News

Citizens do not wish to be (completely) tracked by governments, retailers, or banks

Wednesday, January 24, 2018

View Showroom

By Currency Research

Increasingly we live in a world that scrutinizes every purchase, “mines” every web search, and tracks every physical movement. This personal data is often sold to marketing agents and data analysis companies, and then on to retailers and commercial services companies for use in targeted marketing campaigns. The reason for the commercialization of personal data is obvious: to increase profits for the commercial companies involved.

Technology now exists (but has yet to be deployed) for ATMs to dispense banknotes with known serial numbers to consumers who then can “spend” the notes at a grocery store for known products. With the co-operation of the commercial ATM supplier, the grocery store can then track the serial numbers back to the consumer. The next time the consumer withdraws notes from an ATM in another area, targeted marketing via the ATM screen could inform the consumer that the products they bought last week are on sale around the corner. While this may indeed be the future of banknotes, at present many stores and ATMs would likely be boycotted if this payment scheme were to become widespread. In a climate of increasing distrust regarding the use of personal data, the anonymity of cash is a very important and attractive attribute for many consumers.

As discussed in Myth #11 (“Only Criminals Use Banknotes”) in the Case for Cash Part One, despite the card industry’s ongoing efforts to paint cash use with criminal overtones, research shows that the vast majority of cash users simply wish to avoid targeted marketing and prefer to make their own choices without undue influence.

The level of American consumers’ distrust of the increasingly electronic and online world is revealed in a September 2014 survey conducted by Intel. Interestingly, only just over half of survey participants indicated they would be willing to share purchase history in exchange for targeted discounts. This leaves just under 50% with no willingness to share personal purchasing habits. Consumer distrust of corporate data mining compels many consumers towards a conscious decision to use cash. The Intel survey, excerpted below, reveals an overwhelming and inherent consumer distrust about how businesses and organizations are using their personal data:

A 2014 study on attitudes to personal and sensitive data conducted by the Global Research Business Network (GRBN) revealed that less than 25% of participants claimed to trust financial institutions with their data. More than 50% of those surveyed indicated that information related to purchases made online was considered either personal or sensitive.52

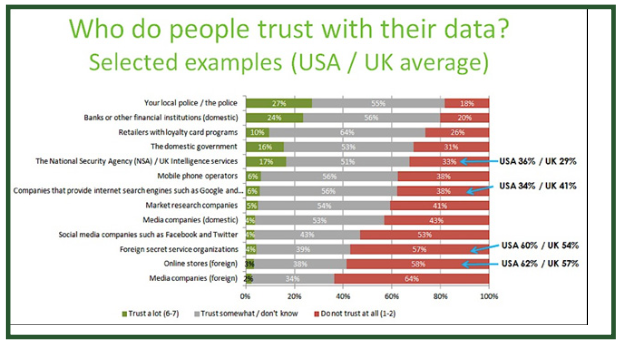

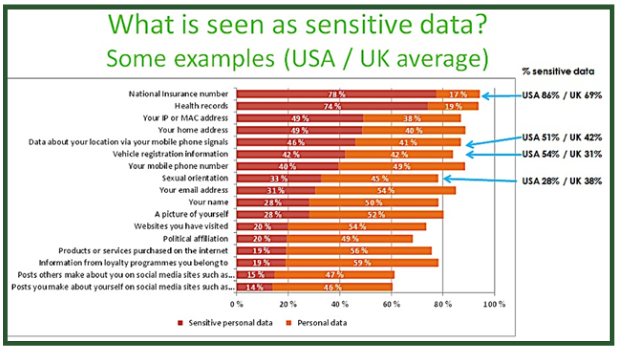

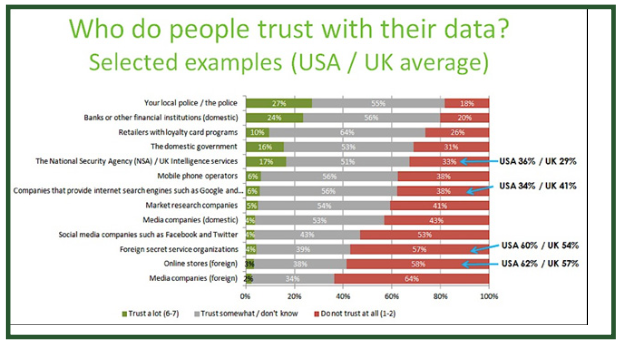

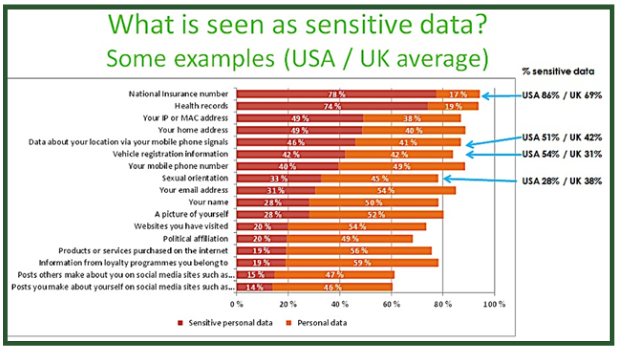

The following GRBN tables evidence significant consumer concern, from both British and American survey participants, about the ways in which their personal data is used. The survey results demonstrate a general consumer distrust in many types of organizations, including market research and social media companies, search engines, and mobile phone operators.

As the press release for the GRBN study indicates, the survey results highlight the role and responsibility of governments to protect consumers and regulate how personal data is used by organizations:

Jeffrey T. Resnick, 2012 Board Chair of CASRO, the US national research trade association and part of the Global Research Business Network, comments: “Sensitivity of personal data is a big issue for consumers. This research shows that there is a high level of distrust from consumers about how their personal data is used. As they hear more about data security breaches and develop a fuller understanding of the implications of the technology they are using, this concern is only going to grow. Governments and businesses cannot afford to stick their heads in the sand and hope it goes away – it won’t.”

Andrew Cannon, President of EFAMRO, the European part of the Global Research Business Network, comments: “While regulation is needed to protect citizens from abuse, I believe that organizations have a responsibility to lead the way, to be more transparent in their activities and earn the trust of citizens. For the sake of democracy, governments and government organizations need to prove their trustworthiness.”54

Citizens expect governments to protect their personal data and to provide a safe and trusted payment alternative that is not rooted in commercial interests. Consumers should have the choice to use their preferred product at their own convenience. For many consumers, that product is cash.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

51 http://www.intel.com/newsroom/kits/bigdata/pdfs/Privacy_Survey_Factsheet.pdf

52 http://www.casro.org/news/162258/GRBN-Study-Reveals-Widespread-Concern-Over-Personal-Data-Security.htm

53 Ibid

54 http://www.casro.org/news/162258/GRBN-Study-Reveals-Widespread-Concern-Over-Personal-Data-Security.htm

Increasingly we live in a world that scrutinizes every purchase, “mines” every web search, and tracks every physical movement. This personal data is often sold to marketing agents and data analysis companies, and then on to retailers and commercial services companies for use in targeted marketing campaigns. The reason for the commercialization of personal data is obvious: to increase profits for the commercial companies involved.

Technology now exists (but has yet to be deployed) for ATMs to dispense banknotes with known serial numbers to consumers who then can “spend” the notes at a grocery store for known products. With the co-operation of the commercial ATM supplier, the grocery store can then track the serial numbers back to the consumer. The next time the consumer withdraws notes from an ATM in another area, targeted marketing via the ATM screen could inform the consumer that the products they bought last week are on sale around the corner. While this may indeed be the future of banknotes, at present many stores and ATMs would likely be boycotted if this payment scheme were to become widespread. In a climate of increasing distrust regarding the use of personal data, the anonymity of cash is a very important and attractive attribute for many consumers.

As discussed in Myth #11 (“Only Criminals Use Banknotes”) in the Case for Cash Part One, despite the card industry’s ongoing efforts to paint cash use with criminal overtones, research shows that the vast majority of cash users simply wish to avoid targeted marketing and prefer to make their own choices without undue influence.

The level of American consumers’ distrust of the increasingly electronic and online world is revealed in a September 2014 survey conducted by Intel. Interestingly, only just over half of survey participants indicated they would be willing to share purchase history in exchange for targeted discounts. This leaves just under 50% with no willingness to share personal purchasing habits. Consumer distrust of corporate data mining compels many consumers towards a conscious decision to use cash. The Intel survey, excerpted below, reveals an overwhelming and inherent consumer distrust about how businesses and organizations are using their personal data:

INTEL SURVEY: DISTRUST AND LACK OF UNDERSTANDING IN DATA PRIVACY

- Nearly two-thirds (65 percent) of device owners have no idea who has access to data from their devices or how it is used.

- Over 4 in 5 device owners (81 percent) have concerns about what businesses or organizations have access to their data (location, browser history and data from apps).

- Over 4 in 5 device owners (85 percent) have concerns about what some businesses or organizations maybe doing with their data.

- A majority of Americans (84 percent) believe there is some type of data that is being collected about or from them and being sold to third parties.

- Twenty-nine percent of device owners have something on their devices they wouldn’t want someone else to see.

- Millennials are more willing to share purchase history in exchange for accurate recommendations or discounts than those aged 45 and older (52 percent versus 48 percent, respectively).51

A 2014 study on attitudes to personal and sensitive data conducted by the Global Research Business Network (GRBN) revealed that less than 25% of participants claimed to trust financial institutions with their data. More than 50% of those surveyed indicated that information related to purchases made online was considered either personal or sensitive.52

The following GRBN tables evidence significant consumer concern, from both British and American survey participants, about the ways in which their personal data is used. The survey results demonstrate a general consumer distrust in many types of organizations, including market research and social media companies, search engines, and mobile phone operators.

As the press release for the GRBN study indicates, the survey results highlight the role and responsibility of governments to protect consumers and regulate how personal data is used by organizations:

Jeffrey T. Resnick, 2012 Board Chair of CASRO, the US national research trade association and part of the Global Research Business Network, comments: “Sensitivity of personal data is a big issue for consumers. This research shows that there is a high level of distrust from consumers about how their personal data is used. As they hear more about data security breaches and develop a fuller understanding of the implications of the technology they are using, this concern is only going to grow. Governments and businesses cannot afford to stick their heads in the sand and hope it goes away – it won’t.”

Andrew Cannon, President of EFAMRO, the European part of the Global Research Business Network, comments: “While regulation is needed to protect citizens from abuse, I believe that organizations have a responsibility to lead the way, to be more transparent in their activities and earn the trust of citizens. For the sake of democracy, governments and government organizations need to prove their trustworthiness.”54

Citizens expect governments to protect their personal data and to provide a safe and trusted payment alternative that is not rooted in commercial interests. Consumers should have the choice to use their preferred product at their own convenience. For many consumers, that product is cash.

This article has been posted with permission from Currency Research and is excerpted from The Case for Cash Part 2: The Justification. To request a copy of the full report or to learn more about Currency Research, please click here.

51 http://www.intel.com/newsroom/kits/bigdata/pdfs/Privacy_Survey_Factsheet.pdf

52 http://www.casro.org/news/162258/GRBN-Study-Reveals-Widespread-Concern-Over-Personal-Data-Security.htm

53 Ibid

54 http://www.casro.org/news/162258/GRBN-Study-Reveals-Widespread-Concern-Over-Personal-Data-Security.htm

Additional Resources from ATM Industry Association

- 4/23/2024 - ATMIA Unveils Strategic Collaboration with Reconnaissance International to Elevate Intelligence & Networking Services to the ATM & Currency Industries

- 4/21/2024 - Fight Against Cashless Economy:

- 4/18/2024 - 3 myths about accepting cash at self service

- 4/18/2024 - Upcoming ATMIA/ASA Committee Meetings: April and May 2024

- 4/18/2024 - ATMIA Joins Atlanta Fed Meeting on Best Practices for ATM Cash Replenishment

- Show All ATM Industry Association Press Releases / Blog Posts