News

Myth: The Cashless Society is Just Around the Corner

Friday, March 17, 2017

View Showroom

By Currency Research

For the last 45 years, newspaper articles and various publications have been predicting the end of cash. One of the first has been identified as Jack Lefler’s 1968 article, which predicted the emergence of a future cashless society that would use a single identification card for all transactions:

At the 2013 Money 2020 Conference, a former Citibanker presented delegates with a newspaper clipping that predicted a cashless society by the late 1970s:

In his 1981 book, World of Tomorrow: School, Work and Play, author Neil Ardley predicted a cashless world by 2002:

A 1996 New York Times article by Michael Marriott, “In A Cashless Future, Robots Will Cook,” begins with the line: “It’s a typical day in the year 2006.” 35

Marriott continues, predicting “smart cards” and the decline of cash:

The February 17, 2007 cover of The Economist envisioned cash as a dinosaur doomed to extinction: 37

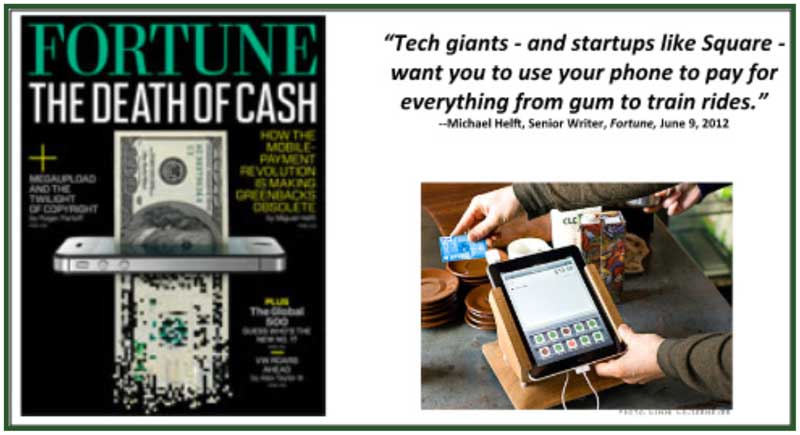

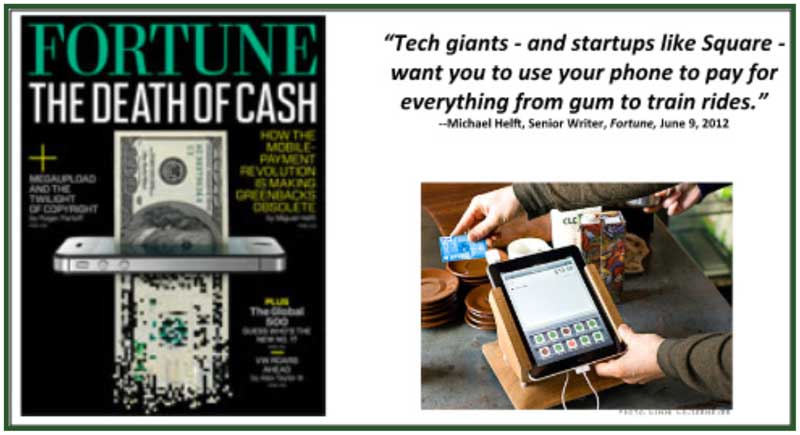

The alleged “death of cash” makes for a great headline on the cover of the July 2012 issue of Fortune: 39

Of course, the credit card industry has been promoting the end of cash in its so-called “War on Cash.” Payment Cards & Mobile, a research and consulting firm offering payments industry intelligence, posts news and articles on this topic regularly, including the recent March 2014 post, “Cashless Volumes – The War on Cash Continues.” 40

In 2006, Maestro declared “Cash has Retired” and “Cash Stinks” in a massive UK advertising campaign: 41

The above examples are just a sampling of the many articles predicting the demise of cash. But the reality is somewhat different. In the following pages, Currency Research looks to findings of the United States Federal Reserve and to our own research among bank and industry representatives for a more informed and balanced prediction.

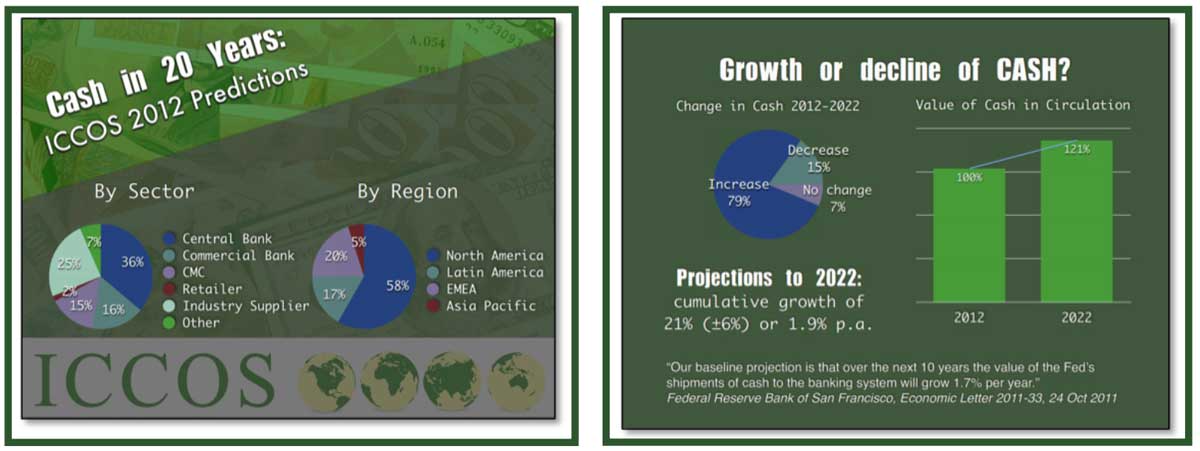

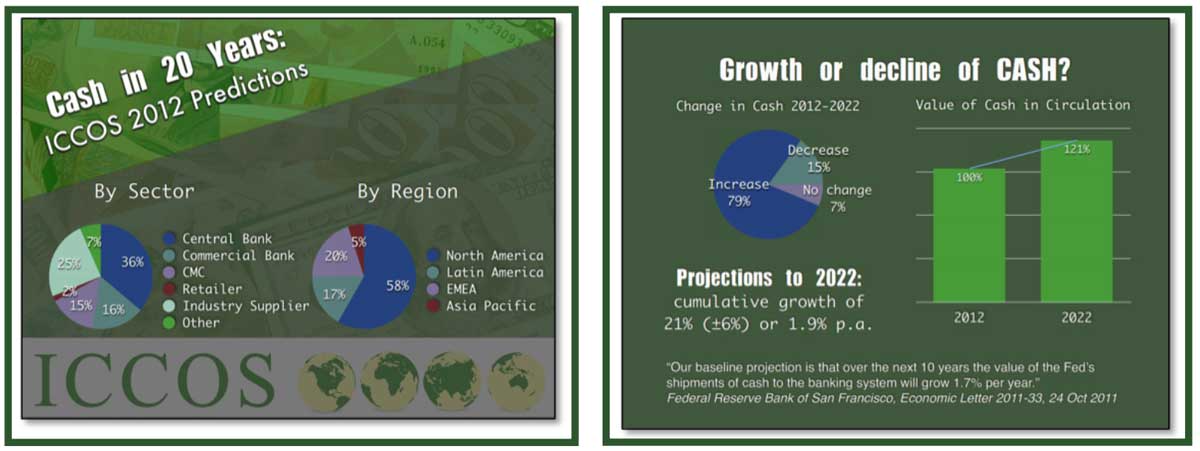

The US Federal Reserve predicts that cash will grow an average of 1.7% per year from 2012 to 2022. 42

Similarly, in a recent 2012 Currency Research survey of central bankers, commercial banks, and cash management companies, 79% concluded that cash would increase in the next 10 years: 43

A number of recent studies conducted on the future of cash support predictions of increased cash usage. In June 2013, the University of Chicago published “Paying with Cash: A Multi-Country Analysis of the Past and Future of the Use of Cash for Payments by Consumers,” a multi-country study on the future of paying with cash. The authors, David S. Evans and Karen Webster, conclude that “contrary to popular reports, cash is not dying” and that the growth of cash spending will decline by 2022, but cash spending itself will continue to increase through 2022. 44

The conclusion to be drawn from these findings is that institutions or individuals who have predicted a decline in the growth rate of cash, let alone cash itself, have been mistaken since 1968. To quote from the aforementioned MasterCard Advisors experts themselves, there is a reluctant agreement that cash is here to stay “whether we like it or not”: 46

Finally, the keynote presentation at the 2013 European Security Transport Association (ESTA) World Congress reported findings from Market Platform Dynamics (MPD) showing that cash will indeed be here to stay for a long time. Business Wire reports on the MPD study:

Or, as Mark Twain wrote in May 1897, “the report of my death was an exaggeration.” As we see from the next myth, cash is not laying on its deathbed; rather, its use is actually increasing.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

33 Lefler’s article appeared in the July 24, 1968 edition of the Las Cruces Sun-News (Las Cruces, NM)

34 http://www.finextra.com/news/fullstory.aspx?newsitemid=25315

35 http://www.nytimes.com/1996/01/24/garden/in-a-cashless-future-robots-will-cook.html

36 http://www.nytimes.com/1996/01/24/garden/in-a-cashless-future-robots-will-cook.html

37 http://www.economist.com/printedition/2007-02-17

38 Ibid.

39 http://tech.fortune.cnn.com/2012/07/09/dorsey-square-death-cash/

40 http://www.paymentscardsandmobile.com/cashless-volumes-war-cash-continues-2/

41 http://www.campaignlive.co.uk/thework/885357/

42 http://www.frbsf.org/economic-research/publications/economic-letter/2011/october/future-cash/

43 http://www.currencyaffairs.org/templates/files/library/ICCOSAmericas2012Archives/ Wednesday_Session_VII_Marci_Chavez.pdf

44 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2273192

45 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2273192

46 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

47 http://www.businesswire.com/news/home/20130603006205/en/Payments-Innovation-Killing-Cash#.U2AUPK1dV2A

For the last 45 years, newspaper articles and various publications have been predicting the end of cash. One of the first has been identified as Jack Lefler’s 1968 article, which predicted the emergence of a future cashless society that would use a single identification card for all transactions:

As a result of the proliferation of credit cards, there has been widespread speculation about the possibilities of a checkless, cashless society in the future. 33

At the 2013 Money 2020 Conference, a former Citibanker presented delegates with a newspaper clipping that predicted a cashless society by the late 1970s:

While much of the chatter at the Money2020 conference in Las Vegas centred on schemes to eliminate hard cash, former Citibanker Jay Bhattacharya took a contrarian approach, brandishing a newspaper clipping from 1972 that confidently forecast the arrival of a cashless society by the end of the 1970s.

The yellowing clipping, headlined ‘Cashless Society Predicted by Credit Card Use,’ claimed cash and paper cheques would disappear with the mass adoption of credit cards and the unveiling of ATM machines at more than 5,300 banks owned by the Interbank Card Association. 34

In his 1981 book, World of Tomorrow: School, Work and Play, author Neil Ardley predicted a cashless world by 2002:

The answer is simple: you do not carry any money on you and neither does anyone else. You pay for everything you buy with an identity card like a credit card. It has a magnetic strip containing your name and other personal information in the form of a magnetic code.

A 1996 New York Times article by Michael Marriott, “In A Cashless Future, Robots Will Cook,” begins with the line: “It’s a typical day in the year 2006.” 35

Marriott continues, predicting “smart cards” and the decline of cash:

Many futurists agree that the next 10 to 20 years may see the beginning of a mostly cashless culture. “Smart cards,” or debit cards, are expected to become popular. In The Futurist, Mr. Cornish wrote that by 2025, cash may be popular only with “thieves, tax dodgers and paranoiacs.” 36

The February 17, 2007 cover of The Economist envisioned cash as a dinosaur doomed to extinction: 37

With electronic payments and various forms of digital money on the rise, the era of coins and bills could be nearing an end: ‘Cash, after millennia as one of mankind’s most versatile and enduring technologies, looks set over the next 15 years or so finally to melt away into an electronic stream of ones and zeros...’ 38

The alleged “death of cash” makes for a great headline on the cover of the July 2012 issue of Fortune: 39

Of course, the credit card industry has been promoting the end of cash in its so-called “War on Cash.” Payment Cards & Mobile, a research and consulting firm offering payments industry intelligence, posts news and articles on this topic regularly, including the recent March 2014 post, “Cashless Volumes – The War on Cash Continues.” 40

In 2006, Maestro declared “Cash has Retired” and “Cash Stinks” in a massive UK advertising campaign: 41

The above examples are just a sampling of the many articles predicting the demise of cash. But the reality is somewhat different. In the following pages, Currency Research looks to findings of the United States Federal Reserve and to our own research among bank and industry representatives for a more informed and balanced prediction.

The US Federal Reserve predicts that cash will grow an average of 1.7% per year from 2012 to 2022. 42

Similarly, in a recent 2012 Currency Research survey of central bankers, commercial banks, and cash management companies, 79% concluded that cash would increase in the next 10 years: 43

A number of recent studies conducted on the future of cash support predictions of increased cash usage. In June 2013, the University of Chicago published “Paying with Cash: A Multi-Country Analysis of the Past and Future of the Use of Cash for Payments by Consumers,” a multi-country study on the future of paying with cash. The authors, David S. Evans and Karen Webster, conclude that “contrary to popular reports, cash is not dying” and that the growth of cash spending will decline by 2022, but cash spending itself will continue to increase through 2022. 44

PAYING WITH CASH: A MULTI-COUNTRY ANALYSIS OF THE PAST AND FUTURE OF THE USE OF CASH FOR PAYMENTS BY CONSUMERS

Abstract: This paper focuses on the value of consumer payments made with cash, which we refer to as “total cash spending”, and the share of total spending that is made with cash, which we refer to as the “cash-spending share”. We provide estimates of these measures of cash use for 2000-2011 and forecasts of these measures of cash use for 2012-2022 for ten diverse countries: France, Germany, Italy, Poland, Portugal, Spain, Sweden, Turkey, the United Kingdom, and the United States.

We summarize the results across these countries using GDP-weighted compound annual growth rates. We estimate that total real cash spending increased by 2.4 percent annually between 2000 and 2011 and forecast that this growth will decline to a 0.9 percent increase annually between 2012 and 2022. We also show that the cash-spending share increased by 1.6 percent annually between 2000 and 2011 but will likely decline by 1.5 percent annually between 2012 and 2022.

We find that total cash spending will increase between 2012 and 2022, despite the decline in the cash-spending share, because total spending will increase over this period. There is great diversity in the details across countries in the historical and future evolution of cash use by consumers. However, our key finding is that, contrary to popular reports, cash is not dying. In most countries total cash spending will continue to increase, although at a slower rate than historically, and the share of spending with cash will decline but at a modest rate. 45

The conclusion to be drawn from these findings is that institutions or individuals who have predicted a decline in the growth rate of cash, let alone cash itself, have been mistaken since 1968. To quote from the aforementioned MasterCard Advisors experts themselves, there is a reluctant agreement that cash is here to stay “whether we like it or not”: 46

CONCLUSIONS

There will always be a need for cash in some form. In places where infrastructures do not exist, or have been compromised, its portability and stored value can mean that cash is the only way to pay. Cash in some form is here to stay, whether we like it or not.

Finally, the keynote presentation at the 2013 European Security Transport Association (ESTA) World Congress reported findings from Market Platform Dynamics (MPD) showing that cash will indeed be here to stay for a long time. Business Wire reports on the MPD study:

PAYMENTS INNOVATION NOT KILLING CASH

In spite of the many payments innovations coming to market around the world, and efforts on the part of many, including banks and card networks, to shift consumers away from cash, a new study released today by Market Platform Dynamics (MPD) shows that the total use of cash is increasing in many developed and developing countries. The study findings were the subject of a keynote presentation made by MPD CEO Karen Webster at the ESTA World Congress and Convening in Marseilles, France. The study findings conclude that although payments innovation will eventually impact the consumers’ use of cash, significant impacts will take at least a decade to be felt.

The study was sponsored by Loomis AB, one of the world’s leading cash processing and delivery organizations in an effort to understand the impact between cash usage by consumers and the payment innovations coming to market.

“Cash isn’t going to die – or not at least any time soon, in spite of the explosive growth of electronic payments, in spite of the bulls eye that it has on its back from players who want to see it dead and buried, and in spite of the convincing narrative that electronic payments pundits deliver, “ remarked Webster during her presentation. “Pundits have been predicting the death of cash for as long as the plastic card has been in existence – more than 60 years now but the existing ways of measuring cash tell us nothing about how consumers actually use it. We’ve developed a new methodology that provides a much more accurate understanding how much cash is used by consumers to pay for things at merchants in different countries over time.”

Lars Blecko, ESTA Conference Chair and CEO of Loomis AB stated that “it’s easy to lose perspective about the relevance of cash in society given the wave of news reports on payments innovation. The ability to have a more robust methodology for understanding how much cash is really used by consumers to pay for things at merchants is extraordinarily valuable and why we felt very strongly that this piece of work be done for the benefit of the entire cash ecosystem. It turns perceptions about cash into a set of tangible and actionable metrics that help the industry understand how cash will evolve alongside mobile and the other payments innovation that will certainly come our way over the years.” 47

Or, as Mark Twain wrote in May 1897, “the report of my death was an exaggeration.” As we see from the next myth, cash is not laying on its deathbed; rather, its use is actually increasing.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

33 Lefler’s article appeared in the July 24, 1968 edition of the Las Cruces Sun-News (Las Cruces, NM)

34 http://www.finextra.com/news/fullstory.aspx?newsitemid=25315

35 http://www.nytimes.com/1996/01/24/garden/in-a-cashless-future-robots-will-cook.html

36 http://www.nytimes.com/1996/01/24/garden/in-a-cashless-future-robots-will-cook.html

37 http://www.economist.com/printedition/2007-02-17

38 Ibid.

39 http://tech.fortune.cnn.com/2012/07/09/dorsey-square-death-cash/

40 http://www.paymentscardsandmobile.com/cashless-volumes-war-cash-continues-2/

41 http://www.campaignlive.co.uk/thework/885357/

42 http://www.frbsf.org/economic-research/publications/economic-letter/2011/october/future-cash/

43 http://www.currencyaffairs.org/templates/files/library/ICCOSAmericas2012Archives/ Wednesday_Session_VII_Marci_Chavez.pdf

44 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2273192

45 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2273192

46 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

47 http://www.businesswire.com/news/home/20130603006205/en/Payments-Innovation-Killing-Cash#.U2AUPK1dV2A

Additional Resources from ATM Industry Association

- 4/26/2024 - Time to Take Action! Support the Crime Bill - We Need You!

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- Show All ATM Industry Association Press Releases / Blog Posts