a public key computer system. To obtain this key pair, we will need to provide sufficient evidence of our identity to the issuing authority. Identifying ourselves, therefore, will become an integral part of everyday life. Those people, such as the homeless or illegal immigrants, who are unable to produce satisfactory evidence to confirm their background and where they live, may be unable to use many of the services which others take for granted.16

For these individuals, cash remains the only option.

Kenya presents a noteworthy example of how to boost financial inclusion by increasing access to cash and cash usage. In its 2013 Annual Report, the Central Bank of Kenya reports on its financial inclusion goals, which focus on increasing and enhancing market access to diverse groups:

FINANCIAL SECTOR DEVELOPMENT AND FINANCIAL INCLUSION.

The Central Bank continued to play a proactive role in financial sector development through:

- Encouraging different products that are cost effective, serve different market segments and lower barriers of entry and thus increases market access

- Strengthening regulatory capacity and capabilities to provide adequate oversight

- Supporting development of traditional and alternative financial infrastructures

- Developing partnership with key players

- Promoting competition and diversity.

To deliver the above listed measure, the Central Bank pushed and encouraged the market to adopt innovative delivery channels beyond the traditional brick and mortar models including mobile phone financial services (MFS), deposit taking microfinance institutions (MFIs), technology led agency banking model and Islamic financial services (including Sharia compliant Islamic banking).

The use of agency banking model by banks continued to enhance financial access. The Central Bank licensed three banks during the year, raising the total number of banks using the agency banking model to 13 by June 2013. As a result, the number of agents increased by 7,582 or 62.8 percent to 19,649 agents. Since the launch of the agency banking model in 2010, the contracted agents have facilitated over 58.6 million transactions worth Ksh 310.5 billion.

Deposit taking microfinance institutions increased by 6 during the year to June 2013 bringing down the total number of institutions to 9. The number of accounts increased to 1.9 million from 1.6 million in June 2012. The DTM recorded impressive growth in deposits and loans (at 60.2 percent and 25.7 percent, respectively). The Central Bank also licensed 2 foreign banks (Central Bank of India and Bank of Kigali) to open representative offices in Kenya, raising the number of banks with representative office to ten.17

As shown in the following tables, the figures collected by the Central Bank of Kenya from 2006 to 2013 point to success in their stated goal to increase financial inclusion by offering a range of accessible payment methods.18 Table 12.3, below, shows the increasing volume of transactions moved through the Kenya Electronic Payment and Settlement System (KEPSS) from 2006 to 2013. These numbers represent single customer payment transfers, usually low value payments, that credit multiple or single beneficiaries (MT102 and MT103 respectively).

To further illustrate the Central Bank of Kenya’s support of a range of payment methods, Table 12.6A, below, shows an increase in the usage of automated teller machines, while Table 12.6B shows a steady increase in the number of payment cards in circulation.

At the same time, Kenya’s currency in circulation (banknotes) grew steadily, increasing by 14% from June 2012 to June 2013 alone:

Currency Research believes financial inclusion stimulates overall improvements to a nation’s GDP, including improvements to transportation, banking, and communications infrastructure. These improvements, as shown in the Central Bank of Kenya’s Chart 2A below, lead to enhanced growth and prosperity, which then requires additional currency in circulation.19

November 2014 report by the Sveriges Riksbank (Bank of Sweden), “Does Cash Have Any Future as Legal Tender?”, acknowledges the role cash plays in advancing social inclusion:

People in Sweden are used to being able to use cash for payments between individuals and at a point of sale, such as a shop or a restaurant...

Although the Riksbank’s own surveys indicate that the number of cash payments is declining, it is difficult to be sure that this is the case.

For those groups who want to pay in cash or who are forced to use cash for other reasons, a binding obligation would be positive, as it would ensure that they could use cash everywhere, even in the future. This in turn would give them access to goods and services.

On the other hand, there may be groups that for some physical, technical or legal reason are prevented from paying by any other means than in cash. It is mainly these groups that would experience the positive socio-economic effects (of legal tender).20

In light of these compelling reasons, the Riksbank concludes that cash indeed has a future as legal tender:

As cash is nevertheless still common, there is no immediate need to abolish its unique status as legal tender. It is also important that there is continued support for the groups that for some reason risk not having access to future electronic payment services.21

Card issuers would prefer the public to believe that currency and financial inclusion are mutually exclusive. We firmly believe that the reality is quite the contrary. Increased currency circulation promotes financial inclusion, as illustrated in the Kenyan example cited above, where financial inclusion has increased from below 30% to above 70% over the last decade, while cash in circulation has continued year on year growth.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

15 https://www.centralbank.ie/paycurr/paysys/Documents/National%20Payments%20Plan%20-%20Final%20Version.pdf

16Russell G. Smith, “Identity-Related Economic Crime: Risks and Countermeasures,” trends & issues No. 129: http://aic.gov.au/documents/D/6/ E/%7BD6E60060-303B-4C82-A6EF-88570F8B950F%7Dti129.pdf

17https://www.centralbank.go.ke/images/docs/CBKAnnualReports/2013annualreport.pdf

18Ibid. In Table 12.3, KEPSS is the Kenya Electronic Payment and Settlement System.

19https://www.centralbank.go.ke/images/docs/CBKAnnualReports/2013annualreport.pdf

20 http://www.riksbank.se/Documents/Rapporter/Ekonomiska_kommentarer/2014/rap_ek_kom_nr09_141125_eng.pdf

21 Ibid.

Additional Resources from ATM Industry Association

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- 4/18/2024 - ATMIA Joins Atlanta Fed Meeting on Best Practices for ATM Cash Replenishment

- Show All ATM Industry Association Press Releases / Blog Posts