News

Myth: Cash is expensive

Monday, March 13, 2017

View ShowroomBy Currency Research

The “expense” and social costs of cash are currently the new arguments for the war on cash. Headlines tout the recent Tufts University study that “cash costs 200 billion a year to the US taxpayer” or a similar British study that asserted cash is more expensive than credit cards for retailers. Certain central banks are using this reason for actively discouraging the use of cash, saying “it is costing the government ‘x%’ in GDP.”

Currency Research acknowledges that the cost of cash is fraught with variables and statistics. There are many assumptions that can be made and independent studies tend not to examine the entire spectrum due to confidentialities and the commercial nature of the question. However, some central banks and retailer organizations have undertaken in-depth cost studies and uniform comparisons to other payment methods.

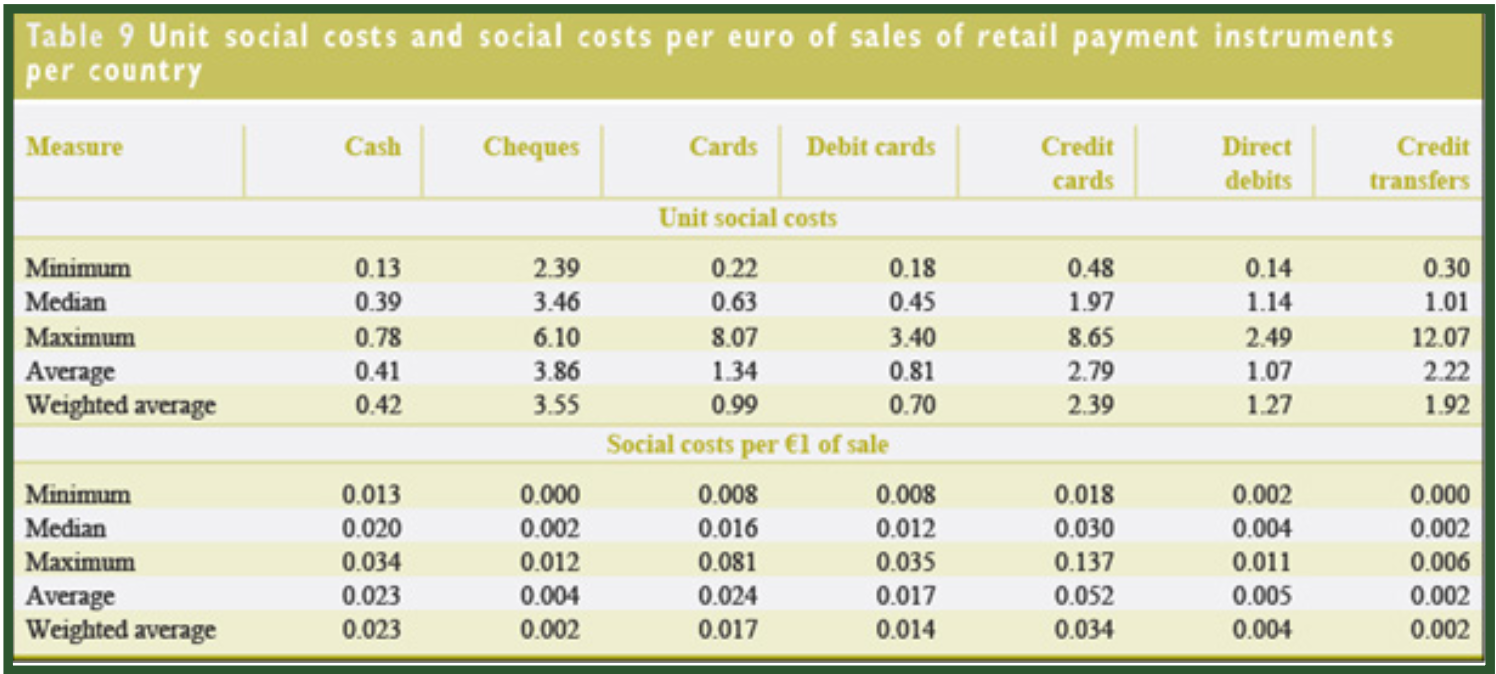

In the European Central Bank’s (ECB) 2012 occasional paper, The Social and Private Costs of Retail Payment Instruments, it was concluded:

On average, cash payments show the lowest social costs per transaction, followed closely by debit card payments. 3

[caption id="attachment_631" align="aligncenter" width="1496"]

Source: EBC, The Social and Private Costs of Retail Payment Instruments, 2012[/caption]

Source: EBC, The Social and Private Costs of Retail Payment Instruments, 2012[/caption]Some other key references to support the low cost of cash as compared to debit/credit cards include the financial IT solutions network, bobsguide, which notes:

McKinsey, the consultancy firm, has estimated that society spends about €200 (£180) a year per person in order to cover the cost of cash and that the real cost of cash to a retailer is 1.3% of the purchase price.4

This is a critical statistic to acknowledge as debit and credit card fees alone tend to be well above 1.3% and up to 5%. These fees are charged by the credit card industry to the retailer, who then carries the fees over to the consumer. Consumer interest charges are not included in the card fees and compound the overall costs to the consumer. On April 3, 2014, European lawmakers backed a plan to force the credit card industry to reduce charges, estimated to save consumers hundreds of millions of Euros.5

Further to this, the British Retail Council’s (BRC) 2012 Cost of Payment Collection Survey similarly found that “unjustifiably” high debit and credit card fees are carried over to retailers and consumers:

The survey also shows banks continue to levy unjustifiably high charges on retailers for handling card payments. The average cost to a retailer of having a credit or charge card payment processed was 25 times higher than for cash (38p versus 1.5p). Credit and charge cards account for only 10.6 per cent of transactions but over half (50.1 per cent) of costs, and total costs associated with those cards were up by 7 per cent, even though use is down on the previous year. 6

The same BRC figures in 2009 showed that the average credit card transaction cost retailers 34p, compared with 81⁄2p for a debit card transaction and 2.1p for cash. The costs of credit and debit card transactions rose while those of cash fell. 7

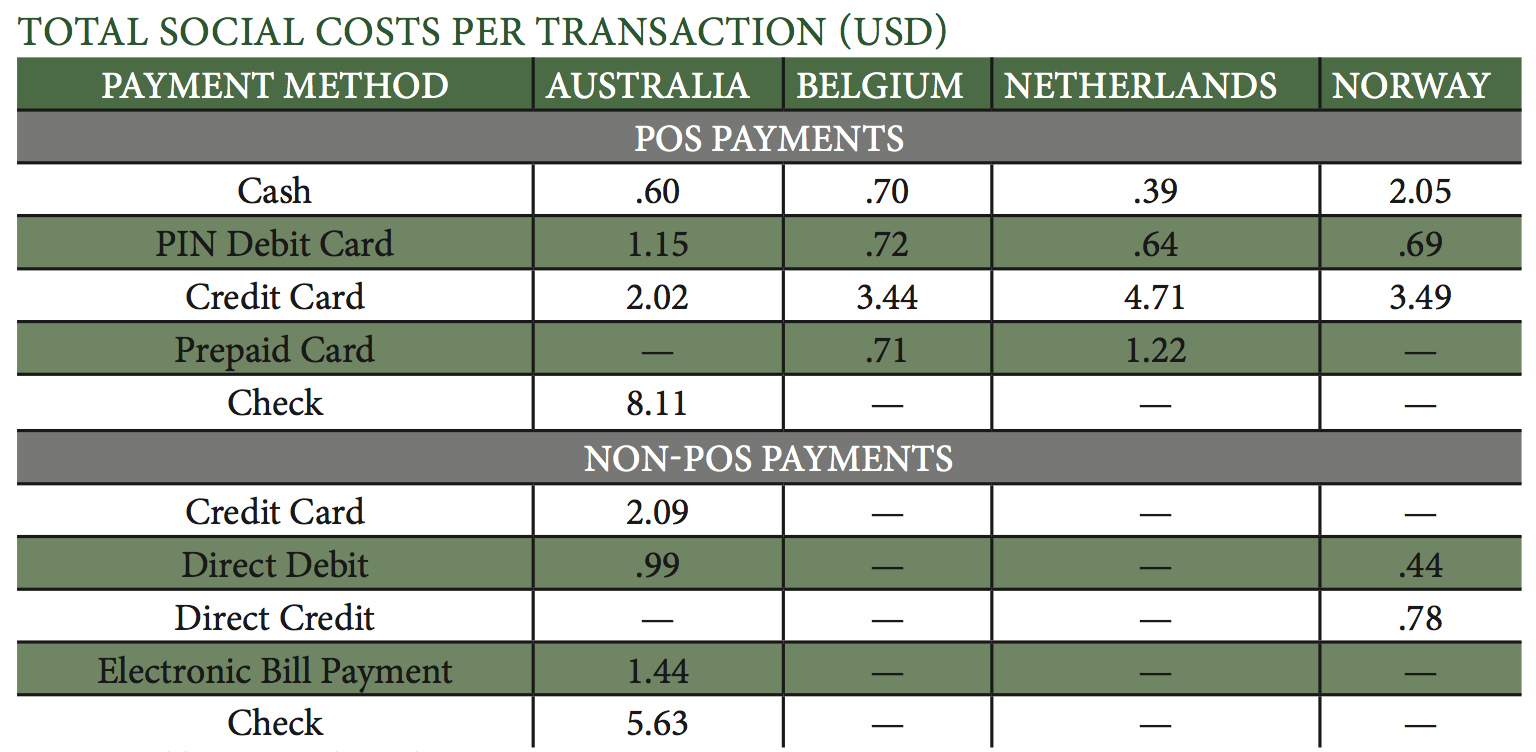

Fumiko Hayashi and William R. Keeton’s 2012 US Federal Reserve Bank of Kansas study, “Measuring the Costs of Retail Payment Methods,” reviews the methodology and results of past cost studies of retail payment methods. 8 The authors examine the key features and findings of recent studies from Norway, Australia, Belgium, and the Netherlands, which showed that cash and debit cards had the lowest social cost per transaction.

Hayashi and Keeton distinguish the social costs of transaction from private costs:

In evaluating the relative efficiency of different payment methods, what matters is the social cost of each payment instrument. The social cost of a payment instrument is the sum of the resource costs incurred by all parties in transactions using that instrument. This cost is distinguished from the private cost of a payment instrument to an individual party. The latter cost includes not only the resource costs incurred by an individual party to a payment transaction, but also the fees paid by that party to other parties as part of the transaction. These fees are excluded from social costs because from society’s point of view, the fees paid by one party to a transaction are offset by the fees received by another party. 9

In the following tables, Hayashi and Keeton present the social costs per transaction in each of the four countries studied:

[caption id="attachment_632" align="aligncenter" width="1536"]

Source: Table 4, Hayashi and Keeton, p. 58[/caption]

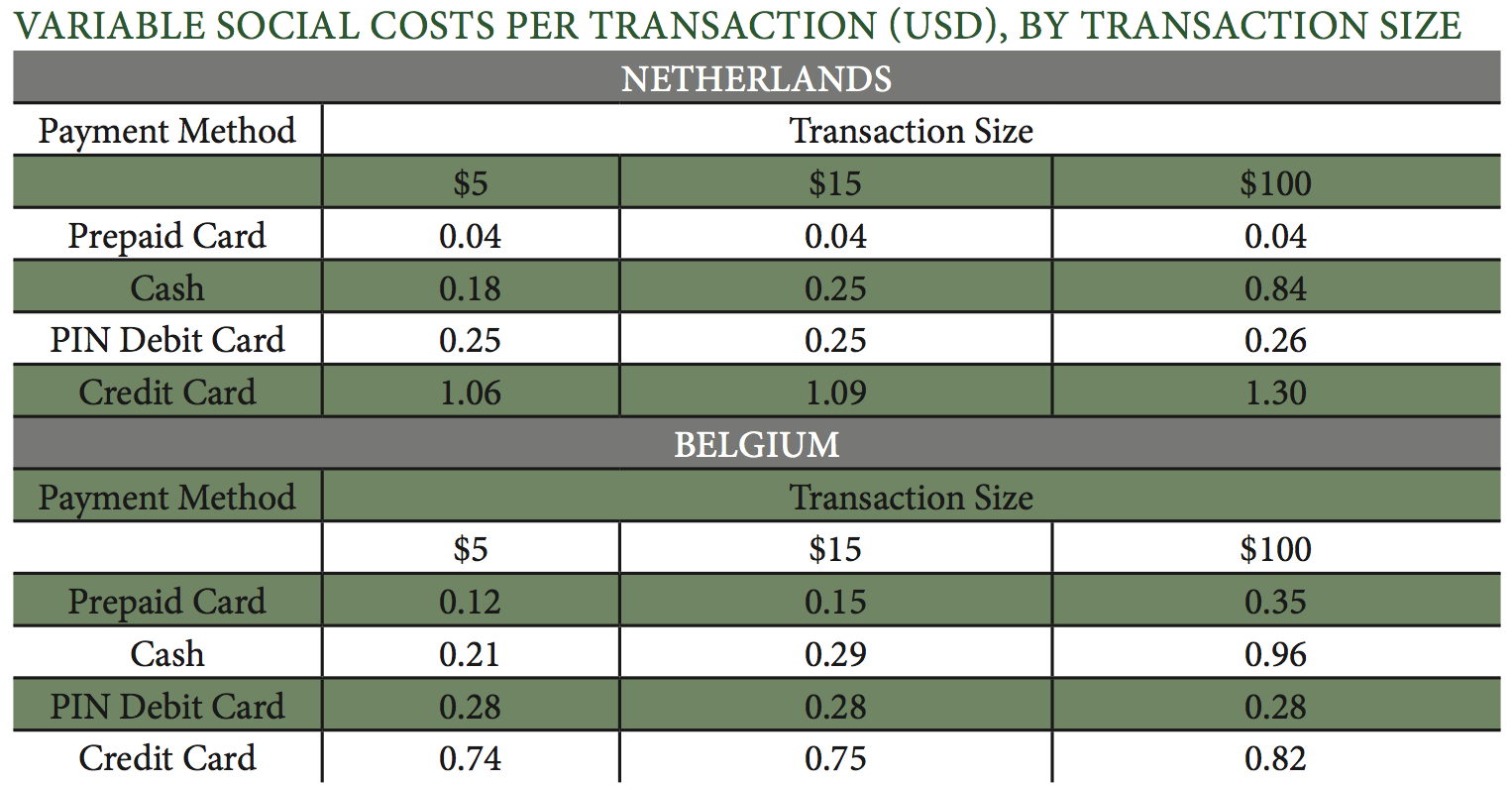

Source: Table 4, Hayashi and Keeton, p. 58[/caption][caption id="attachment_633" align="aligncenter" width="1526"]

Source: Table 4, Hayashi and Keeton, p. 62[/caption]

Source: Table 4, Hayashi and Keeton, p. 62[/caption]Hayashi and Keeton express interest that cash was found to be less expensive than debit and credit cards for small and medium-size transactions in both Belgium and the Netherlands and that credit cards had the highest social cost per transaction:

... credit cards had both higher social cost per transaction than debit cards and higher social cost per unit of value. That finding suggested that the higher cost per transaction of credit cards was not due solely to their higher average transaction size. 10

Most importantly, the study advocates for the availability of more accurate and comprehensive information about retail payment costs to better inform the decision making of central banks and the overall efficiency of the payments system:

To meet the policy goal of an efficient retail payments system, central banks need accurate and comprehensive information about the costs of making retail payments. The potential gains from reducing retail payment costs may be considerable, with such costs estimated to ab-sorb 0.5 percent to 0.9 percent of annual economic output

in a number of countries. As this article has noted, reductions in retail payment costs will represent a net gain to society only if the benefits of the payments system to merchants and consumers are maintained or increased. Thus, to assess the overall efficiency of the payments system, central banks need information on the benefits of each payment method in addition to the costs. 11

In the two studies discussed above it is important to note that prepaid cards tended to be less expensive than other forms of payment. However, these cards are often very limited in scope and distribution.

Both Visa Cash and Mondex are examples of credit card company entries into this market that ultimately failed. Visa Cash even maintains a website devoted to preserving their memory! 12

To suggest that a cashless society in some way reduces social costs is clearly a myth, particularly as the proposed replacements to cash are payment cards, both credit and debit, along with their fees and higher social costs per transaction. We mentioned above that measuring the cost of cash is challenging, but it should be noted that no study offsets the “cost of cash” with various incomes received by the central bank related to cash, which could reduce the social cost of cash even further.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

3 Occasional Paper No. 137, September 2012: http://www.ecb.europa.eu/pub/pdf/scpops/ecbocp137.pdf

4 http://www.bobsguide.com/guide/news/2013/Jul/31/a-battleground-in-payments-cash-v-plastic.html

5 http://www.dw.de/eu-lawmakers-vote-for-lower-credit-card-fees-and-no-roaming-costs/a-17541497

6 http://www.brc.org.uk/ePublications/Cost_of_Collection_Survey_2012/index.html

7 http://www.retailresearch.org/retailpaymentsystems.php

8 http://www.kansascityfed.org/publicat/econrev/pdf/12q2Hayashi-Keeton.pdf

9 http://www.kansascityfed.org/publicat/econrev/pdf/12q2Hayashi-Keeton.pdf

10 http://www.kansascityfed.org/publicat/econrev/pdf/12q2Hayashi-Keeton.pdf

11 http://www.kansascityfed.org/publicat/econrev/pdf/12q2Hayashi-Keeton.pdf

12 http://www.visacash.org/main_page.html

4 http://www.bobsguide.com/guide/news/2013/Jul/31/a-battleground-in-payments-cash-v-plastic.html

5 http://www.dw.de/eu-lawmakers-vote-for-lower-credit-card-fees-and-no-roaming-costs/a-17541497

6 http://www.brc.org.uk/ePublications/Cost_of_Collection_Survey_2012/index.html

7 http://www.retailresearch.org/retailpaymentsystems.php

8 http://www.kansascityfed.org/publicat/econrev/pdf/12q2Hayashi-Keeton.pdf

9 http://www.kansascityfed.org/publicat/econrev/pdf/12q2Hayashi-Keeton.pdf

10 http://www.kansascityfed.org/publicat/econrev/pdf/12q2Hayashi-Keeton.pdf

11 http://www.kansascityfed.org/publicat/econrev/pdf/12q2Hayashi-Keeton.pdf

12 http://www.visacash.org/main_page.html

Additional Resources from ATM Industry Association

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- 4/18/2024 - ATMIA Joins Atlanta Fed Meeting on Best Practices for ATM Cash Replenishment

- Show All ATM Industry Association Press Releases / Blog Posts