Loading...

Euronet Worldwide

We power the payments that bring businesses and consumers together.

Euronet Worldwide, Inc. (NASDAQ: EEFT), is a global provider of electronic payment and transaction processing solutions, facilitating the movement of payments around the world. Our solutions serve as a critical link between Financial Institutions, Retailers, Service Providers and Consumers.

Founded in 1994, Euronet has established itself as a leading electronic payments provider within its core business segments: Electronic Financial Transactions, Prepaid and Money Transfer, and operates the largest independent ATM network in Europe, with transaction processing centers in four global locations.

Euronet has built a unique network of networks that drives transactions in the quickly evolving global payments landscape through diverse cash-based and digitally driven services for consumers and businesses. These capabilities combined with the worldwide reach and real time power of our networks provides us — and our customers — a presence in every level of the global payments value chain.

Through our business segments, we have the capability to accept and globally distribute funds for virtually any digital or cash transaction through secure connections to banks, card networks, alternative payments, digital wallets, leading brands and retailers, as well as through our physical networks of ATMs, POS terminals, and money transfer locations.

With extensive knowledge, state of the art technology and strategic partnerships, we enable Financial Institutions to accelerate growth, whilst actively adapting to a competitive and changing landscape.

Euronet Worldwide - Headquarters

3500 College Boulevard

Leawood, Kansas, 66211

USA

T: +1 913 327 4200

F: +1 913 327 1921

CEO – Michael J. Brown

www.euronetworldwide.com

Euronet Worldwide – European Headquarters

7th Floor, North Block, 55 Baker Street

London, W1U 7EU

UK

EVP & CEO EFT EMEA and Americas - Nikos Fountas

www.euronetATMs.com

Euronet Worldwide Software Solutions – World Headquarters

17300 Chenal Parkway

Little Rock, Arkansas

USA

President & Managing Director - Tony Warren

www.euronetsoftware.com

Electronic Funds Transfer (EFT) Products & Services

Independent ATM Networks

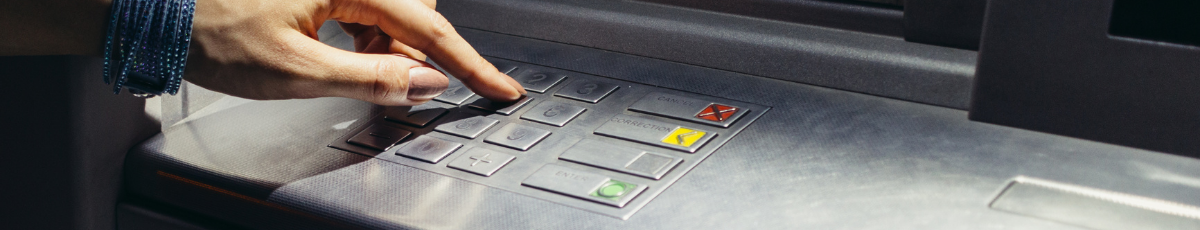

We are a global ATM operator. We deploy, operate, and manage ATMs across the complete value chain in Europe, Asia, and North America. Out ATM networks embed the latest technologies and are securely managed by our proprietary advanced payments processing and services REN and REV ecosystem. Beyond the traditional cash withdrawals, our ATM networks offer a variety of value-added services and transaction types. These include cash deposits, cardless cash-outs, money transfer, digital product purchasing, multicurrency dispensing, etc. Our aim is to make cash accessible to consumers on a 24/7 basis in convenient high-traffic locations, such as airports, shopping malls, and city center, as well as in remote locations where banks are retracting their branches and ATMs.

Through our global ATM networks, we enable a self-service banking solution, providing the possibility of cash deposits for merchants and consumers. Euronet’s new and unique Independent Automated Deposit Terminal (ADT) deployment model features deposit terminals located in off-bank-branch, high-traffic, and retail locations. Our ADT solution provides extended banking hours to consumers along with convenient deposit facilities. It also offers secure deposit solutions that have been actively adopted by our banking clients who have joined our ADT network. By offering customers real-time access to their funds, with a variety of deposit types including account deposits and deposits for credit card or loan payments, our ADT solution is the perfect complimentary service for banks wanting to extend their service offering.

ATM-as-a-Service: Solutions and Technology for Financial Institutions

We leverage our global ATM networks, unparalleled operational expertise and state-of-the-art technologies delivered through our REN and REV ecosystem, to offer banks and financial institutions solutions across the payment value chain, including ATMs and POS acquiring.

With our ATM-as-a-Service offerings, we address a strategic imperative for Banks and Financial Institutions; the need to optimize their ATM networks and operations in line with the dynamically changing payments landscape. We are a strategic catalyst for ATM consolidation given our extended global presence. We have the technology, resources, knowledge, and a robust value proposition that places us in the forefront of payments innovation. All of these are available to banks wishing to compete in challenging market conditions.

|

Our ATM Network Participation Program offers Financial Institutions connectivity to our global ATM network. Instant increase of Financial Institutions’ market footprint, without the need for capital investments. |

|

With our ATM Purchase Program, we acquire Banks’ and Financial Institutions’ ATM Assets, either off-site or on premise. With seamless integration into our Independent ATM Network, we offer multiple benefits in cost optimization and market footprint expansion. |

|

ATM Managed Services: leveraging our unique purpose-built ATM processing platform and our Global Competence Centers, we offer a range of services to support and align with ATM Strategic Priorities of Banks and Financial Institutions. |

|

Card Issuing Services: Euronet offers banks a quick and effective card entry strategy with internationally and locally certified debit, credit, prepaid and loyalty card programs. By effectively capitalizing on the speed-to-market of Euronet's card solutions, banks can secure market share and efficiently build a full-service, card issuing reputation. |

|

Merchant Acquiring Outsourcing Services for Banks: an all-encompassing solution that eliminates the need for banks to source partial offerings from multiple vendors. The convenience of centrally managed services, combined with the flexibility of customized POS products, enables fast business expansion, with minimum up-front investment. |

Download: ATM Solutions, ATM Purchase Program, Cash Deposit ATMs, Network Participation Solutions, ATM Outsourcing

Merchant Services Solutions

Taking Brands Global, Making Payments Local

Euronet Merchant Services offers banks and merchants a specialized range of innovative services, including card acceptance, DCC solutions and tax refund. Our array of services complement the payments flow, driving growth and revenue for banks and merchants across the world.

|

Payments: supplying and supporting both physical devices and digital solutions, including ATMs, POS Terminals, Smart POS, eCommerce and mobile apps. Offering gateway support for acquiring, processing, switching and alternative payments. |

|

Dynamic Currency Conversion (DCC): increasing profitability through a new, direct and recurring revenue stream. With DCC, foreign currency conversion takes place directly and instantly at the POS, providing full conversion details to the customer. Our high DCC acceptance rates and industry proven track record are a result of proprietary patented customer interface technology. |

|

Tax Refund Solutions offer Retailers a complete suite of technology and related marketing services to capture the benefits of a strong international Tax Refund market, driven by increasing tourism flows. |

|

Digital Content and Gift Card: We help manage digital content sales and gift card sales e2e, opening new revenue streams with our unique global content platform via our ePay division. |

|

Currency Exchange and Pay Out: we manage pay out in 180 currencies to anywhere in the world, via out XE division. We also can provide multi-currency accounts to simplify settlement across your group. |

|

Merchant Acquiring Outsourcing Services, our all-encompassing solution eliminates the need for banks and merchants to source partial offerings from multiple vendors. The convenience of centrally managed services, combined with the flexibility of customized POS products, enables fast business expansion, with minimum up-front investment. |

Download: Merchant Services

Unique Payments Platform: REN and REV Ecosystem

On premise. Private or Public Clouds. As services.

REV is part of Euronet’s state of the art REN™ Ecosystem, which provides advanced payments processing and services from a private cloud at Euronet Worldwide’s data centers. REN and REV encompass the latest in payments innovations and provide gateways to fintech products and services, advancing the company to the forefront of our industry. Bridging the gap between digital and physical transactions, Euronet’s omnichannel products and services, together with the company’s rapidly expanding alternative global payout capabilities, provide unprecedented consumer choice.

Through the API-driven architecture of REV, Euronet enables swift connectivity and migration of Bank ATM assets into Euronet’s unified ATM network. From this vantage point, we support services that span from ATM device driving to the full value chain of ATM operations with the highest security and availability standards.

Furthermore, a host of new services, including cash deposits, multicurrency dispenses, contactless features, card-less cash transactions, and money transfers are all enabled through REV to enhance the functional and value potential. These new products are completely managed by Euronet’s Global Competence Centers, ensuring operational excellence, added value and peace of mind for our customers.

Video: REN Ecosystem

Download: REN Foundation - Retail Payments, REN Foundation - Central Banking Solutions

Value Added Services (VAS)

Euronet's vast array of value-added services are deployed across Euronet networks and networks that are managed on the behalf of banks. Some services are deployed across multiple markets while others are market-specific, highlighting Euronet's flexibility to provide customized niche products as well as off-the-shelf solutions that are fast-to-market and easy to leverage.

Euronet has developed a comprehensive portfolio of value-added services. Services include:

- ATM Advertising & Promotions

- Bill Payment

- Cardless Withdrawal

- Charity Donations

- Couponing

- Customer Relationship Management

- Domestic & International Gateways

- Dynamic Currency Conversion

- e-wallet Top-up

- Foreign Currency Dispense

- FX Remittances

- Instant Loans

- Intelligent Deposit

- Mobile Funds Transfer

- Mobile Airtime Top-up

- Person-to-Person Remittances

- Prepaid Content Distribution

- 6/6/2024 - Euronet Expands Malaysian Market Presence with the Acquisition of MEPS ATM Terminals from PayNet

- 2/13/2024 - Euronet Announces Acquisition of Infinitium, a Leading Digital Payments Company in Southeast Asia

- 2/6/2024 - Euronet Expands Independent ATM Network Into Belgium and Mexico

- 6/27/2023 - Euronet to Increase Visibility for Its Ren Payments Platform in Latin America and the Caribbean Through Mastercard Engage and Fintech Express Programs

- Show All Euronet Worldwide Press Releases / Blog Posts