News

Myth: Without cash, crime would decline or disappear

Wednesday, March 15, 2017

View Showroom

By Currency Research

The myth that cash use attracts criminal behavior tends to generate sensational headlines and is often picked up by the media since it is as controversial as much as it is thought provoking. While investigating this myth, Currency Research found that the research underlying each relevant “study” began with the premise that reducing cash would reduce crime, looking selectively at the supporting “evidence,” while bypassing counter-arguments contrary to the study’s presumed outcome.

In Rolf Dobelli’s bestselling book on human psychology and cognitive biases, The Art of Thinking Clearly, this is termed the “confirmation bias.”

Three recent reports published by Tufts University,13 MasterCard Advisors,14 and the National Bureau of Economic Research15 illustrate this sensationalist tendency to align cash use with criminal behavior. Currency Research looks at each of the three reports and then to sources of substantiated evidence that serve to dispel this myth.

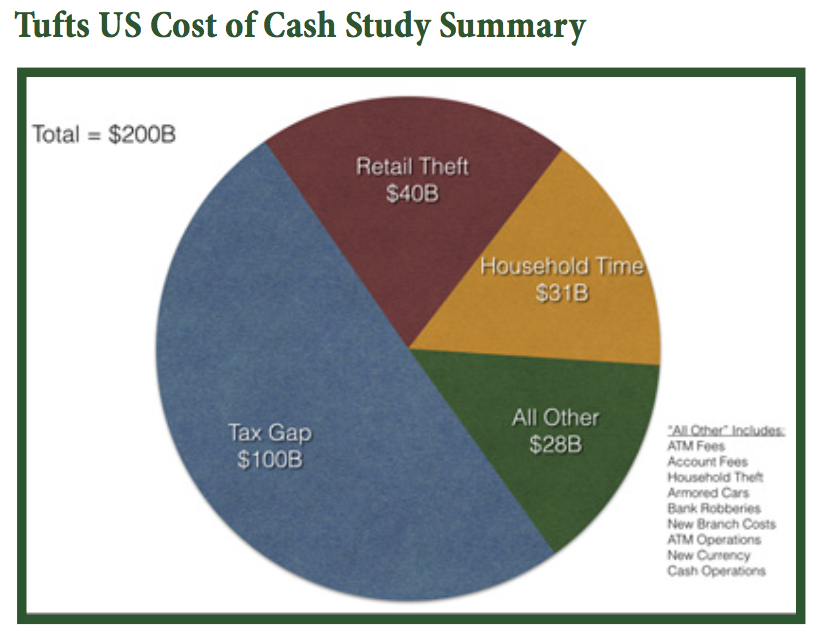

In the Tufts University “study,” the authors conclude that cash costs the US economy $200 billion per year based primarily on crime rates and that a cashless society would see an attendant decrease in crime. Fred Purches, a long-time player in the cash handling industry, dissects this myth:

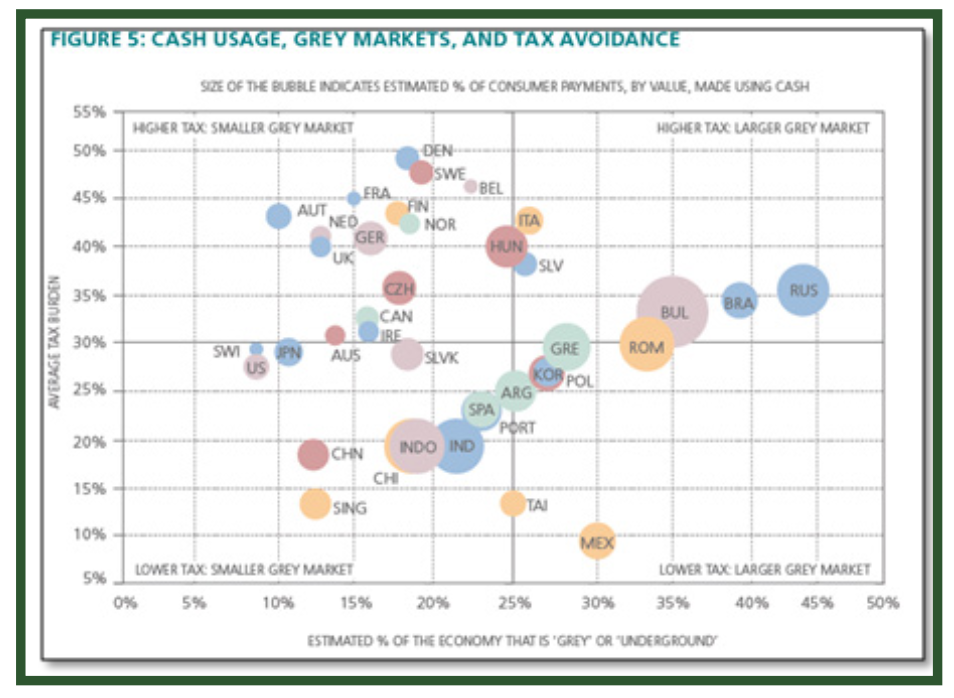

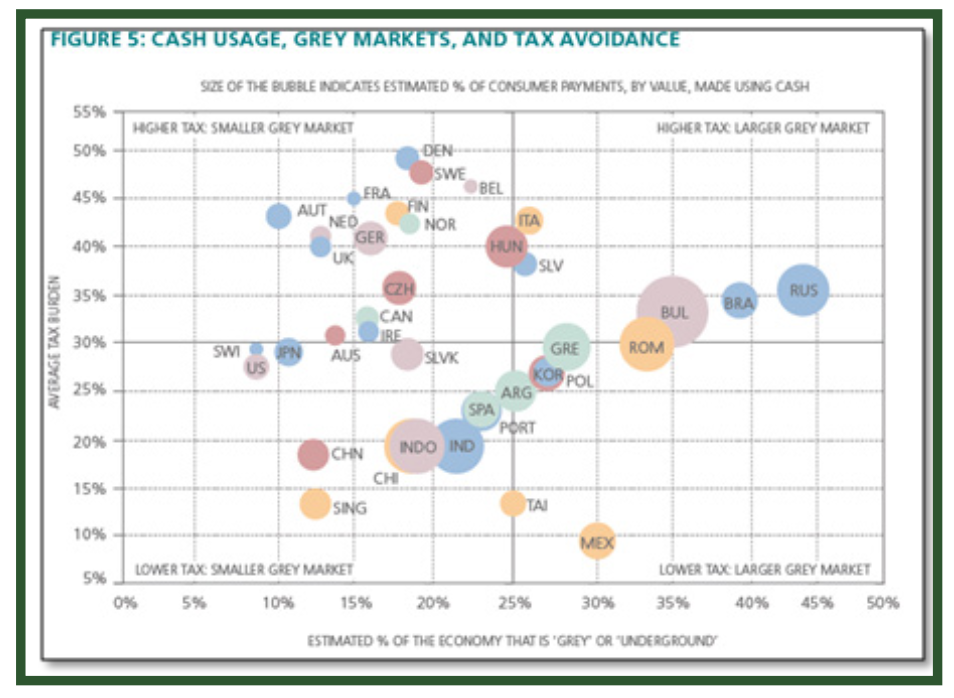

Hugh Thomas and Kevin Mellyn, authors of the MasterCard Advisors “study,” employ confusing graphics in an attempt to demonstrate a cause and effect between cash usage figures and crime-related data sourced from the World Bank Ease of Doing Business Index, the Transparency International Global Corruption Perceptions Index, and the Tax Justice Network’s 2009 tax haven report. Thomas and Mellyn do this in an effort to link cash usage to corruption, bribery, crime, and general business difficulties.

In spite of the attention-grabbing title of the MasterCard Advisors study:

And the implication of a connection between cash use and “bad behavior”:

And then showing “proof ” that links cash usage to corruption:

Thomas and Mellyn undermine their own argument by admitting:

Throughout the study, research and evidence that contradict the authors’ preferred theory are conveniently overlooked.

The third “study,” a working paper published in March 2014 by the National Bureau of Economic Research (NBER), made headlines in the Washington Post:

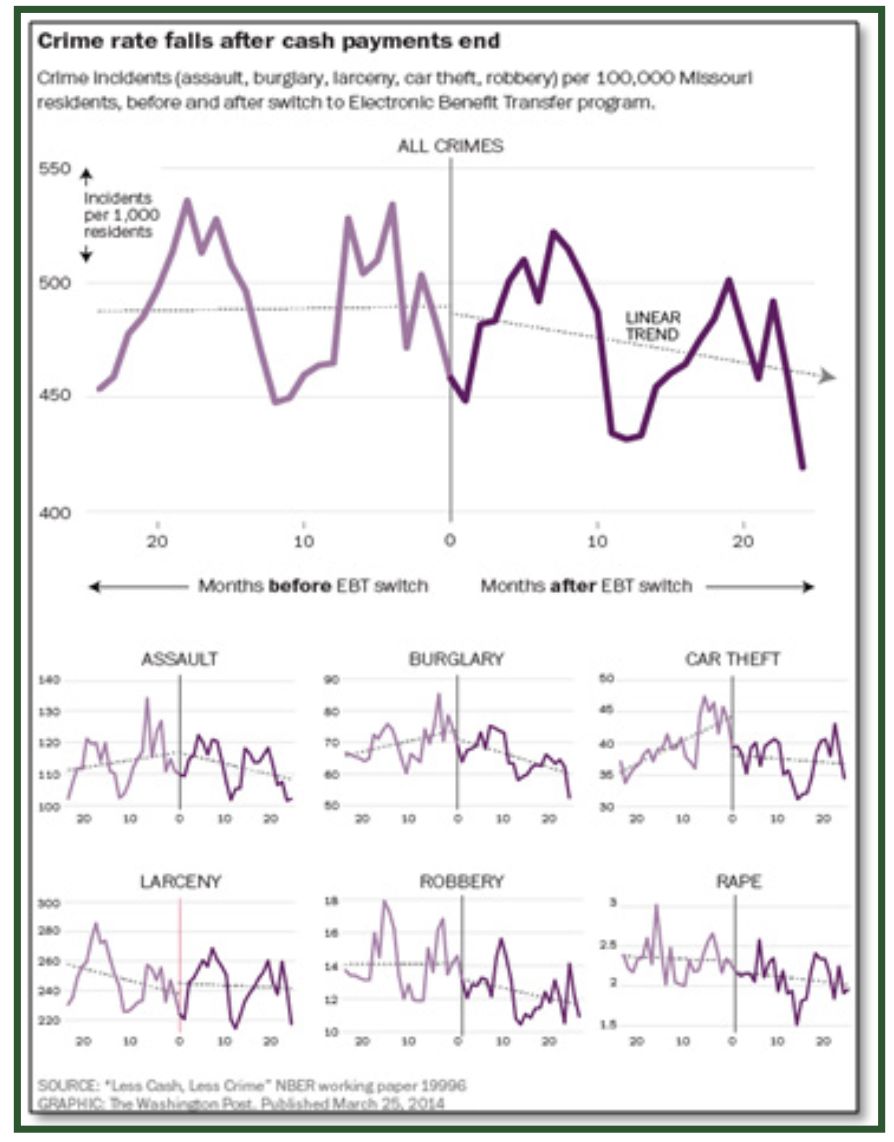

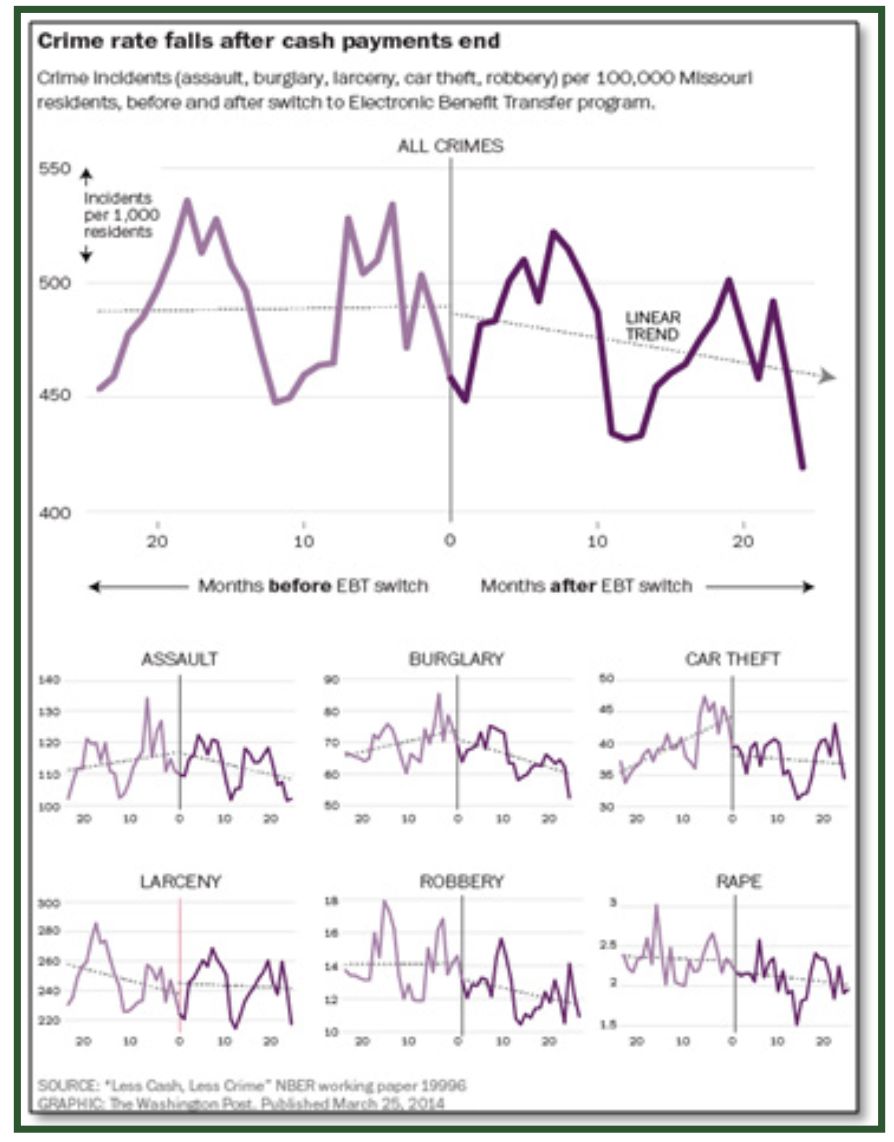

In this NBER study, entitled “Less Cash, Less Crime: Evidence from the Electronic Benefit Transfer Program,” the five authors “prove” a link between lower crime rates in Missouri and the decline of circulating cash due to the transition of welfare payments from check to debit card. The charts below illustrate the study’s findings: 20

However, a telling disclaimer precedes the NBER study:

This “complex interaction of factors” is largely ignored in the NBER study. The authors point out that the number of welfare recipients has declined alongside crime rates, but do not factor this information into their investigation. Nor did they consider the GDP fluctuation of Missouri, the state’s unemployment rate, police budgets, the number of police on the street, nor countless other factors that could have greater bearing on the decline of crime rates than simply changing the welfare system’s method of payment. But of course, these complexities do not make for good headlines.

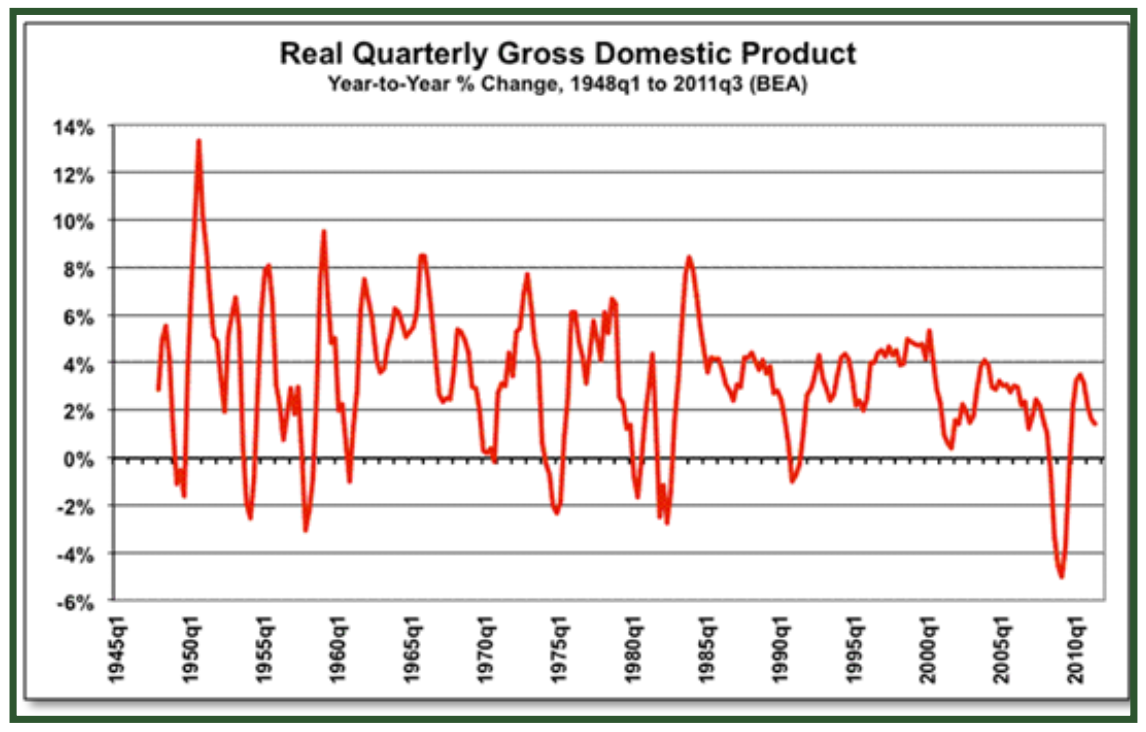

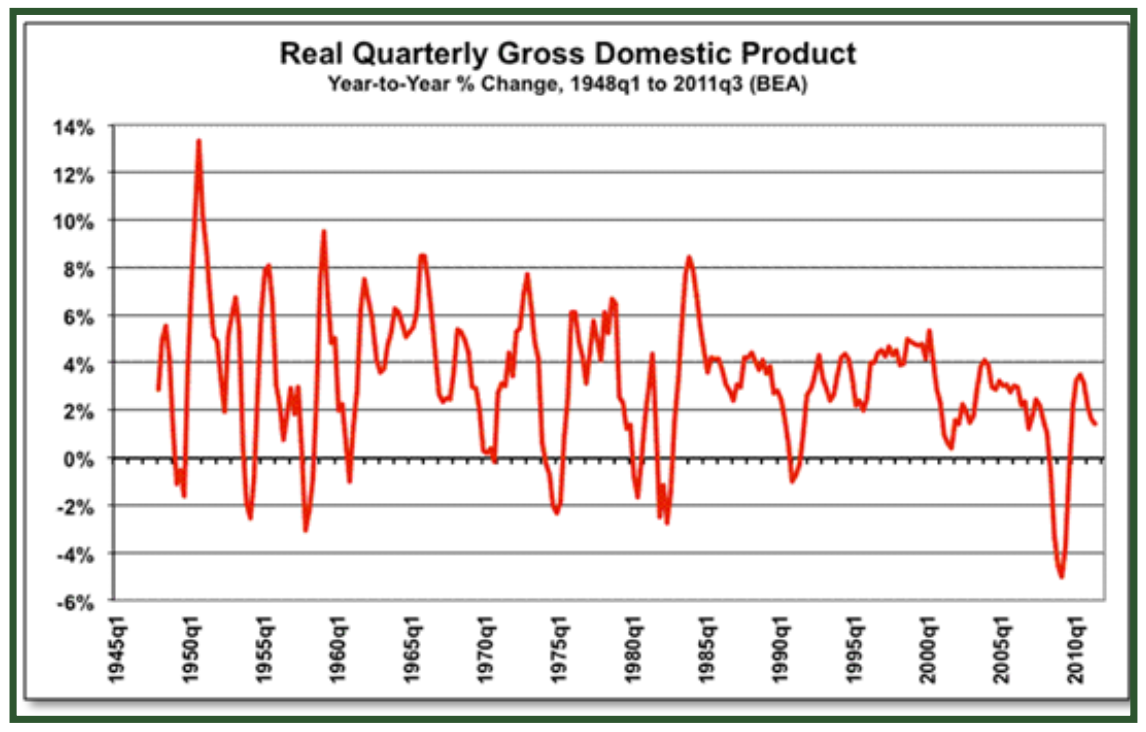

For example, the trend of the US GDP from 1990 to 2010 has been relatively stable, which could very well be a considerable factor in lowering overall crime rates: 22

The authors conclude the NBER study with one last headline-grabbing statement:

Of course, the Washington Post article cited above omits this “back of the envelope” comment. We cannot imagine a central bank relying on a “back of the envelope” calculation.

To further investigate into the presumed correlation between cash use and crime, Currency Research looked to Sweden, a country that has been at the forefront of promoting a cashless society and has witnessed a decline in cash usage as a percentage of total purchases. This decline should indicate that people are carrying less cash. Indeed, many Swedish newspaper articles feature interviewees who state that they no longer carry cash, with headlines touting a cashless, crimeless Sweden: 24

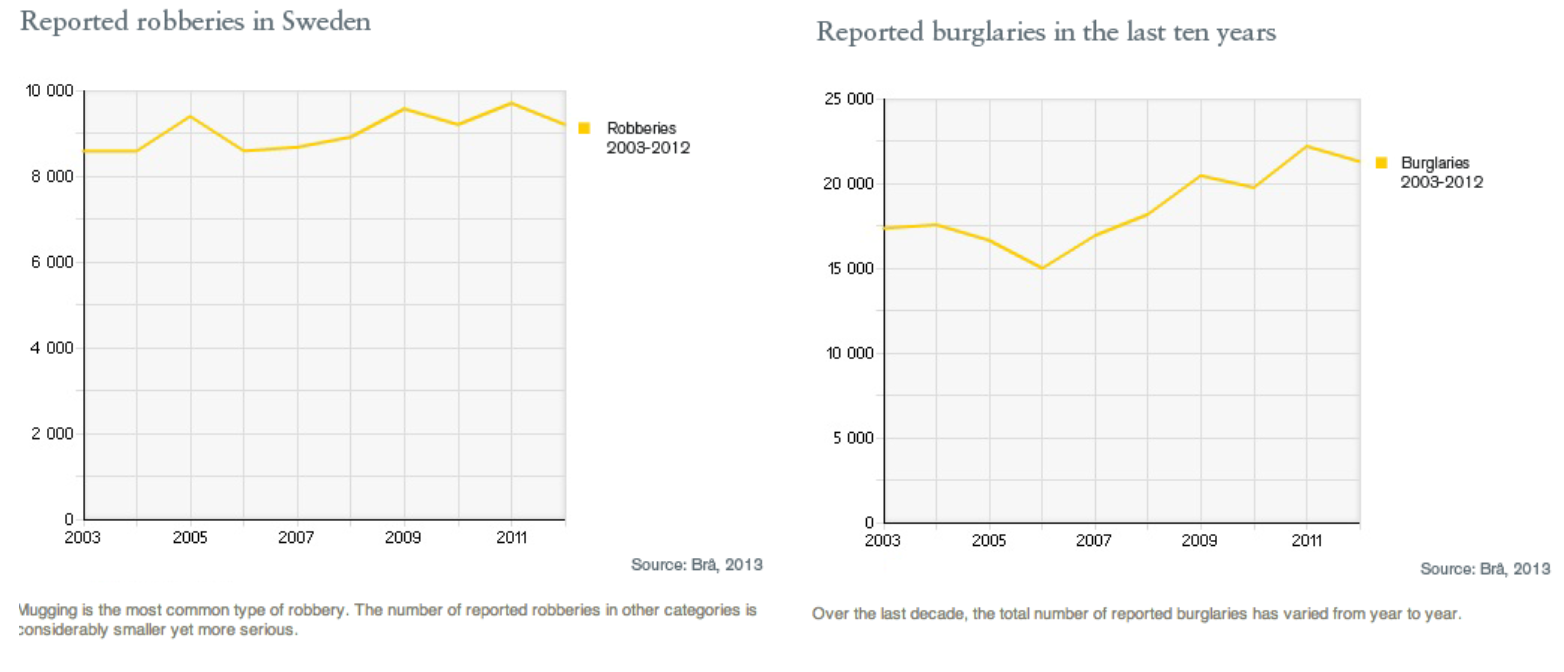

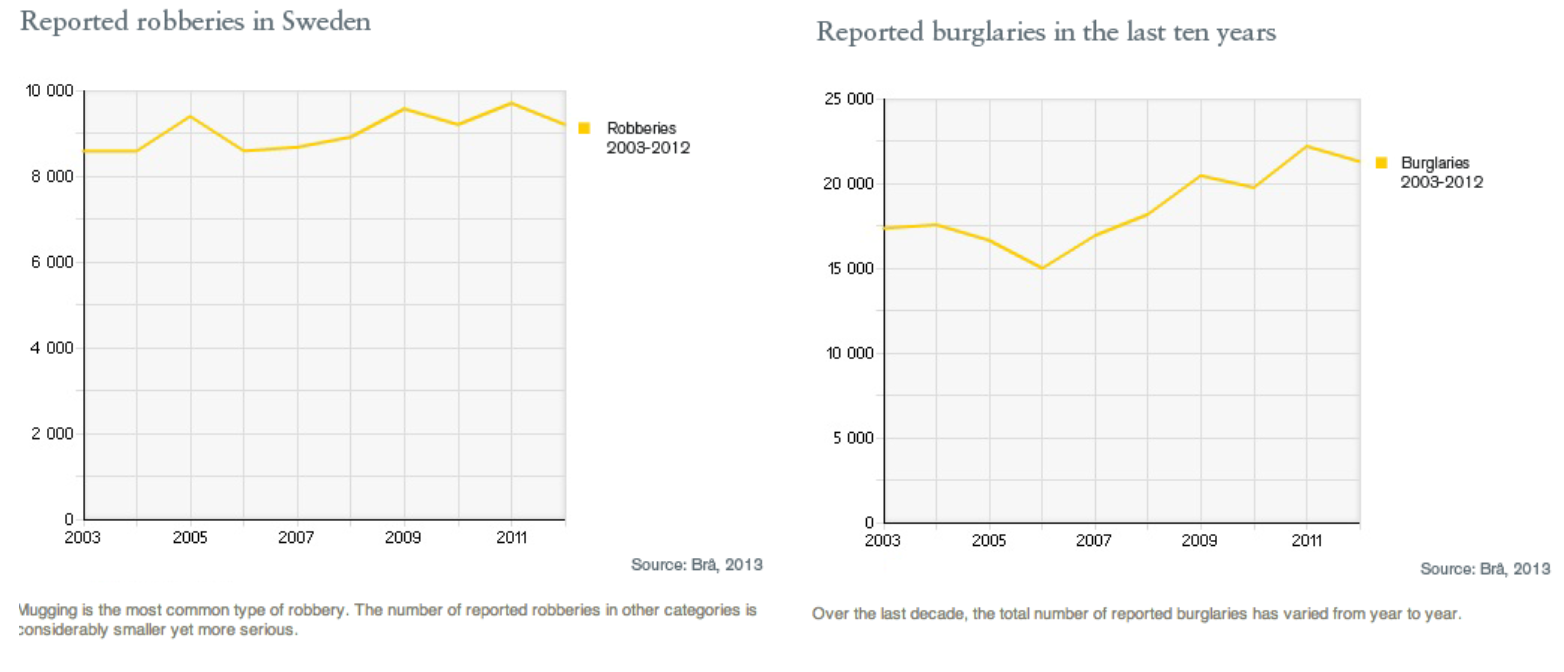

However, upon examining the numbers in the Swedish National Council for Crime Prevention’s most recent report on crime statistics, robberies and burglaries in Sweden have remained constant or have increased over the past 10 years, while cash in circulation has declined.25 This would suggest that the correlations often drawn between crime and cash use, as in the studies cited above, are unfounded.

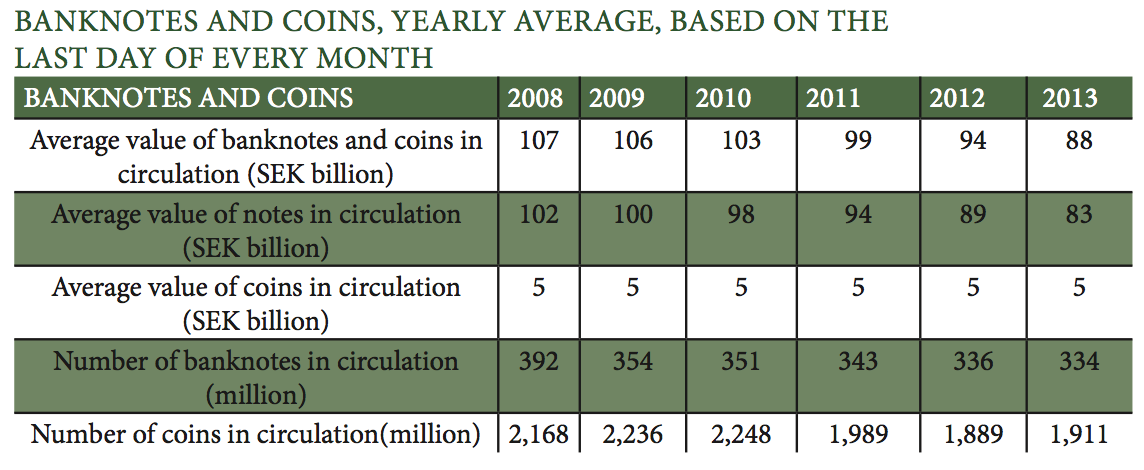

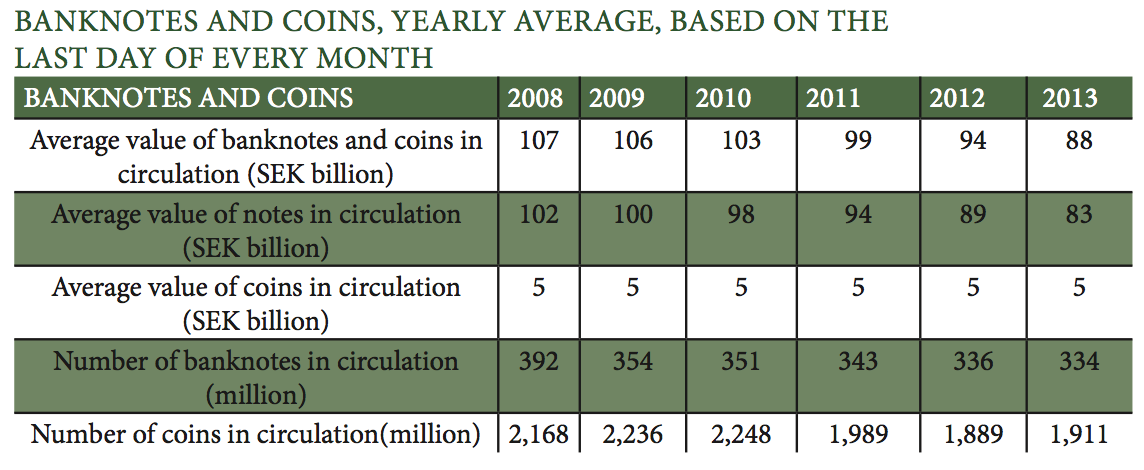

To demonstrate, the Riksbank collects statistics on the value and number of banknotes and coins in circulation in Sweden:26

[caption id="attachment_643" align="aligncenter" width="1144"] Note: The figures on the average value of banknotes and coins and on the number of banknotes and coins in circulation are rounded off. The figures for the average value of coins in circulation and the number of coins in circulation do not include commemorative coins.[/caption]

Note: The figures on the average value of banknotes and coins and on the number of banknotes and coins in circulation are rounded off. The figures for the average value of coins in circulation and the number of coins in circulation do not include commemorative coins.[/caption]

Compare the Riksbank’s dwindling cash circulation numbers to the following crime statistics for reported burglaries and robberies published by the Swedish National Council for Crime Prevention:27

Currency Research concludes from this data comparison that, at the very least, Sweden’s criminals have found lucrative alternatives to cash and have not reduced their criminal activities due to the declining circulation of cash in Sweden.

Others are also coming to the same or similar conclusions about the false correlation of a cashless society and declining crime rates. In her article, “Would a Cashless Society Have Less Crime?: How Paper Money Facilitates Tax Evasion and the Black Market,” Slate assistant editor Katy Waldman presents the following perspective that cashless does not necessarily mean crimeless:

Criminals and criminal behavior do not rely on a single preferred payment instrument to the degree that MasterCard and others would have us believe. As history has shown, criminals rapidly adapt to those technological changes that best facilitate their criminal behavior. Examples of this in the financial world are easy to point out. Widespread computer hacking and online identity theft did not exist twenty years ago; however, now both are very much in evidence.

If we look to the US example, anti-money laundering legislation was first passed in the 1970s and cash grew. “Know Your Customer (KYC)” legislation was introduced in the 1990s and cash grew. The rigorous reporting requirements of the Patriot Act and mandatory KYC processes followed in 2002 and cash grew. Enforcement followed in the late 2000s and cash grew. It is obvious that cash and money laundering crime are not so interrelated as the payment card manufacturers would have us believe. The myth that cash causes crime or that certain types of crime would disappear in a cashless world is simply that, another myth.

To add fuel to this debate, researchers have found lead to be a potent neurotoxin and declining crime rates have recently been linked to decreasing amounts of lead in the environment, as the BBC News Magazine reported in April 2014:29

But that is another story!

It is clear that the criminal element has already shifted to the non-cash world and that criminal acts are not contingent on the availability of cash, as evidenced in the following Global Financial Integrity (GFI) press release and Economist article.

The Economist also recently reported on illicit flows of capital and the misuse of trade:

The last word, however, comes from the 2013 World Payments Report (WPR) published by Capgemini and the Royal Bank of Scotland (RBS):

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

13 http://fletcher.tufts.edu/CostofCash/%7E/media/Fletcher/Microsites/Cost of Cash/CostofCashStudyFinal.pdf

14 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

15 http://www.nber.org/papers/w19996

16 Reproduced with permission from the author. Originally published to the HarmonicVent blog on December 2, 2013: http://harmonicvent.wordpress.com/2013/12/02/cash-costs-americans-200-billion-a-year-really/

17 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

18 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

19 http://www.washingtonpost.com/blogs/wonkblog/wp/2014/03/25/to-fight-crime-in-your-community-stop-using-cash/

20 http://www.nber.org/papers/w19996

21 http://www.nber.org/papers/w19996

22 http://www.shadowstats.com/article/no-414-hyperinflation-special-report-2012

23 http://www.nber.org/papers/w19996

24 http://www.interaksyon.com/infotech/from-robbers-to-vendors-swedes-brace-for-cashless-future

25 http://www.bra.se/bra/bra-in-english/home/crime-and-statistics/economic-crime.html

26 http://www.riksbank.se/en/Statistics/Statistics-on-notes-and-coins/

27 http://www.bra.se/bra/bra-in-english/home/crime-and-statistics/robbery.html and http://www.bra.se/bra/bra-in-english/home/crime-and-statistics/burglary.html

28 http://www.slate.com/articles/business/cashless_society/2012/03/living_without_cash_would_a_ cash_free_world_have_lower_crime_rates_.html

29 http://www.bbc.com/news/magazine-27067615

30 Press release available at http://www.gfintegrity.org/content/view/686/70/ and full report available at http://iff.gfintegrity.org/hiding/Hiding_In_Plain_Sight_Report-Final.pdf

31 http://www.economist.com/news/international/21601537-trade-weakest-link-fight-against-dirty-money-uncontained

The myth that cash use attracts criminal behavior tends to generate sensational headlines and is often picked up by the media since it is as controversial as much as it is thought provoking. While investigating this myth, Currency Research found that the research underlying each relevant “study” began with the premise that reducing cash would reduce crime, looking selectively at the supporting “evidence,” while bypassing counter-arguments contrary to the study’s presumed outcome.

In Rolf Dobelli’s bestselling book on human psychology and cognitive biases, The Art of Thinking Clearly, this is termed the “confirmation bias.”

Three recent reports published by Tufts University,13 MasterCard Advisors,14 and the National Bureau of Economic Research15 illustrate this sensationalist tendency to align cash use with criminal behavior. Currency Research looks at each of the three reports and then to sources of substantiated evidence that serve to dispel this myth.

In the Tufts University “study,” the authors conclude that cash costs the US economy $200 billion per year based primarily on crime rates and that a cashless society would see an attendant decrease in crime. Fred Purches, a long-time player in the cash handling industry, dissects this myth:

CASH COSTS AMERICANS $200 BILLION A YEAR.

REALLY?

I recently read the September 2013 report from Tufts University that seeks to calculate the cost of cash handling in the US (“The Cost of Cash in the United States”). In the report the authors, Bhaskar Chakravorti and Benjamin D. Mazzotta, identify that cash has digital substitutes and wonder why it has not seen the same level of disruption as other information goods (i.e. “communication, music, movies, and, increasingly, books”).

This is a very good question, and one that deserves analysis. However, the headline that gets picked up by the media tends to focus primarily on the cost of cash, like this one from CNBC, “Cash costs Americans $200 billion a year.”

The cost of cash is a very interesting topic and one that has been studied several times around the world. Total cash transactions in the US are estimated to be $1.6 trillion on an annual basis. If the cost of cash is really $200B then this represents 12.5% of the total value paid. This is much, much higher than any other numbers that I have seen (usually less than 1% of total value) and would be a very significant finding.

Let’s take a look then at the numbers from the study and see what we can find. We will start by isolating the largest cost components. As shown in the chart below, there are 3 that make up roughly 85% of the (Tax Gap, Retail Theft and Household Time). I have concerns with all 3 of them.

- Tax gap ($100B)– This is largest component by far and represents 50% of the total cost of cash. The Tax Gap as defined in the study essentially represents unpaid taxes. This is not a component that I have seen included in other studies. The authors contend that the untraceable nature of cash enables off-books transactions which make underreporting of taxes easier. As a result, these missing taxes should be included as a cost of cash. While this makes sense in principle, I have a couple of problems with it:

- Quality of data – The “conservative estimate” of $100B is based on 2 key figures. An IRS estimate of total underreported taxes ($400B) and an estimate made by the authors that 25% of these taxes would be paid if cash was replaced with some payment mechanism with an electronic record. The only basis for author’s estimate of 25% is statement from Nina Olsen, National Taxpayer Advocate that “52% of under-reported taxes can be attributed to under-reporting attributable to self-employed tax payers who file their own taxes.” The statement from Ms. Olsen does not mention cash at all. While I do not doubt that cash has some impact on taxes, this seems like a very weak set of assumptions for something that makes up half of the total cost.

- Impact of switching on taxes – As noted above, these estimates also assume that replacing cash with some alternative will result in increased tax payments. I’m not so sure about that. In my experience, people who want to get around paying taxes are going to figure out a way to get around taxes. In other words, “cheaters gonna cheat.” While I don’t have any data to back this up, the authors do not present any data to support the contention that the additional taxes will be paid either.

- Aggregation – When calculating the total cost, the authors aggregate the costs to consumers, business and the government. If taxes are unpaid then does that represent a benefit to the consumers and businesses who avoid paying them? Stated differently, if the taxes were paid, would they now be shown as a cost to consumers and businesses? I am not an economist, but this does not make sense to me. Some costs (like taxes) would seem to need to be “eliminated” in consolidation.

- Retail Theft ($40B)– The second largest cost component is cash theft losses from retailers. The authors state that “Cash theft losses are greater than bad checks, credit card fraud, refund fraud, and internet fraud combined.” There is only one slight problem with this, the source of the data is listed as “Richard Hollinger, National Retail Security Survey, 2010.” If you read Mr. Hollinger’s survey you will note that the figure that is reported (which incidentally is only $34.5 billion) reflects “retail shrinkage—a loss of inventory due to employee theft, shoplifting, paperwork errors, or supplier fraud.” This, of course, is much broader than “cash theft losses” which only represent a small percentage of this total. I contacted Mr. Holliger and he confirmed that cash losses are only a small percentage of the total. He also gave me access to his study and my calculation of cash losses for retail would be less than $200 million. This is less than 1/200th of the $40B figure shown in the study.

The fact that I have issues with all of these 3 items representing 85% of the $200B total cost of cash is concerning to me. I have to add that I did not spend a significant amount of time in identifying and calculating the discrepancies that I identified. I am sure that there are errors in my logic. However, I do have a pretty good amount of experience in the industry and the figures in the study just do not make sense to me. As always, I welcome your comments.

Nevertheless, I have no doubt that the $200B figure will continue to be used as “truth” by those who need to show how expensive cash is. I also note that authors intend to replicate this work in other countries (Egypt, India, and Mexico). If you hear that these are occurring in your country, you may want to reach out to the authors to make sure that the figures are calculated accurately.

PS: I sent a draft copy of this post to the authors of the study and they responded very quickly. They sent me a fairly detailed explanation (which I will admit was not convincing to me). I have alerted them to this final post so they may post any comments or views directly [to this blog]. 16

Hugh Thomas and Kevin Mellyn, authors of the MasterCard Advisors “study,” employ confusing graphics in an attempt to demonstrate a cause and effect between cash usage figures and crime-related data sourced from the World Bank Ease of Doing Business Index, the Transparency International Global Corruption Perceptions Index, and the Tax Justice Network’s 2009 tax haven report. Thomas and Mellyn do this in an effort to link cash usage to corruption, bribery, crime, and general business difficulties.

In spite of the attention-grabbing title of the MasterCard Advisors study:

IS THERE SUCH A THING AS HAVING TOO MUCH CASH?

An Examination of the Links Between Cash Usage and Bad Behavior

And the implication of a connection between cash use and “bad behavior”:

The estimates of cash usage prepared for this paper suggest that cash usage in many economies far outstrips what would be expected of consumers making rational micro-economic choices, and inasmuch as cash seems to be facilitating bad behavior, this preference for cash is not a good thing.17

And then showing “proof ” that links cash usage to corruption:

Thomas and Mellyn undermine their own argument by admitting:

The information presented here can in no way be seen as implying any causation between cash usage and bad behavior. To blame bad behavior like corruption on a preference for cash would be like blaming high unemployment on too many job seekers. 18

Throughout the study, research and evidence that contradict the authors’ preferred theory are conveniently overlooked.

The third “study,” a working paper published in March 2014 by the National Bureau of Economic Research (NBER), made headlines in the Washington Post:

TO FIGHT CRIME IN YOUR COMMUNITY, STOP USING CASH

A new study has found that paying welfare benefits via debit card, rather than cash, caused a 10 percent drop in crime. 19

In this NBER study, entitled “Less Cash, Less Crime: Evidence from the Electronic Benefit Transfer Program,” the five authors “prove” a link between lower crime rates in Missouri and the decline of circulating cash due to the transition of welfare payments from check to debit card. The charts below illustrate the study’s findings: 20

However, a telling disclaimer precedes the NBER study:

The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications.

Although there is little consensus regarding the overall importance of any single factor, it is generally agreed that a significant fraction of the decline has yet to be identified empirically, with some arguing that it likely is the result of a complex interaction of factors (see Blumstein and Wallman, 2006; Zimring, 2008). 21

This “complex interaction of factors” is largely ignored in the NBER study. The authors point out that the number of welfare recipients has declined alongside crime rates, but do not factor this information into their investigation. Nor did they consider the GDP fluctuation of Missouri, the state’s unemployment rate, police budgets, the number of police on the street, nor countless other factors that could have greater bearing on the decline of crime rates than simply changing the welfare system’s method of payment. But of course, these complexities do not make for good headlines.

For example, the trend of the US GDP from 1990 to 2010 has been relatively stable, which could very well be a considerable factor in lowering overall crime rates: 22

The authors conclude the NBER study with one last headline-grabbing statement:

Finally, we implement a back of the envelope calculation of the degree to which removal of cash on the streets is related to reduction of crime.

This amount is $671.2 million, which can be interpreted as the maximum amount of cash that needs to be removed from circulation in order to produce a decrease of 9.8 percent in the total crime rate. 23

Of course, the Washington Post article cited above omits this “back of the envelope” comment. We cannot imagine a central bank relying on a “back of the envelope” calculation.

To further investigate into the presumed correlation between cash use and crime, Currency Research looked to Sweden, a country that has been at the forefront of promoting a cashless society and has witnessed a decline in cash usage as a percentage of total purchases. This decline should indicate that people are carrying less cash. Indeed, many Swedish newspaper articles feature interviewees who state that they no longer carry cash, with headlines touting a cashless, crimeless Sweden: 24

FROM ROBBERS TO VENDORS, SWEDES BRACE FOR CASHLESS FUTURE

However, upon examining the numbers in the Swedish National Council for Crime Prevention’s most recent report on crime statistics, robberies and burglaries in Sweden have remained constant or have increased over the past 10 years, while cash in circulation has declined.25 This would suggest that the correlations often drawn between crime and cash use, as in the studies cited above, are unfounded.

To demonstrate, the Riksbank collects statistics on the value and number of banknotes and coins in circulation in Sweden:26

[caption id="attachment_643" align="aligncenter" width="1144"]

Note: The figures on the average value of banknotes and coins and on the number of banknotes and coins in circulation are rounded off. The figures for the average value of coins in circulation and the number of coins in circulation do not include commemorative coins.[/caption]

Note: The figures on the average value of banknotes and coins and on the number of banknotes and coins in circulation are rounded off. The figures for the average value of coins in circulation and the number of coins in circulation do not include commemorative coins.[/caption]Compare the Riksbank’s dwindling cash circulation numbers to the following crime statistics for reported burglaries and robberies published by the Swedish National Council for Crime Prevention:27

Currency Research concludes from this data comparison that, at the very least, Sweden’s criminals have found lucrative alternatives to cash and have not reduced their criminal activities due to the declining circulation of cash in Sweden.

Others are also coming to the same or similar conclusions about the false correlation of a cashless society and declining crime rates. In her article, “Would a Cashless Society Have Less Crime?: How Paper Money Facilitates Tax Evasion and the Black Market,” Slate assistant editor Katy Waldman presents the following perspective that cashless does not necessarily mean crimeless:

“The hypothesis that a cashless economy would make crime and under-the-table dealing more difficult is almost certainly true,” said Harvard economics professor Raj Chetty. After all, the black market runs on greenbacks for

a reason: Unlike digital ones, cash transactions don’t leave a paper trail. Ray Fisman, a professor at the Columbia Business School (and a Slate contributor) is less optimistic. He contends that black market mavens would simply develop alternatives to paper money, keeping crime rates more or less constant. For instance, traders might resort to using diamonds, opals, or gold pieces...

Latin America already offers a glimpse of one such substitute mechanism in action. As its economy grows ever more fluid (most South and Central Americans bank on their phones, using mobile apps that offer accounting and brokerage services), people have turned to “stored value cards,” which hold a fixed amount of money and can be bought or sold like any other good. Since they don’t draw from a bank account—funds and data are maintained by the card issuers and accessed by scanning a magnetic stripe—these cards are much harder to track. In a cashless world, SVCs might join precious metals and gems as currencies favored for illegal transactions.

Ellen Zimiles, a lawyer and expert on fraud and money laundering, has a different hypothesis. She suspects that financial crime would increase in a cashless society, since it’s easier to move electronic currency fast. Paper bills can be unwieldy, she pointed out: Because withdrawing reams of Benjamins might raise a red flag, most illegal sales involve tens and twenties. A suitcase containing large amounts of money thus tends to weigh a lot—plus, it’s far more vulnerable to interception than an instantaneous wire transfer. And we shouldn’t forget about the hackers who would be delighted by a world in which all financial dealings took place online, she said. 28

Criminals and criminal behavior do not rely on a single preferred payment instrument to the degree that MasterCard and others would have us believe. As history has shown, criminals rapidly adapt to those technological changes that best facilitate their criminal behavior. Examples of this in the financial world are easy to point out. Widespread computer hacking and online identity theft did not exist twenty years ago; however, now both are very much in evidence.

If we look to the US example, anti-money laundering legislation was first passed in the 1970s and cash grew. “Know Your Customer (KYC)” legislation was introduced in the 1990s and cash grew. The rigorous reporting requirements of the Patriot Act and mandatory KYC processes followed in 2002 and cash grew. Enforcement followed in the late 2000s and cash grew. It is obvious that cash and money laundering crime are not so interrelated as the payment card manufacturers would have us believe. The myth that cash causes crime or that certain types of crime would disappear in a cashless world is simply that, another myth.

To add fuel to this debate, researchers have found lead to be a potent neurotoxin and declining crime rates have recently been linked to decreasing amounts of lead in the environment, as the BBC News Magazine reported in April 2014:29

DID REMOVING LEAD FROM PETROL SPARK A DECLINE IN CRIME?

But that is another story!

It is clear that the criminal element has already shifted to the non-cash world and that criminal acts are not contingent on the availability of cash, as evidenced in the following Global Financial Integrity (GFI) press release and Economist article.

FOR IMMEDIATE RELEASE

May 11, 2014

AFRICAN COUNTRIES LOSE BILLIONS THROUGH MISINVOICED TRADE

Fraudulent Trade Transactions Channeled at Least US$60.8 Billion Illegally in or out of 5 African Countries from 2002-2011

Tax Loss from Trade Misinvoicing Potentially at 12.7% of Uganda’s Total Government Revenue, followed by Ghana (11.0%), Mozambique (10.4%), Kenya (8.3%), & Tanzania (7.4%)

COPENHAGEN, Denmark / WASHINGTON, DC – The fraudulent misinvoicing of trade is hampering economic growth and potentially resulting in billions of U.S. dollars in lost tax revenue in Ghana, Kenya, Mozambique, Tanzania, and Uganda, according to a new report [ HTML | PDF ] to be published Monday by Global Financial Integrity (GFI), a Washington DC-based research and advocacy organization. The study—funded by the Ministry of Foreign Affairs of Denmark—finds that the over- and under-invoicing of trade transactions facilitated at least US$60.8 billion in illicit financial flows into or out of the five African countries between 2002 and 2011.30

The Economist also recently reported on illicit flows of capital and the misuse of trade:

UNCONTAINED: TRADE IS THE WEAKEST LINK IN THE FIGHT AGAINST DIRTY MONEY

Cuddly toys don’t have to be stuffed with cocaine or cash to be useful to traffickers. A few years ago American customs investigators uncovered a scheme in which a Colombian cartel used proceeds from drug sales to buy stuffed animals in Los Angeles. By exporting them to Colombia, it was able to bring its ill-gotten gains home, convert them to pesos and get them into the banking system.31

The last word, however, comes from the 2013 World Payments Report (WPR) published by Capgemini and the Royal Bank of Scotland (RBS):

A hidden, or at least unreported, non-cash payments market is emerging as new regions become more active and non-banks take an increasing share of the market via instruments such as e- and m-payments, prepaid cards, and virtual currency. Improved statistical data collection would help firms make more informed investment decisions in addition to helping combat future market risk.32

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

13 http://fletcher.tufts.edu/CostofCash/%7E/media/Fletcher/Microsites/Cost of Cash/CostofCashStudyFinal.pdf

14 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

15 http://www.nber.org/papers/w19996

16 Reproduced with permission from the author. Originally published to the HarmonicVent blog on December 2, 2013: http://harmonicvent.wordpress.com/2013/12/02/cash-costs-americans-200-billion-a-year-really/

17 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

18 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

19 http://www.washingtonpost.com/blogs/wonkblog/wp/2014/03/25/to-fight-crime-in-your-community-stop-using-cash/

20 http://www.nber.org/papers/w19996

21 http://www.nber.org/papers/w19996

22 http://www.shadowstats.com/article/no-414-hyperinflation-special-report-2012

23 http://www.nber.org/papers/w19996

24 http://www.interaksyon.com/infotech/from-robbers-to-vendors-swedes-brace-for-cashless-future

25 http://www.bra.se/bra/bra-in-english/home/crime-and-statistics/economic-crime.html

26 http://www.riksbank.se/en/Statistics/Statistics-on-notes-and-coins/

27 http://www.bra.se/bra/bra-in-english/home/crime-and-statistics/robbery.html and http://www.bra.se/bra/bra-in-english/home/crime-and-statistics/burglary.html

28 http://www.slate.com/articles/business/cashless_society/2012/03/living_without_cash_would_a_ cash_free_world_have_lower_crime_rates_.html

29 http://www.bbc.com/news/magazine-27067615

30 Press release available at http://www.gfintegrity.org/content/view/686/70/ and full report available at http://iff.gfintegrity.org/hiding/Hiding_In_Plain_Sight_Report-Final.pdf

31 http://www.economist.com/news/international/21601537-trade-weakest-link-fight-against-dirty-money-uncontained

Additional Resources from ATM Industry Association

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- 4/18/2024 - ATMIA Joins Atlanta Fed Meeting on Best Practices for ATM Cash Replenishment

- 4/18/2024 - Cryptocurrency Legislation at the State Level Still Outpacing Other Types of Legislation

- 4/18/2024 - Moving ATMs Into the Future with Cash Recycling

- Show All ATM Industry Association Press Releases / Blog Posts