News

Citizens want choice

Monday, January 22, 2018

View Showroom

By Currency Research

In the Case for Cash Part One, CR concluded that all payment schemes, new or old, are inevitably compared to cash. In order for a method of payment to be considered “as good as cash,” it must be:

As easy to use as

As flexible as

As secure as

As confidential as

As fast as

As universally accepted as

As reliable as

As high tech as

As unquestionable as

As identifiable as

As reconcilable as

As immediate as

As irreversible as

And probably, most importantly, as trusted as

CASH

To date, a payment method that meets all of the above criteria has not been developed. As such, a method that is “as good as cash” simply does not exist. As evidence of this, the 2012 Diary of Consumer Payment Choice (DCPC) survey conducted by the US Federal Reserve’s Cash Product Office (CPO) shows that the majority of respondents chose cash as the first or second preferred method of payment and concluded that “cash is still the most used payment instrument.”44 Consumers want, need, and deserve the choice to use cash as a means of payment.

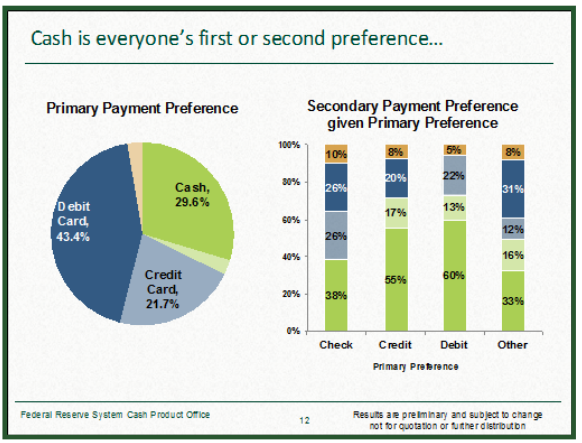

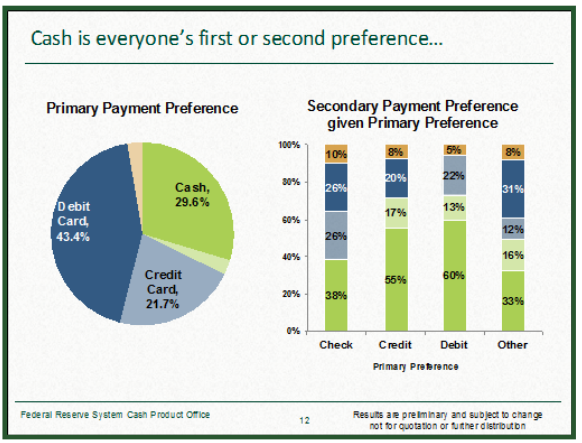

The preliminary results of the DCPC survey presented at the 2013 Miami ICCOS Cash Cycle Seminar showed that cash was the primary preferred payment method for 29.6% of respondents and the secondary choice for 55% and 60% of credit and debit cardholders respectively, as indicated in the two charts in the slide below: 45

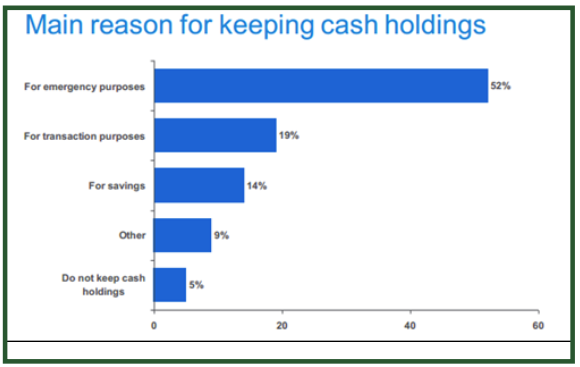

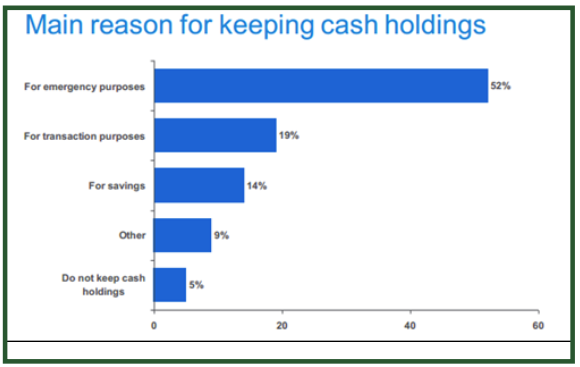

Despite MasterCard and Visa spending approximately one billion dollars combined on marketing strategies per year, and despite many false statements heralding the death of cash, consumers continue to universally prefer cash to any other payment method. In a 2010 consumer study by the Reserve Bank of New Zealand, 95% of participants responded that they used cash for various “primary” reasons: 46

Although overwhelming evidence exists to show that consumers continue to prefer cash, a recent Master- Card Advisors press release identified a so-called problem – the “burden of cash usage” accounting for 85% of worldwide consumer transactions. The Advisors then proposed a so-called solution – the creation of a “global study” to lead consumers away from cash!47

Published in 2013, “The MasterCard Advisors’ Cashless Journey” perpetuates common myths surrounding cash, including the misleading claim that cash usage costs “as much as 1.5% of GDP.”48 This oft-circulated misconception was thoroughly dissected and dispelled in Myth #16 (“Cash in Circulation as Percent of GDP and Cost of Payments to GDP is Relevant”) of the Case for Cash Part One. CR found no evidence of a cost of cash to GDP study by any credible source to support this claim. Of course, research funded by MasterCard may potentially lead to such figures, a phenomenon commonly referred to as “funding bias.”49

MasterCard concludes their study with a striking and dire warning: consumers may prevent the completion of “the cashless journey”!

CR’s exploration of the various social and economic reasons for supporting cash usage demonstrates the numerous benefits of cash and shows overwhelming evidence to support consumers’ preference for cash. This evidence signals that until the introduction of a new system that provides all of cash’s benefits, cash will remain a dominant and preferred payment instrument.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

44 http://www.frbsf.org/cash/publications/fed-notes/2014/july/consumer-preferences-cash-use

45 The slide is used with permission of the Federal Reserve’s Cash Product Office

46 http://www.rbnz.govt.nz/notes_and_coins/banknote_upgrade/4436446.pdf

47 http://www.mastercardadvisors.com/_assets/pdf/MasterCardAdvisors-CashlessSociety.pdf

48 http://newsroom.mastercard.com/wp-content/uploads/2013/09/Cashless-Journey_WhitePaper_FINAL.pdf

49 http://en.wikipedia.org/wiki/Funding_bias

50 http://newsroom.mastercard.com/wp-content/uploads/2013/09/Cashless-Journey_WhitePaper_FINAL.pdf

In the Case for Cash Part One, CR concluded that all payment schemes, new or old, are inevitably compared to cash. In order for a method of payment to be considered “as good as cash,” it must be:

As easy to use as

As flexible as

As secure as

As confidential as

As fast as

As universally accepted as

As reliable as

As high tech as

As unquestionable as

As identifiable as

As reconcilable as

As immediate as

As irreversible as

And probably, most importantly, as trusted as

CASH

To date, a payment method that meets all of the above criteria has not been developed. As such, a method that is “as good as cash” simply does not exist. As evidence of this, the 2012 Diary of Consumer Payment Choice (DCPC) survey conducted by the US Federal Reserve’s Cash Product Office (CPO) shows that the majority of respondents chose cash as the first or second preferred method of payment and concluded that “cash is still the most used payment instrument.”44 Consumers want, need, and deserve the choice to use cash as a means of payment.

The preliminary results of the DCPC survey presented at the 2013 Miami ICCOS Cash Cycle Seminar showed that cash was the primary preferred payment method for 29.6% of respondents and the secondary choice for 55% and 60% of credit and debit cardholders respectively, as indicated in the two charts in the slide below: 45

Despite MasterCard and Visa spending approximately one billion dollars combined on marketing strategies per year, and despite many false statements heralding the death of cash, consumers continue to universally prefer cash to any other payment method. In a 2010 consumer study by the Reserve Bank of New Zealand, 95% of participants responded that they used cash for various “primary” reasons: 46

Although overwhelming evidence exists to show that consumers continue to prefer cash, a recent Master- Card Advisors press release identified a so-called problem – the “burden of cash usage” accounting for 85% of worldwide consumer transactions. The Advisors then proposed a so-called solution – the creation of a “global study” to lead consumers away from cash!47

Problem: Even though the world’s population has access to multiple payment options, cash still accounts for 85% of all consumer transactions throughout the world.

Solution: MasterCard Advisors created a global study that showcases cash usage and the conditions that lead towards cashlessness.

Published in 2013, “The MasterCard Advisors’ Cashless Journey” perpetuates common myths surrounding cash, including the misleading claim that cash usage costs “as much as 1.5% of GDP.”48 This oft-circulated misconception was thoroughly dissected and dispelled in Myth #16 (“Cash in Circulation as Percent of GDP and Cost of Payments to GDP is Relevant”) of the Case for Cash Part One. CR found no evidence of a cost of cash to GDP study by any credible source to support this claim. Of course, research funded by MasterCard may potentially lead to such figures, a phenomenon commonly referred to as “funding bias.”49

MasterCard concludes their study with a striking and dire warning: consumers may prevent the completion of “the cashless journey”!

Some Tipping Point markets like Germany and Japan show us that, despite having the necessary infrastructure in place for decades, markets can plateau on their journey before consumers become nearly cashless. If specific consumer attitudes and behaviors towards cash usage are not well understood or accommodated, consumers may prevent the cashless journey’s completion.50

CR’s exploration of the various social and economic reasons for supporting cash usage demonstrates the numerous benefits of cash and shows overwhelming evidence to support consumers’ preference for cash. This evidence signals that until the introduction of a new system that provides all of cash’s benefits, cash will remain a dominant and preferred payment instrument.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

44 http://www.frbsf.org/cash/publications/fed-notes/2014/july/consumer-preferences-cash-use

45 The slide is used with permission of the Federal Reserve’s Cash Product Office

46 http://www.rbnz.govt.nz/notes_and_coins/banknote_upgrade/4436446.pdf

47 http://www.mastercardadvisors.com/_assets/pdf/MasterCardAdvisors-CashlessSociety.pdf

48 http://newsroom.mastercard.com/wp-content/uploads/2013/09/Cashless-Journey_WhitePaper_FINAL.pdf

49 http://en.wikipedia.org/wiki/Funding_bias

50 http://newsroom.mastercard.com/wp-content/uploads/2013/09/Cashless-Journey_WhitePaper_FINAL.pdf

Additional Resources from ATM Industry Association

- 4/26/2024 - Time to Take Action! Support the Crime Bill - We Need You!

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- Show All ATM Industry Association Press Releases / Blog Posts