Loading...

A Chat With Industry Experts ITMX

Monday, July 10, 2023

View Showroom

An insight to the ATMs from industry experts ITMX- a developer and service provider of the electronic payment infrastructure of Thailand.

How do you see the future of cash in your country and how will this impact the ATM network in terms of growth?

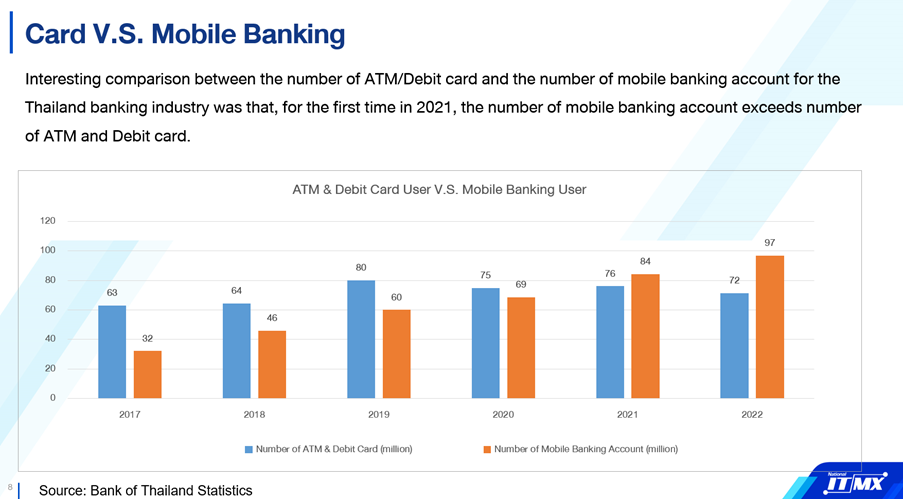

There has been a change with Cash usage in Thailand as a result of digital payment adoption and e-payment.

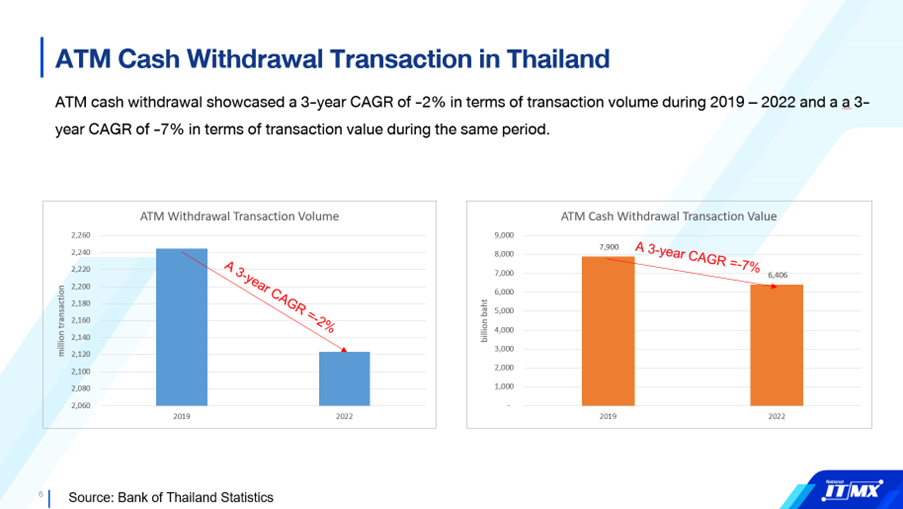

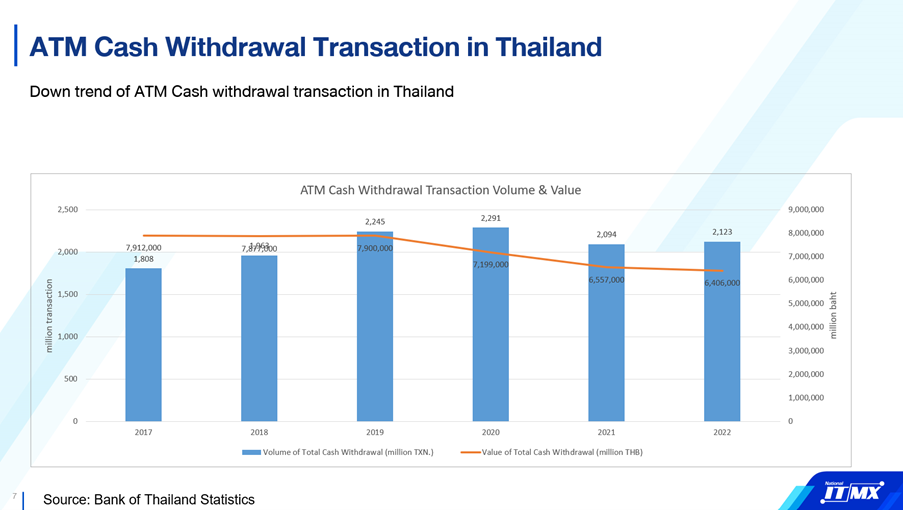

ATM cash withdrawal showcased a 3-year CAGR of -2% in terms of transaction volume during 2019 – 2022 and a 3-year CAGR of -7% in terms of transaction value during the same period.

Nowadays, a demand of cash carrying will be lower than in a past resulting in lower transaction volume of ATM while the cost of ATM increasing every year. The bank must adjust their strategy to reduce operating cost for example reducing the number of ATM in the network or initiate new business model such as white labelling ATM or outsourcing ATM business to independent ATM deployer (IAD).

What do you see as the role of cash in SE Asia and what impact have cashless payment options had upon the usage of cash?

Although the digital adoption and e-payment have been growth rapidly, the proportion of cash usage in Thailand is still high. It’s estimated by the Bank of Thailand that the percentage of cash payment in 2021 is approximately 87% while e-payment is 13%.

In Thailand cash still remains in the digital age and will continue to play the key role in SE Asia, unless the central banks stop printing bank notes and fully adopted retail CBDC or digital currencies.

Starting in March 2022, the Bank of Thailand began distributing 20 Baht Polymer Banknotes. This is the most commonly used banknote, with 600 million of the 1.8 billion banknotes printed by the central bank being of this denomination each year.

What are some of the innovations you believe will drive the ongoing success of the ATM Industry?

The stakeholders of ATM industry have been discussing the concept of smart machines that can do more than just dispense cash. However, simply introducing advanced technology will not ensure success unless it meets the needs of customers. Even the most sophisticated machines will become obsolete if they do not address what customers actually require.

As we explore new possibilities for technology, we must focus on tasks that machines can accomplish but mobile banking cannot. Some examples include the issuance and receipt of payment cards, the KYC process, and other banking activities that require physical interaction with the bank.

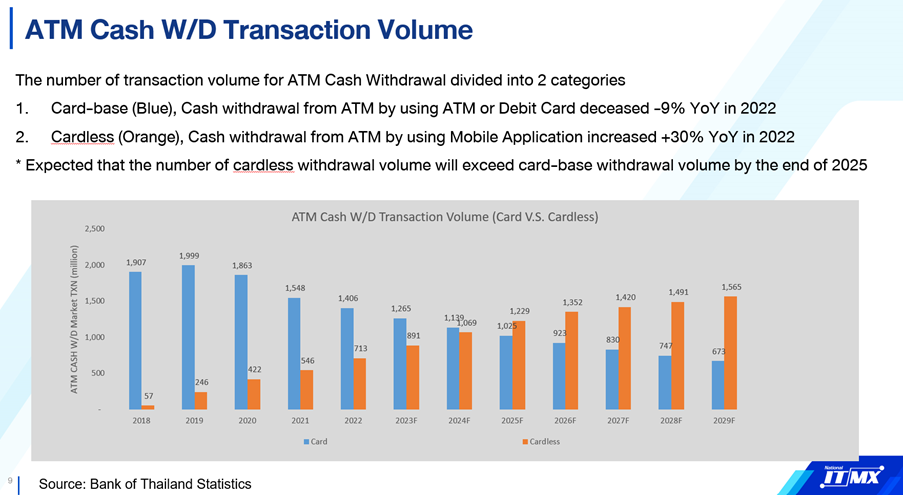

and forecasted by NITMX

Additional Resources from ATM Industry Association

- 5/9/2024 - Rural Towns Invited to Apply for Cash Service Trials as Challenges for Cash Users Grow

- 5/9/2024 - Rural Towns Invited to Apply for Cash Service Trials as Challenges for Cash Users Grow

- 5/1/2024 - ATMIA: The Best of April

- 4/30/2024 - Less Impressed, More Involved

- 4/26/2024 - Time to Take Action! Support the Crime Bill - We Need You!

- Show All ATM Industry Association Press Releases / Blog Posts