News

Myth: Retailers Prefer Credit Cards

Friday, April 14, 2017

View Showroom

By Currency Research

MasterCard is spreading the myth that all retailers will soon eliminate their cash registers and use only card readers for all transactions. To read the headlines, one would come to the conclusion that retailers are rushing to join the cashless world, with cashless register usage “exploding” in supermarkets.

Currency Research cites examples below where not only are retailers and retail associations actively promoting cash in their stores, but are also taking credit card companies to court over their pricing practices.

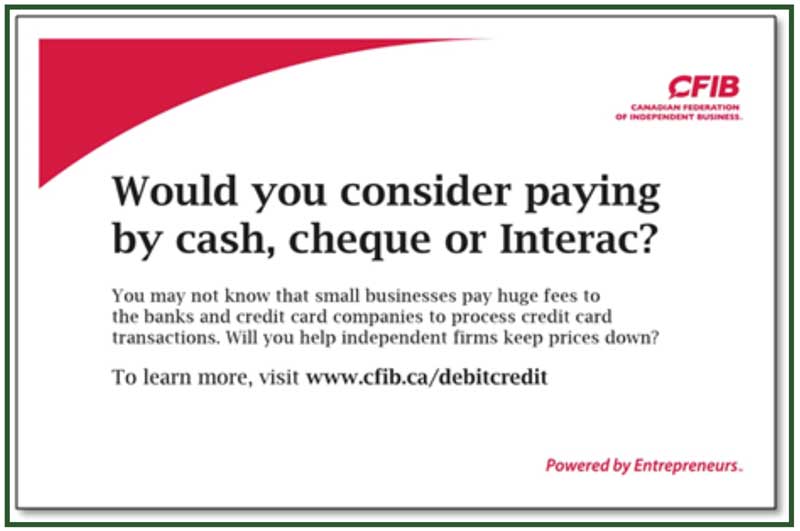

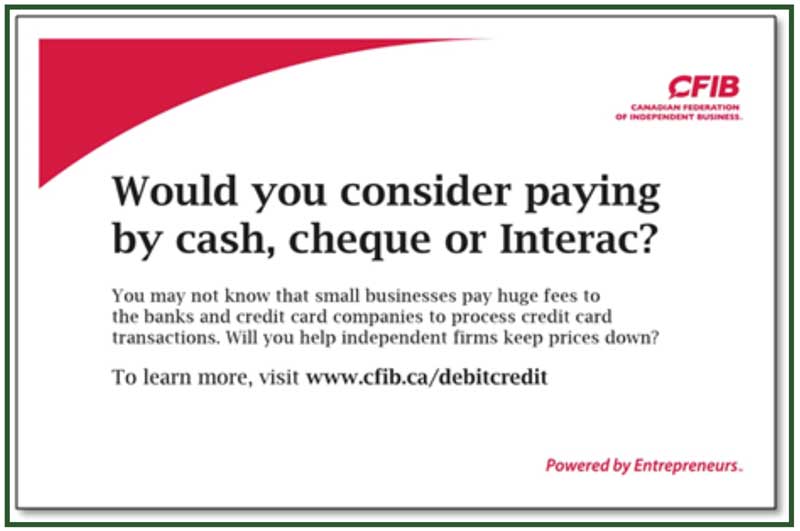

The reality is that retailers in many countries are actively promoting cash payments, while also actively pursuing legal means to reduce the monopoly of Visa and MasterCard. In Canada, often used as the example of a country on the verge of being cashless, the following signs appear in many shops: 57

These signs are made freely available to retailers by the Canadian Federation of Independent Business (CFIB), which represents the interests of small businesses to the Canadian government:

US retailers have recently filed a class action lawsuit against MasterCard and Visa for antitrust and price- fixing schemes. 59 Tellingly, some retail giants, such as Wal-Mart and Target, have opted to file individual lawsuits as they feel the $5.7 billion settlement was not large enough: 60

A December 2013 Reuters article describes the settlement:

Retailers prefer consumer choices with low-cost, secure, and quick transactions:

Obviously cash meets this need, particularly for transactions under a certain value:

Even in near-cashless Sweden, many retailers remain in favor of cash:

Currency Research concludes with another telling statement from the aforementioned MasterCard Advisors study, admitting the challenges of convincing retailers to move away from cash:

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

56 http://newsroom.mastercard.com/2013/01/04/cashless-registers-explode-in-nl-supermarkets-maestro-usage-increases/

57 http://www.cfib-fcei.ca/english/article/2534-download-your-pos-card-and-place-it-by-the-cash-register.html

58 http://www.cfib-fcei.ca/english/article/5278-credit-cards-where-is-your-money-going.html

59 http://www.bloomberg.com/news/2013-12-13/visa-mastercard-swipe-fee-accord-approved-by-u-s-judge.html

60 http://rt.com/business/walmart-sue-visa-5billion-813/

61 http://www.bbc.com/news/business-25375180

62 http://news.yahoo.com/sweden-cash-king-no-more-082544562.html

63 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

MasterCard is spreading the myth that all retailers will soon eliminate their cash registers and use only card readers for all transactions. To read the headlines, one would come to the conclusion that retailers are rushing to join the cashless world, with cashless register usage “exploding” in supermarkets.

CASHLESS REGISTERS EXPLODE IN NL SUPERMARKETS: MAESTRO USAGE INCREASES

We believe at this pace, 100 million transactions at ‘card only’ registers can be expected in 2013, the same amount as the previous 3.5 years combined. 56

Currency Research cites examples below where not only are retailers and retail associations actively promoting cash in their stores, but are also taking credit card companies to court over their pricing practices.

The reality is that retailers in many countries are actively promoting cash payments, while also actively pursuing legal means to reduce the monopoly of Visa and MasterCard. In Canada, often used as the example of a country on the verge of being cashless, the following signs appear in many shops: 57

These signs are made freely available to retailers by the Canadian Federation of Independent Business (CFIB), which represents the interests of small businesses to the Canadian government:

Merchants are free to encourage customers to pay with lower cost payment methods. While this approach may not be possible in all firms, if you believe your firm would benefit from encouraging customers to pay with cash or Interac, CFIB created small information posters in various sizes for you to cut out, laminate and display at your cash register or even inspire you to create your own. As different firms may prefer to encourage customers to pay with cash, debit or both, we provided several options.

Canada’s Code of Conduct for the credit and debit card industry is unique in the world and provides merchants with new powers in their dealings with credit card companies and banks. We believe that the best way to ensure the credit card companies do not increase merchant fees even further is for merchants to act directly and promote the benefits of paying with Interac or cash.

Working to promote the benefits of paying with lower cost options can help small businesses like you save money and fight back against rising credit card merchant fees. 58

US retailers have recently filed a class action lawsuit against MasterCard and Visa for antitrust and price- fixing schemes. 59 Tellingly, some retail giants, such as Wal-Mart and Target, have opted to file individual lawsuits as they feel the $5.7 billion settlement was not large enough: 60

WAL-MART SUES VISA FOR $5BN OVER ‘EXCESSIVE’ CARD FEES

A December 2013 Reuters article describes the settlement:

On Dec 13, 2013 a US judge has approved a $5.7bn (£3.5bn) class action settlement against credit card firms Visa and MasterCard. The two firms were accused of fixing the credit card fees charged to merchants each time a credit or debit card was used. It is believed to be the largest settlement of an antitrust class action suit ever. Some retailers objected, claiming the terms weren’t satisfactory. Merchants first sued Visa and MasterCard in 2005. An initial settlement of $7.2bn was agreed on, but the amount was lowered after around 8000 retailers, including Amazon and Target, opted out of the agreement. 61

Retailers prefer consumer choices with low-cost, secure, and quick transactions:

Obviously cash meets this need, particularly for transactions under a certain value:

Even in near-cashless Sweden, many retailers remain in favor of cash:

Hanna Celik, whose family owns a newspaper kiosk in a Stockholm shopping mall, says the digital economy is all about banks seeking bigger earnings.

“That stinks,” he says. “For them (the banks), this is a very good way to earn a lot of money, that’s what it’s all about. They make huge profits.” 62

Currency Research concludes with another telling statement from the aforementioned MasterCard Advisors study, admitting the challenges of convincing retailers to move away from cash:

However, the challenge ahead will be to convince more stores in different sectors, to introduce this type of (cashless) register as well. 63

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 1: Myths Dispelled. To request a copy of the full report or to learn more about Currency Research, please click here.

56 http://newsroom.mastercard.com/2013/01/04/cashless-registers-explode-in-nl-supermarkets-maestro-usage-increases/

57 http://www.cfib-fcei.ca/english/article/2534-download-your-pos-card-and-place-it-by-the-cash-register.html

58 http://www.cfib-fcei.ca/english/article/5278-credit-cards-where-is-your-money-going.html

59 http://www.bloomberg.com/news/2013-12-13/visa-mastercard-swipe-fee-accord-approved-by-u-s-judge.html

60 http://rt.com/business/walmart-sue-visa-5billion-813/

61 http://www.bbc.com/news/business-25375180

62 http://news.yahoo.com/sweden-cash-king-no-more-082544562.html

63 http://www.mastercardadvisors.com/_assets/pdf/too_much_cash.pdf

Additional Resources from ATM Industry Association

- 4/26/2024 - Time to Take Action! Support the Crime Bill - We Need You!

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- Show All ATM Industry Association Press Releases / Blog Posts